- Bitcoin price extended gains above $3,900 and traded close to the $4,000 resistance against the US Dollar.

- The price traded as high as $3,973 and later started a downside correction.

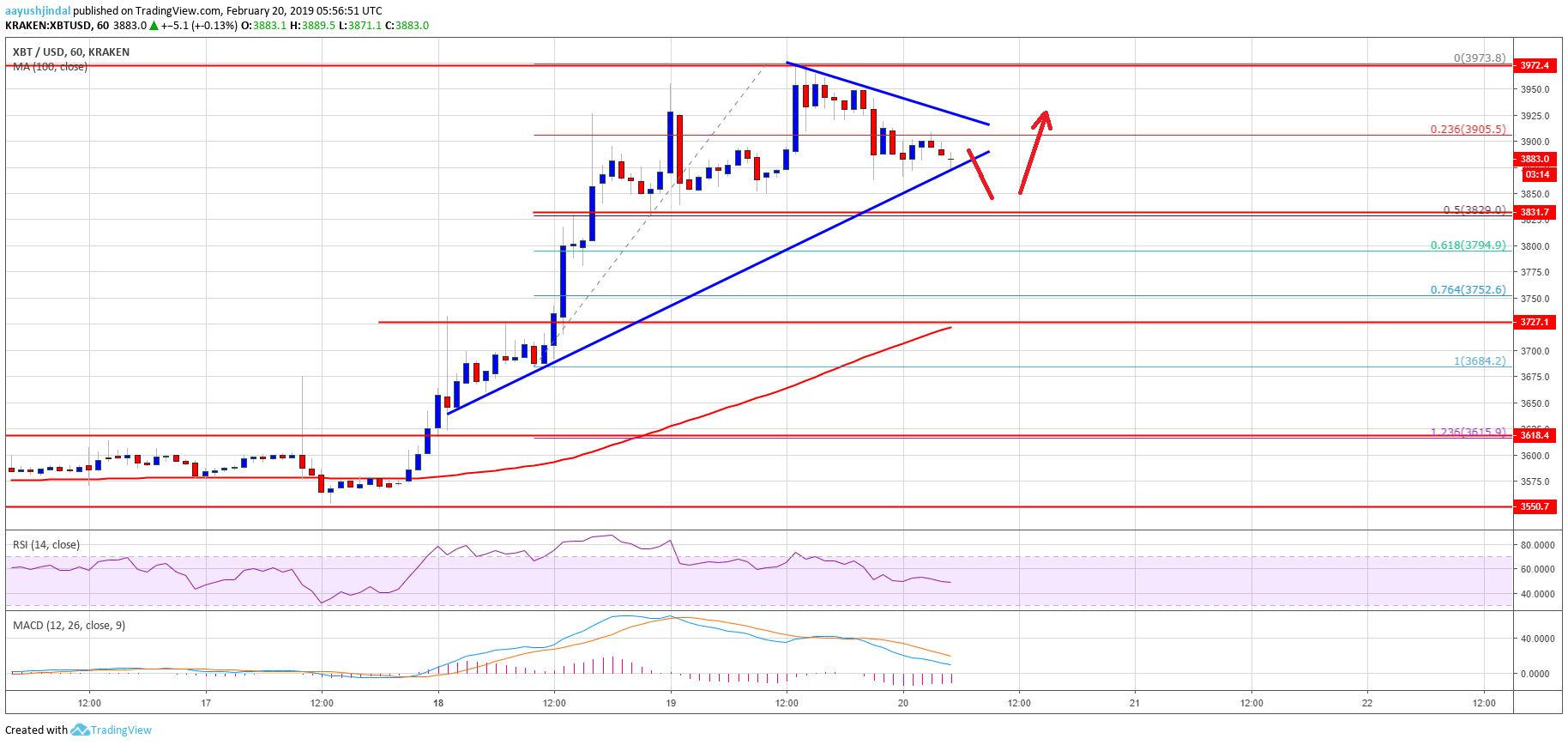

- There is a short term breakout pattern in place with support at $3,875 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is likely to correct further lower towards the $3,830 or $3,800 support levels before fresh increase.

Bitcoin price failed to surpass the $4,000 resistance and corrected lower against the US Dollar. BTC could tested the $3,800 support area before a new upward move towards $4,000.

Bitcoin Price Analysis

Yesterday, we saw a strong rally above the $3,750 resistance in bitcoin price against the US Dollar. The BTC/USD pair spiked towards the $3,950 level and later corrected lower. However, the $3,830 support prevented losses and the price bounced back. It broke the last swing high and traded close to the $4,000 resistance. A new weekly high was formed at $3,973, but the price failed to test the $4,000 barrier. As a result, there was a fresh downside correction and the price declined below $3,950 and $3,920.

There was a break below the 23.6% Fib retracement level of the last wave from the $3,684 low to $3,973 high. However, the current decline is finding bids near yesterday’s highlighted bullish trend line with support at $3,880. More importantly, it seems like there is a short term breakout pattern in place with support at $3,875 on the hourly chart of the BTC/USD pair. If there is a downside break, the pair could test the next key support at $3,830. It coincides with the 50% Fib retracement level of the last wave from the $3,684 low to $3,973 high.If the price fails to hold the $3,830 support, it could test the main $3,800 support area in the near term. On the upside, the price must break the $3,925 and $3,950 resistance levels to revisit $3,975. The main resistance for buyers is near the $4,000 level, above which there are chances of further gains.