- Ripple (XRP) sink 12 percent

- Yoshitaka Kitao, the CEO of SBI, is now a Ripple Inc board member

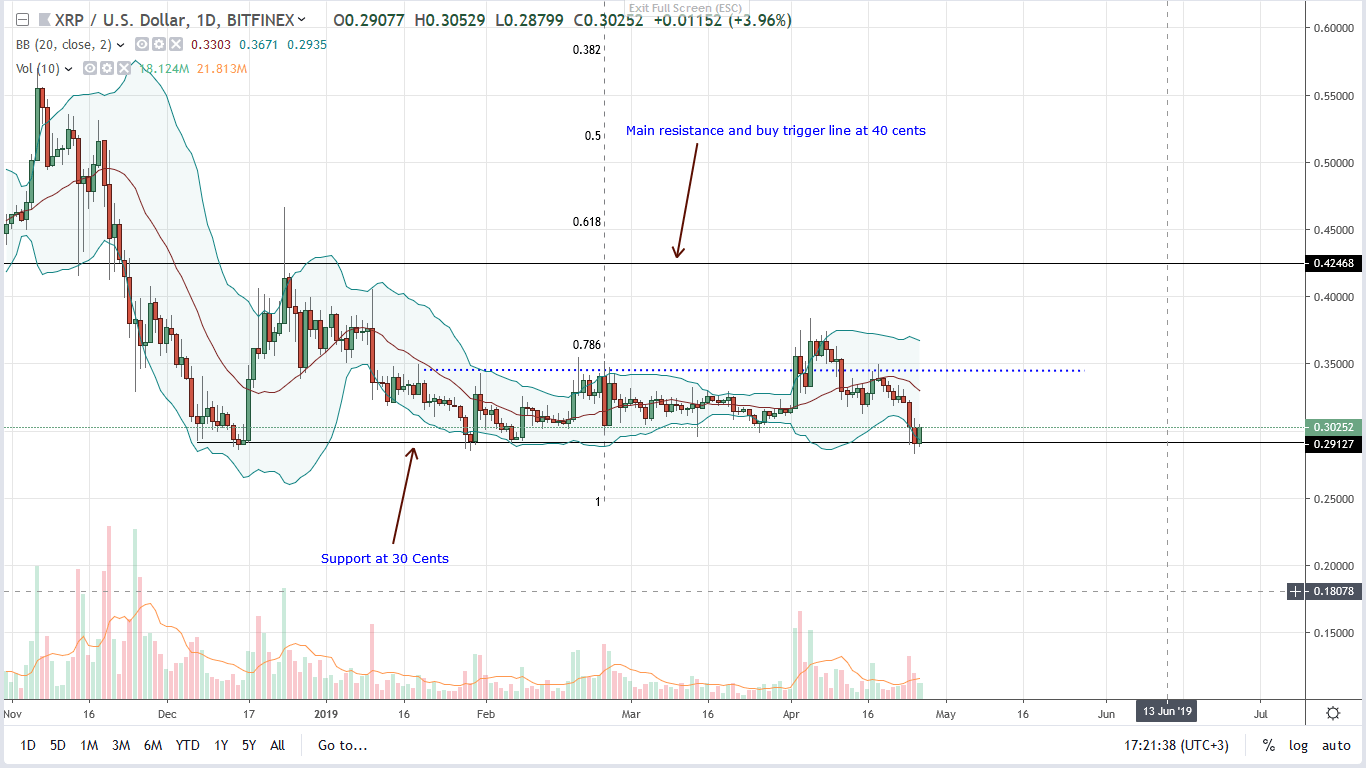

Bringing on board Yoshitaka Kitao, the president of SBI Holdings is bullish for Ripple (XRP). It’s not hard to see why. He brings expertise that would guide Ripple Inc towards world domination. Meanwhile, Ripple (XRP) is down 12 percent retesting Q1 2019 support.

Ripple Price Analysis

Fundamentals

The crypto and blockchain space never settles. It’s always on a mill and sometimes slowed down by multi-plane controversies. Even so, Ripple Inc remains a market leader. World Bank acknowledges its innovative solutions saying they impact people’s lives positively. True, several firms and payment processors are using the RippleNet though not many prefer to upgrade to xCurrent version 4, which avails a rail for xRapid deployment.Chris Larsen, the Chair executive chair of the board, commented:“Blockchain and digital assets are changing the way we move money around the world, and Ripple is the driving force behind this positive change. I am excited by this opportunity to lend my expertise and be part of the company’s next phase of growth.”

“I am excited to welcome Mr. Kitao to our Board of Directors. From conventional financial markets to digital asset markets, his deep understanding of the financial services industry will offer valuable business and financial expertise to help Ripple continue to scale”

Candlestick Arrangements

Once that happens, Ripple (XRP) bulls would flow back as prices break off this accumulation confirming buyers of Jan 30. Considering the duration of this 4 cents consolidation, we expect a sharp, wide-ranging bar to either thrust the asset above 40 cents in confirmation or towards 25 cents nullifying our stance. Before then, traders should stay on the sidelines.

Technical Indicators

Our anchor bar is Apr-24 with 48 million. With above average volumes—48 million against 20 million, bear reversal and trend continuation must be with similar participation levels exceeding 48 million or even Apr-2’s 79 million.Chart courtesy of Trading View