- Bitcoin price fund a strong support near the $4,920 level and later recovered against the US Dollar.

- The price broke the $5,120 resistance level to move into a positive zone.

- There was a break above a key bearish trend line with resistance at $5,080 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is now trading nicely above the $5,150 level and the 100 hourly simple moving average.

Bitcoin price rebounded nicely above $5,100 against the US Dollar. BTC is currently showing positive signs and a break above $5,200 is likely to accelerate gains above $5,250 in the near term.

Bitcoin Price Analysis

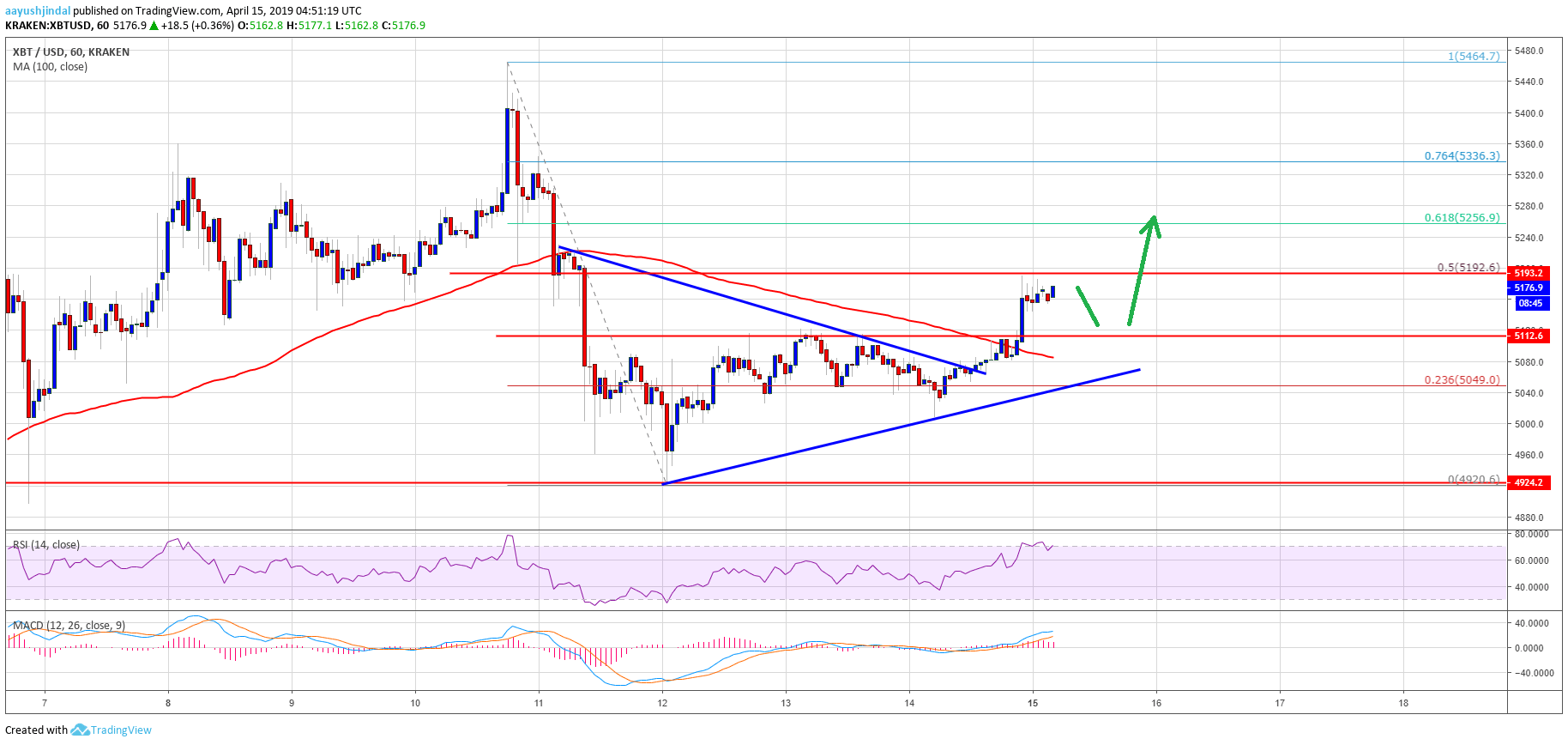

This past week, we saw a major downside correction below $5,200 in bitcoin price against the US Dollar. The BTC/USD pair even broke the $5,000 level and traded as low as $4,920. Later, the price consolidated in a range and formed a decent support above the $4,950 level. Finally, the price started a fresh increase and traded above the $5,040 and $5,120 resistance levels. Buyers gained traction and pushed the price above the $5,150 level and the 100 hourly simple moving average.

Besides, the price broke the 23.6% Fib retracement level of the last drop from the $5,464 high to $4,920 low. More importantly, there was a break above a key bearish trend line with resistance at $5,080 on the hourly chart of the BTC/USD pair. The pair is now trading nicely above the $5,150 level and the 100 hourly simple moving average. It traded close to the $5,200 resistance and the 50% Fib retracement level of the last drop from the $5,464 high to $4,920 low.A break above the $5,200 level is needed for more gains. The next key resistance could be $5,255 and the 61.8% Fib retracement level of the last drop from the $5,464 high to $4,920 low. A successful close above the $5,260 level might open the doors for a strong rise towards the $5,330 level. On the downside, the recent resistance at $5,120 is likely to act a solid support.