Record BTC Contract Volumes on CME

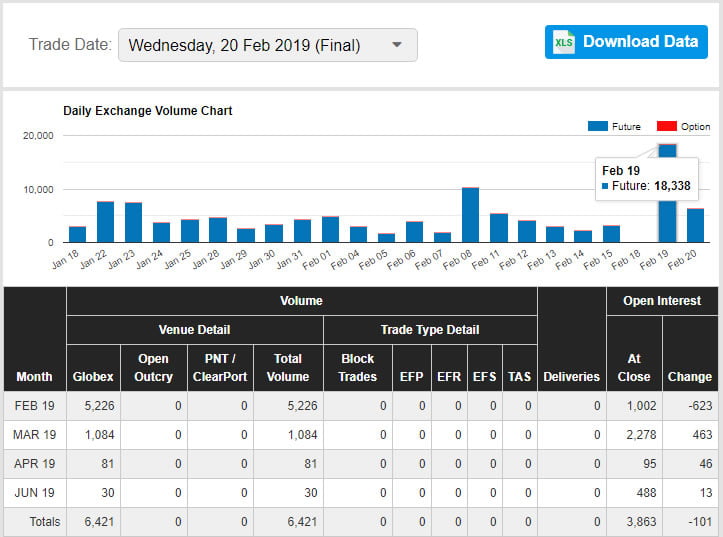

According to there were 18,338 on Wednesday, the highest figure ever recorded. This is equivalent to 91,690 Bitcoins or roughly $365 million at today’s prices.

This year will be different and many industry experts predict the launch of at least one institutional investment vehicle. Bakkt is the primary candidate but it has been in a holding pattern with a few others while US regulators finally wake up from their month-long imposed vacation.

According to European exchange giant, Eurex, is gearing up to launch crypto futures so the list of institutional offerings is growing rapidly. The derivatives exchange operated by Germany’s Deutsche Börse will be offering Bitcoin, Ethereum and XRP imminently according to the report.Exchange Traded Funds are The Future

In addition to these future products, there is already one type of ETF that is actually traded through an ETN (exchange traded note) which allows investors to get direct exposure to Bitcoin prices. The Grayscale Bitcoin Trust (GBTC) bypasses the technicalities of buying and storing Bitcoin but still allows investors to get in on the action by buying shares that trade at around a thousandth of the price of BTC, so a few dollars instead of thousands.

GBTC has been wildly popular with over $800 million already invested in the Bitcoin fund:2/21/19 UPDATE: Holdings per share and net assets under management for our investment products Total AUM: $872.1 million — Grayscale (@Grayscale)

Image from Shutterstock