- Bitcoin (BTC) sinks 5.1 percent in the last day

- Holders are steadfast, 21.5 percent of all BTC in circulation static in the last half a decade

In an independent research, Delphi Capital now reveals that holders are unmoved even by the recent Bull Run. Overly, it is a good sign that over 21.5 percent of all BTC in circulation are secure. It’s a sign of confidence, especially now that bulls are cooling off in a correction.

Bitcoin Price Analysis

Fundamentals

Coinciding with Yen, CHF and gold revival, Bitcoin’s rally was significant. Despite criticism, Bitcoin is gradually emerging as a reliable store of value regardless of historical price fluctuations.

Even though the same volatility tick traders, fund managers and the wealthy seeking safe refuge for their rightly accrued wealth are funneling their stash to Bitcoin. Timely entries could lead to extraordinary gains. On the other hand, buying the asset without a safety net could mean deep losses.Nonetheless, what is attractive is Bitcoin’s stability. Secured by pitch-perfect distribution and decentralization, the network is robust and presently impervious. Add that to the trustlessness and the lack of intermediaries guaranteeing an autonomous system and that could explain the reason why 21.5 percent of all BTC in circulation are static, stored in a single address over the last five years.

A further 60 percent of all BTC, as per an analysis of UTXO (Unspent Transaction Output), are yet to be moved in the previous year. According to Delphi Capital, recent price swings also attracted new sellers. Outflows through to June also increased revealing that coin owners may be moving their stash offline in readiness of holding.

Candlestick Arrangements

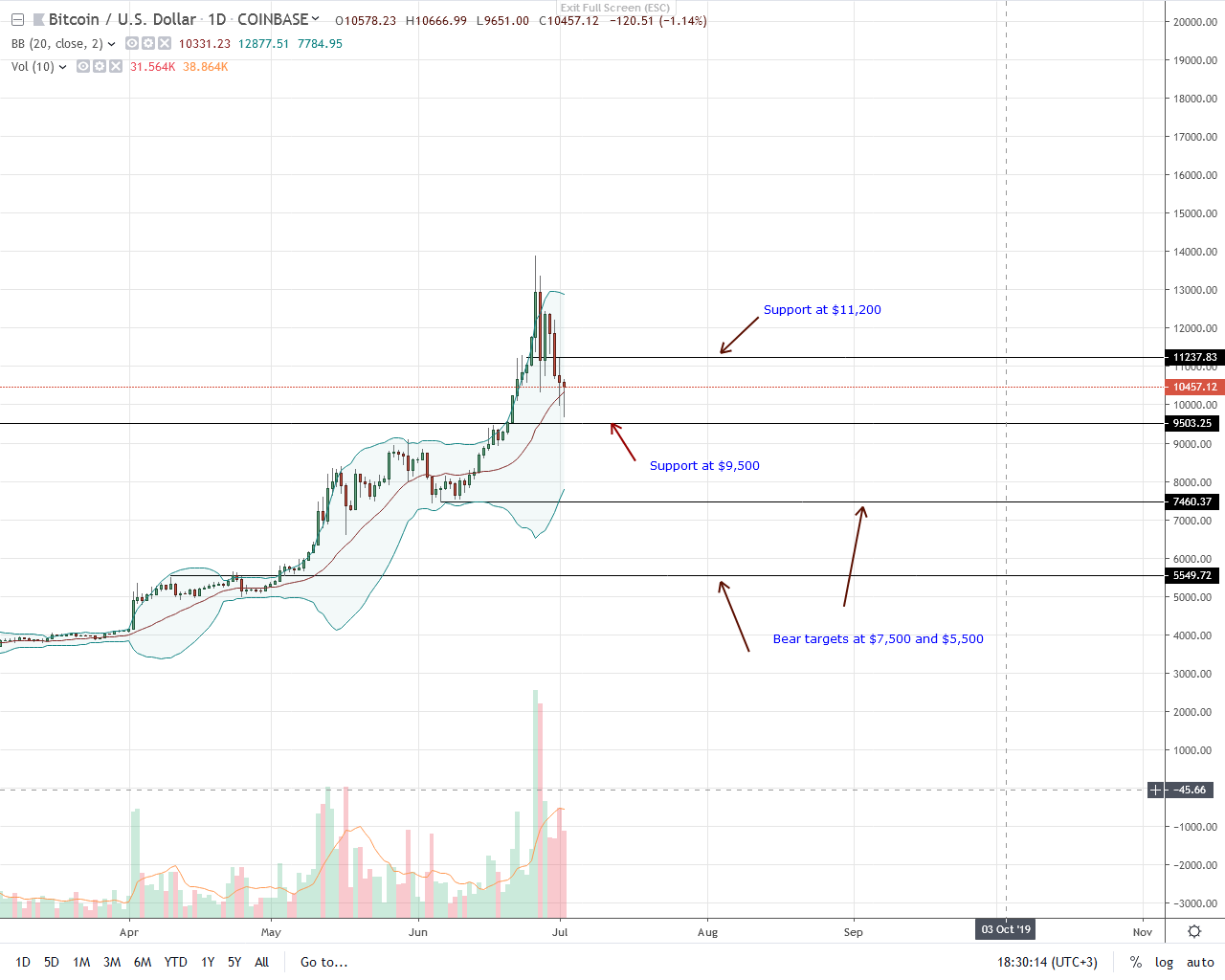

Tumbling 5.1 percent from last week’s close, BTC sellers are in the driving seat. Although it is too early to draw conclusions, the temporary dip below $9,500 hint of fractures. Moving on, and in sync with previous BTC/USD trade plans, every pullback is technically a selling opportunity in days ahead.

Because of yesterday’s drawdown, sellers have a chance. Risk-off traders can capitalize on across the board panic sells while aiming at $9,500 and $7,500. Such a move will confirm the double bar bear reversal pattern of June 26 and 27, as price action seeks to strike equilibrium following the over-pricing of June 26. That is when prices spiked, closing above the upper Bollinger Band (BB) complete with surging trade volumes marking a climax.Technical Indicators

Overall sentiment is shifting, and bears may reverse gains. Posting superior gains in the first half of the year, buyers will be back in control if there are upsurges above $14,000. Accompanying this price rally must be high trading volumes exceeding 82k of June 26. On the flip side, dumps below $9,500 reaffirming sellers ought to be with similar participation levels.courtesy of Trading View. Image Courtesy of Shutterstock