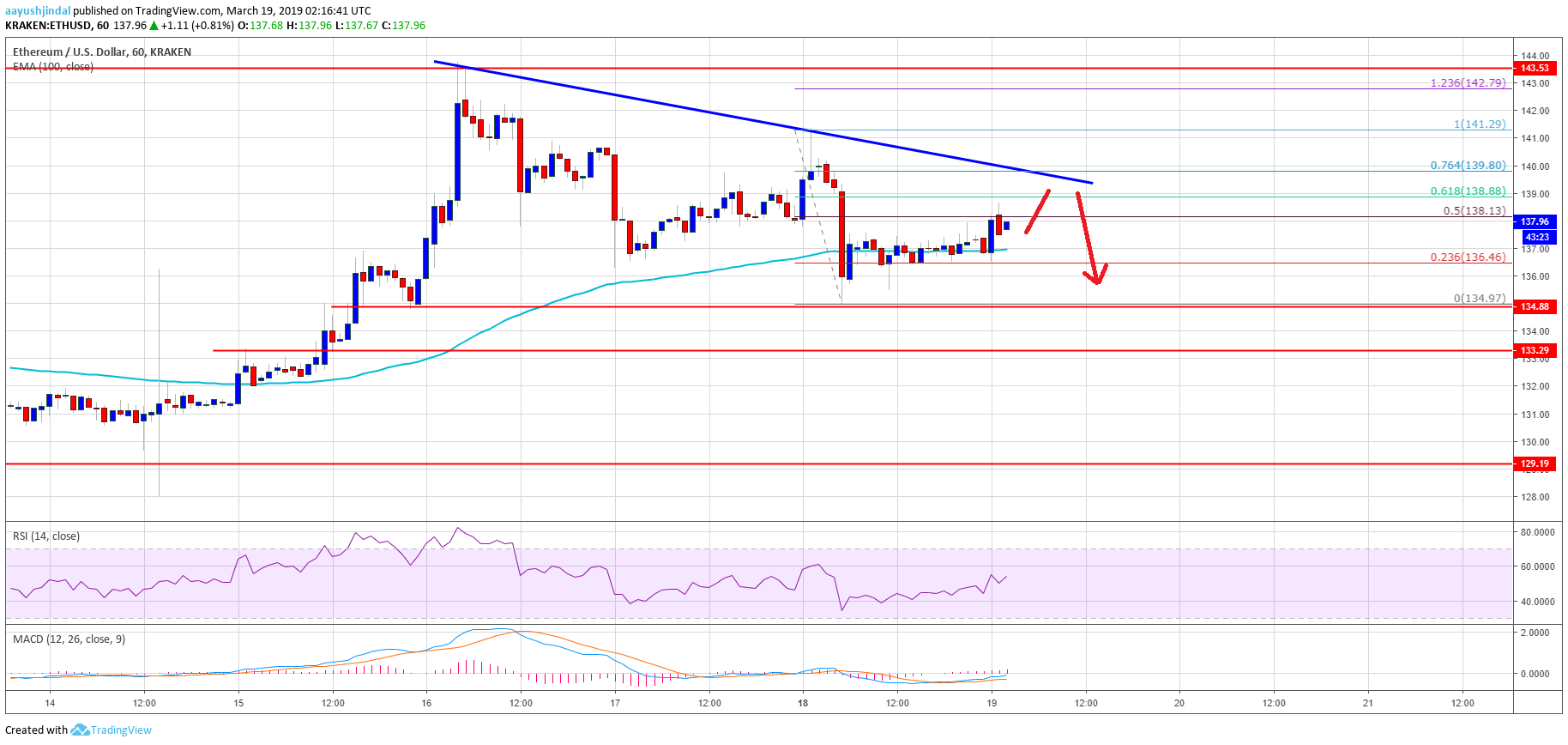

- ETH price failed to climb above the $140-141 resistance area and declined against the US Dollar.

- The price even broke the $137 support level and traded to a new weekly low near $135.

- This is a major bearish trend line formed with resistance at $140 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair may extend the current downside correction if it fails to surpass the $140 resistance area.

Ethereum price is slowly moving into a bearish zone against the US Dollar and bitcoin. ETH is now at a risk of a bearish reaction if it fails to climb above the $140 hurdle.

Ethereum Price Analysis

Yesterday, we saw the start of a downside correction in ETH price from the $144 swing high against the US Dollar. The ETH/USD pair declined below the $140 support level and traded close to the $137 level. Later, there was an upside correction, but the price failed to clear the $140-141 resistance area. The price also failed to climb above the 61.8% Fib retracement level of the last slide from the $144 swing high to $137 swing low. As a result, there was a fresh drop and the price even broke the $137 support level.A new weekly low was formed near the $135 level and the price is currently correcting higher. It moved above the $137 level and the 100 hourly simple moving average. There was a break above the 50% Fib retracement level of the recent decline from the $141 high to $135 swing low. However, there is a strong resistance formed near the $140 and $141 levels. There is also a major bearish trend line formed with resistance at $140 on the hourly chart of ETH/USD.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly gaining pace in the bullish zone.

Hourly RSI – The RSI for ETH/USD spiked above the 50 level and it is currently moving higher towards 60.

Major Support Level – $135