What Does Volume Tell You?

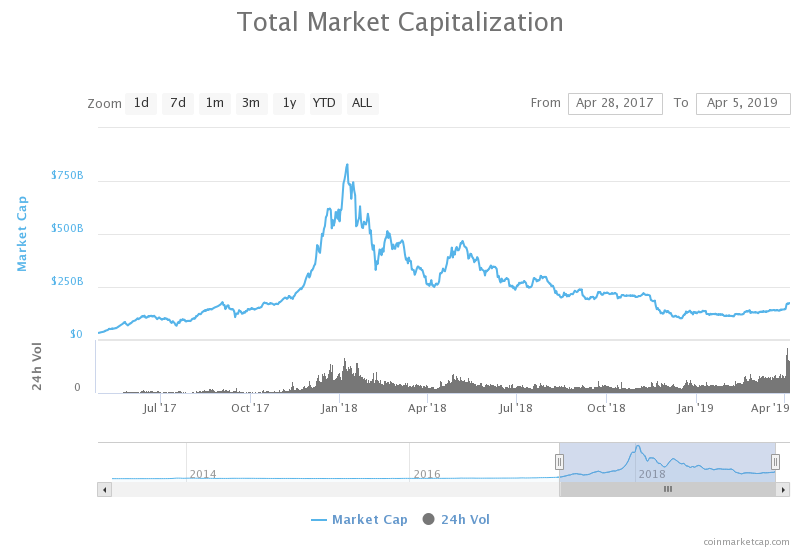

Volume relates to the value of transactions traded in the market at a given time. For each buyer, there will be a seller. And when both parties agree on a price, that transaction contributes to the total volume. It follows that high volume indicates high interest. But more than that, volume is an indication of market movement. On defining volume, says:“Volume is an important indicator in technical analysis as it is used to measure the relative worth of a market move. If the markets make a strong price movement, then the strength of that movement depends on the volume for that period. The higher the volume during the price move, the more significant the move.”

In consideration of this, many are interpreting all-time high volume as a positive change in crypto sentiment. But given recent reports of fake volume, it would be wise to exercise caution. Research conducted by showed that only ten exchanges, out of eighty-one analyzed, had any genuine trading volume. The rest consisted mostly of wash traded transactions to misrepresent activity. With that in mind, until authorities clamp down on wash trading, volume figures should be read with skepticism.

Dude, you really still trust in any of that reported volume? — ALTriano Celentano (@ATHomiCrypto)

Tether Controversy

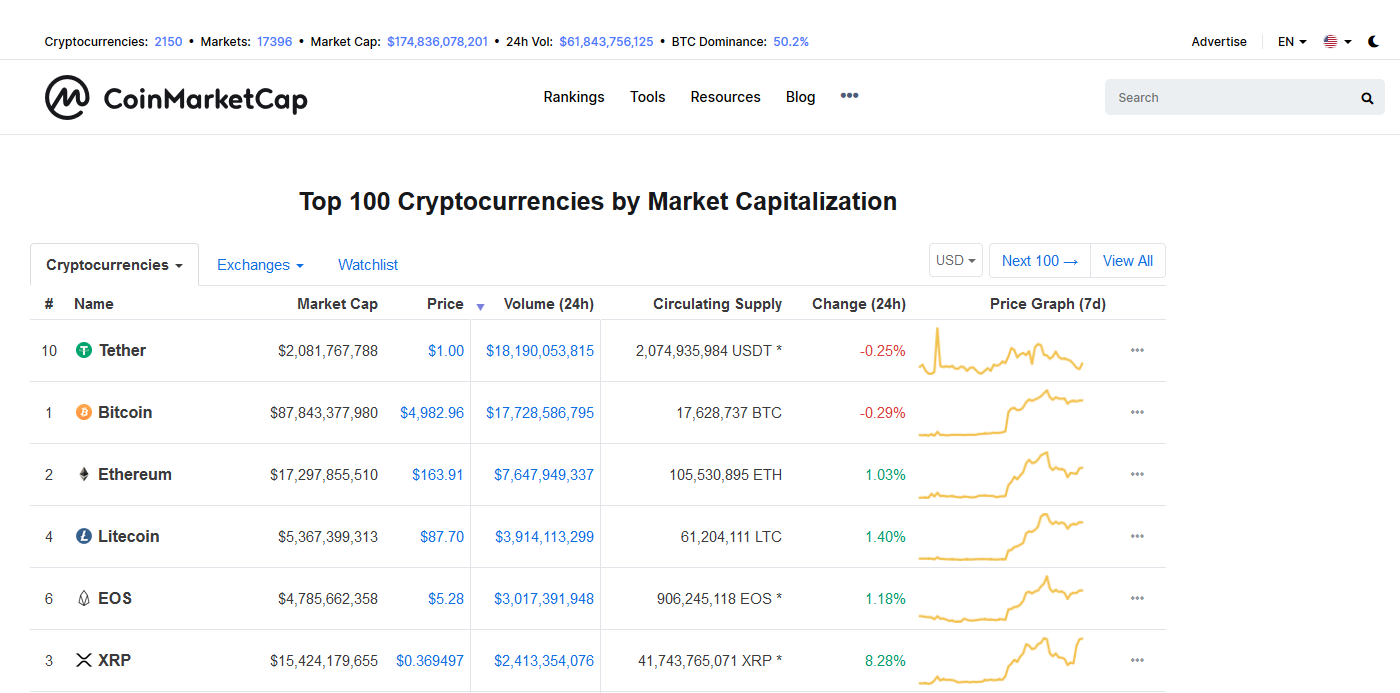

Despite some controversies over the last year and a half, Tether is performing strongly. At the time of writing, it is the number one coin by volume, beating Bitcoin by almost $500 million. And it continues to be the most popular option for investors to move their crypto assets into stable form.

“similar to bank run as their usd peg is not enough to keep usdt at 1;1”And while that scenario may not materialize, for example, there is no other indication of a mass USDT sell-off, and, the company’s reserves may be sufficiently liquid if that did happen, it still pays to be vigilant, even during a bullish phase. //twitter.com/Emperor_YZ/status/65434368 Featured Image Via Shutterstock