- Bitcoin price was unfazed and it recently broke the $6,200 resistance level against the US Dollar.

- The price even broke the $6,300 level and it seems like the bulls are now aiming $6,500.

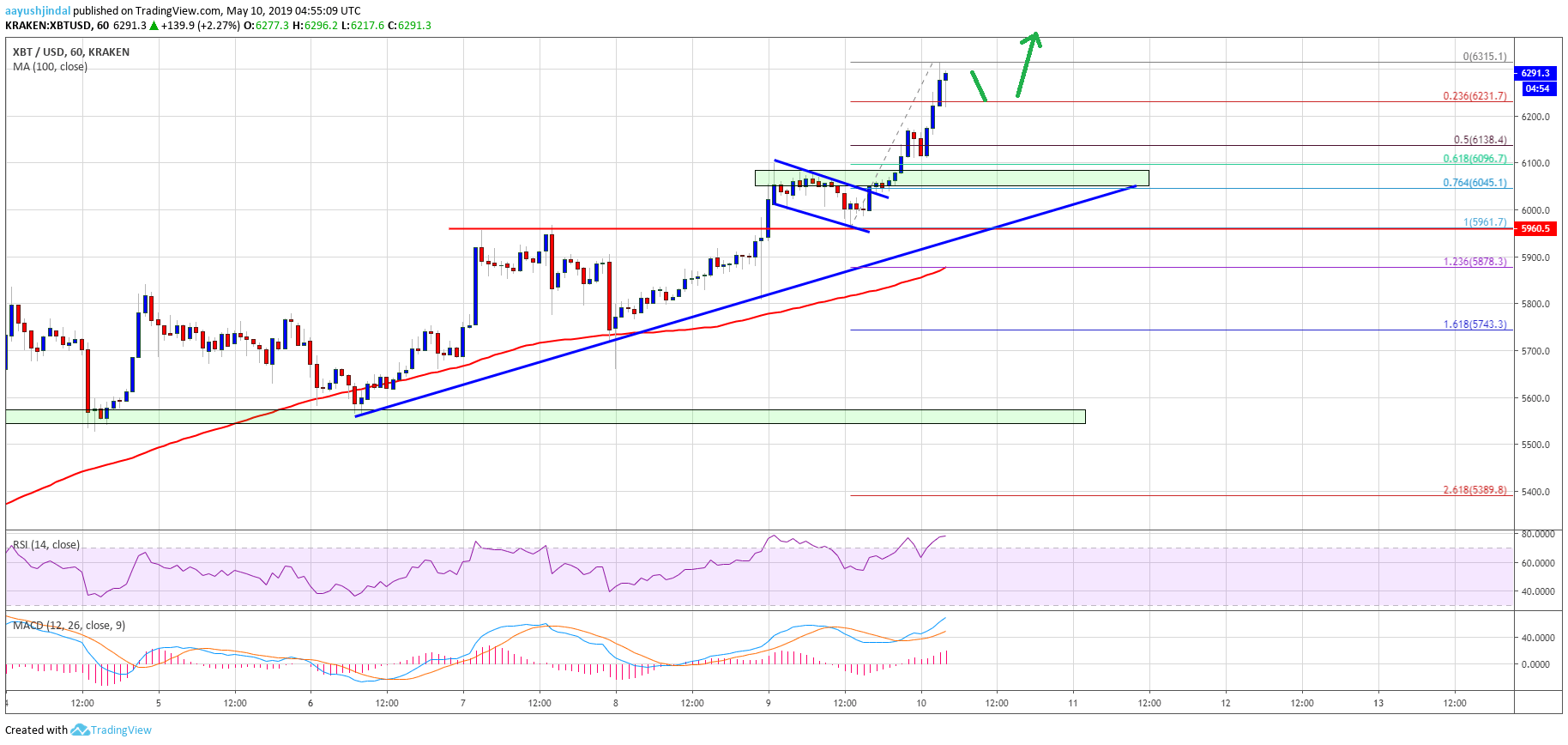

- There is a major bullish trend line forming with support at $6,050 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could find a strong buying interest if it corrects lower towards $6,100 or $6,000.

Bitcoin price rallied more than 4% and cleared $6,300 against the US Dollar. BTC remains in a strong uptrend and it seems like the bulls are now aiming a test of $6,400 or even $6,500.

Bitcoin Price Analysis

This week, bitcoin price overcame all hurdles and rallied above $6,000 and $6,200 against the US Dollar. The BTC/USD pair gained bullish momentum after it settled above $6,100 and the 100 hourly simple moving average. Recently, it broke a bullish flag pattern with resistance near $6,040 on the hourly chart to start a strong upward move. As a result, the bulls pushed the price above the $6,250 and $6,300 resistance levels. A new 2019 high was formed at $6,315 and the price is likely to extend gains.

An initial support is near the $6,230 level, and the 23.6% Fib retracement level of the recent rally from the $5,961 low to $6,315 high. If there is a downside extension, the next key support could be $6,140. It represents the 50% Fib retracement level of the recent rally from the $5,961 low to $6,315 high. More importantly, there is a major bullish trend line forming with support at $6,050 on the hourly chart of the BTC/USD pair. Moreover, the previous resistance area near $6,050 is likely to act as a strong buy zone if the price corrects lower.Besides, the price is now well above the $6,000 pivot level and the bullish 100 hourly SMA. Therefore, there are chances of more upsides above the $6,300 and $6,350 levels. The next main hurdle is near the $6,400 level, above which the price could rally towards the $6,500 level.