As traders have begun to realize that the news regarding the financial status of Tether Limited (USDT’s issuer) and Bitfinex isn’t all too harrowing, Bitcoin (BTC) has recently stabilized. In fact, analysts have claimed that the crypto market’s lack of reaction to the seemingly bearish news shows strong fundamental strength, and may, in fact, be a precursor to a bull run.

Related Reading: Bitcoin Price Reaction to Tether Fiasco May Signal Strong Fundamental Strength

However, a number of chartists have recently taken to Twitter to note that contrary to popular belief, Bitcoin isn’t poised for a rally just yet.Bitcoin Could See One. More. Drop.

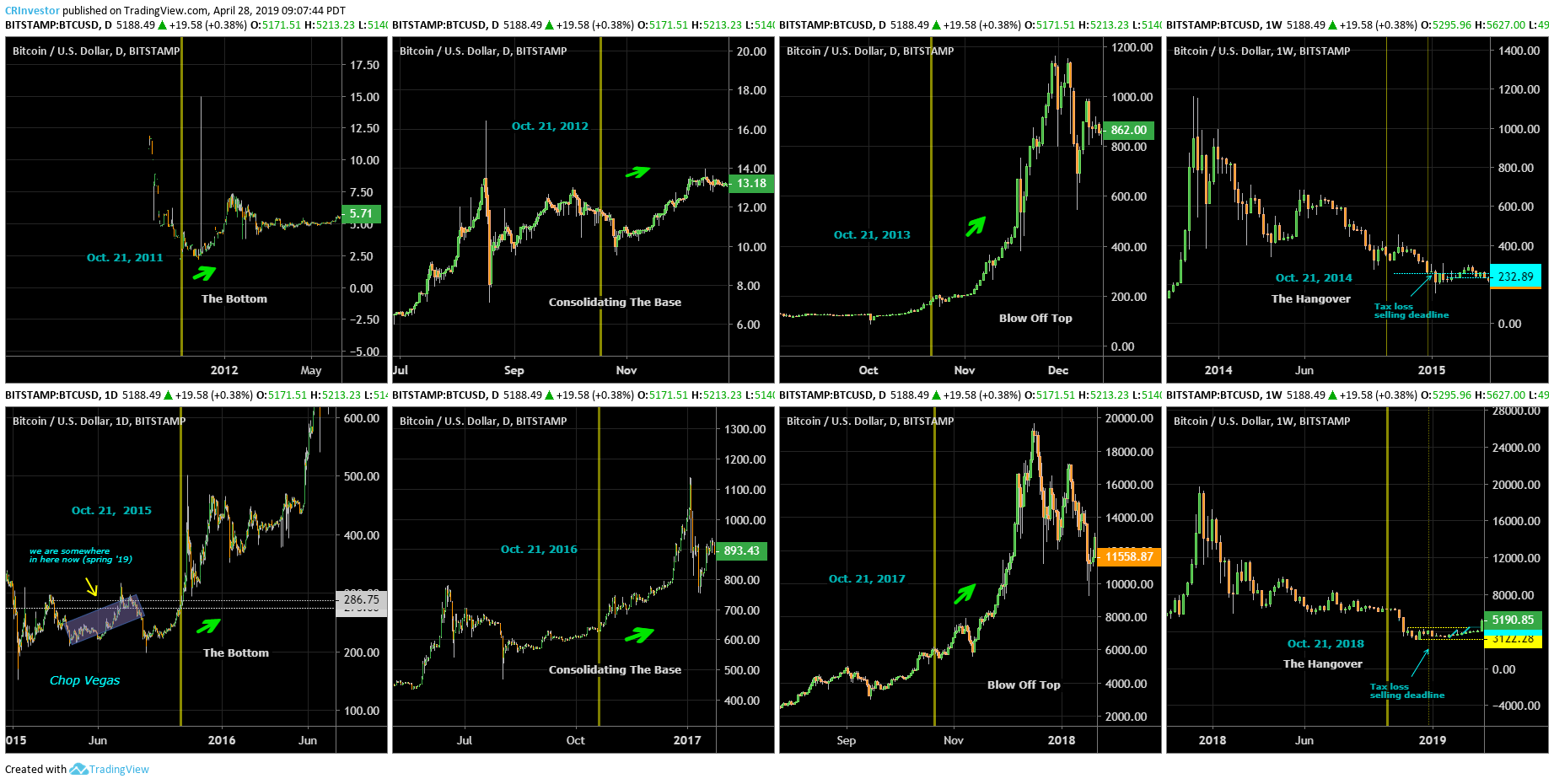

Since BTC has become a liquid, tradable asset, it has followed short-term and long-term trends, most of which can be charted and extrapolated for price prediction purposes. One popular technical analyst, Brian “The Rational Investor” Beamish, that if Bitcoin follows its four-year cycle again, a move lower may soon be inbound.

“Based on this comparison, from a technical standpoint, I have absolutely no reason to believe that we won’t retrace to at least the 0.618 [Fibonacci retracement], which is just above $4,000. People who think we are just going to skyrocket above that major resistance around $6,000 are delusional. It took months of testing for us to break down below that level. It will take months of testing for us to break out above it.”

Featured Image from Shutterstock