- Bitcoin price surged above the $5,800 level and traded to a new 2019 high against the US Dollar.

- The price traded as high as $5,837 on Kraken and recently corrected below the $5,600 level.

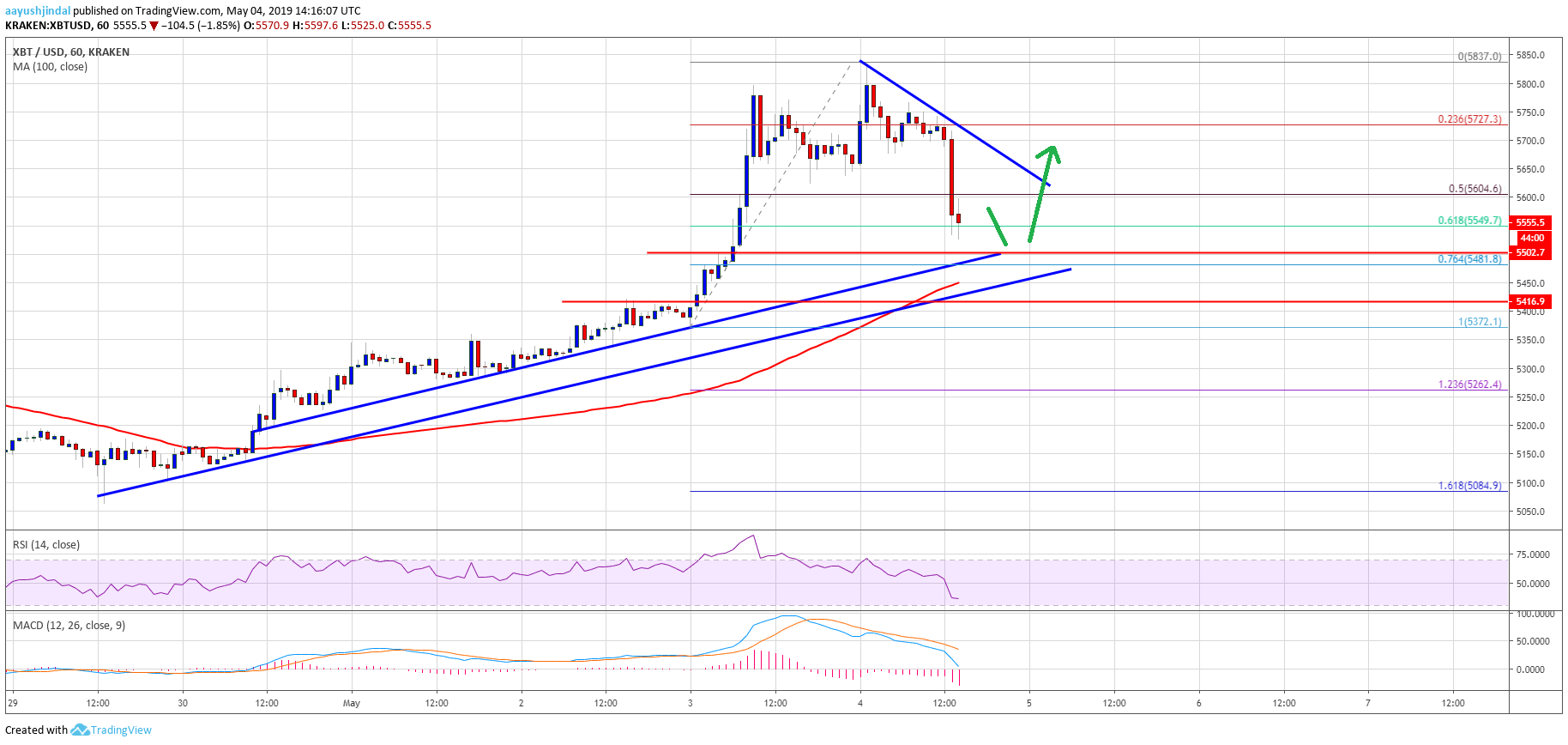

- This week’s followed two bullish trend lines are intact with support near $5,500 and $5,480 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair remains supported on dips and it is likely to bounce back above $5,650 in the near term.

Bitcoin price surged above the $5,700 and $5,800 resistance levels. BTC corrected lower recently, but dips remain attractive to the bulls near $5,500 in the near term.

Bitcoin Price Analysis

The past two days were very bullish on bitcoin price above the $5,500 resistance against the US Dollar. The BTC/USD pair broke the $5,650 and $5,700 resistance levels to trade to a new 2019 high. The pair even surged above the $5,800 level and settled well above the 100 hourly simple moving average. The price traded as high as $5,837 and recently started a downside correction. As a result, it broke the $5,650 level and the 50% Fib retracement level of the recent wave from the $5,372 low to $5,837 high.

However, there are many supports near the $5,550 and $5,500 levels. The 61.8% Fib retracement level of the recent wave from the $5,372 low to $5,837 high seems to be acting as a strong support near $5,540. More importantly, this week’s followed two bullish trend lines are intact with support near $5,500 and $5,480 on the hourly chart of the BTC/USD pair. If the price dips again, the bulls are likely to defend the $5,500 support area. The last line of defense is near $5,480, and the 76.4% Fib retracement level of the recent wave from the $5,372 low to $5,837 high.

On the upside, an initial resistance is near the $5,650 level. The next key resistance is near $5,650 and a connecting bearish trend line on the same chart. A successful close above $5,650 may call for a fresh increase above $5,700 and $5,750.

Looking at the , bitcoin price is trading in a strong uptrend above $5,500 and $5,480. Therefore, any dips remain attractive and the price could bounce back above $5,700 in the near term. The main hurdle is near the $5,800 level, above which the price is likely to test the $6,000 resistance area.

Technical indicators:

Hourly MACD – The MACD is currently placed heavily in the bearish zone, with a few positive signs.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD dipped sharply below the 50 level, but stable near 35.

Major Support Levels – $5,550 followed by $5,500.

Major Resistance Levels – $5,600, $5,650 and $5,750.