- Ethereum (ETH) steady above $150

- After rumors of a public-private blockchain, Samsung investing in crypto projects

Samsung is investing in crypto projects. Through Samsung Ventures, the electronics giant channeled $2.9 million in Ledger before investing an undisclosed amount in ZenGo which managed to raise $4 million. Meanwhile, Ethereum (ETH) is recovering after retesting $150 support.

Ethereum Price Analysis

Fundamentals

Talks of Ethereum 2.0, Serenity and EIP 1234 apart, the involvement of Samsung is massive for Ethereum (ETH). As a reiteration, Samsung is experimenting and part of their trials may lead to the issuance of Samsung Coin.

If anything this is an endorsement of Ethereum as a reliable blockchain with solid plans of scaling and further developing the network to handle all the heavy lifting from an established electronics giant. Add that to Samsung Galaxy S10 Blockchain Store wallet supporting Ethereum (ETH) and ERC-20 tokens, and investors don’t need other signals for what the future holds.

Furthermore, Samsung Ventures invested $2.9 million in Ledger and channeled an undisclosed amount to —raising $4 million from several investors including Elron and Benson Oak Ventures. While Ethereum 2.0 may take months before full implementation, the confidence of Joseph Lubin that ETH will explode 1000X in two years is a hint of what is in store for the world’s second largest cryptocurrency.

Candlestick Arrangement

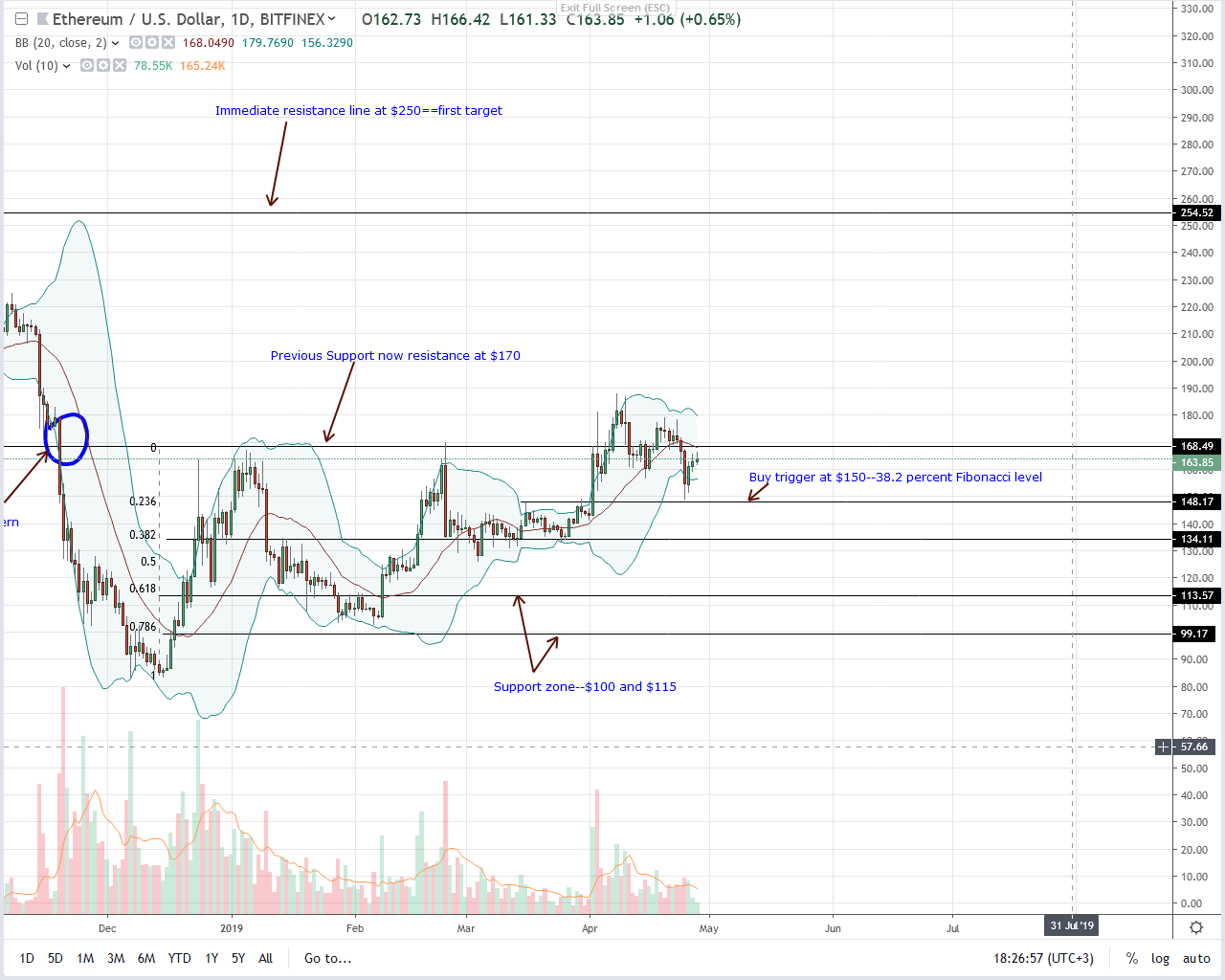

After events of Apr-25, Ethereum (ETH) prices did drop back to $150 in a retest phase. Because of the deep, unexpected slide, ETH fall did cause an over-extension. By closing below the lower BB, there was a temporary undervaluation and correction from Apr-26 could spur another wave as buyers flow back, reversing losses.

As it is, Ethereum (ETH) is neutral but with bullish leanings all depending on the ability of buyers to resist losses below Apr-2 lows. Note that Apr-2 bull bar, in light of recent events, anchors our analysis. Besides, since prices broke above $150 triggering short-term buyers aiming for $170, it guides our near-term trajectory in short to medium term from an effort versus result point of view.

Therefore, while we are optimistic, it is all-important that buyers, first of all, close above $170 nullifying bears of Q4 2018 and later $190 confirming buyers of Apr-2 in a trend continuation towards $250. Before then, risk-averse traders should be on the sidelines until after our trade conditions are true.

Technical Indicators

The Apr-2 bull bar guides our trade plan while Apr-25 is our reference bar from an effort versus result point of view. For trend continuation then bears of Apr-25 must be canceled. Propelling ETH to new highs should be volumes exceeding 239k of Apr-25.

Chart courtesy of Trading View.