- Bitcoin price failed to stay above the $11,000 level and resumed decline against the US Dollar.

- The price traded below the key $10,000 and $9,800 support levels to enter a bearish zone.

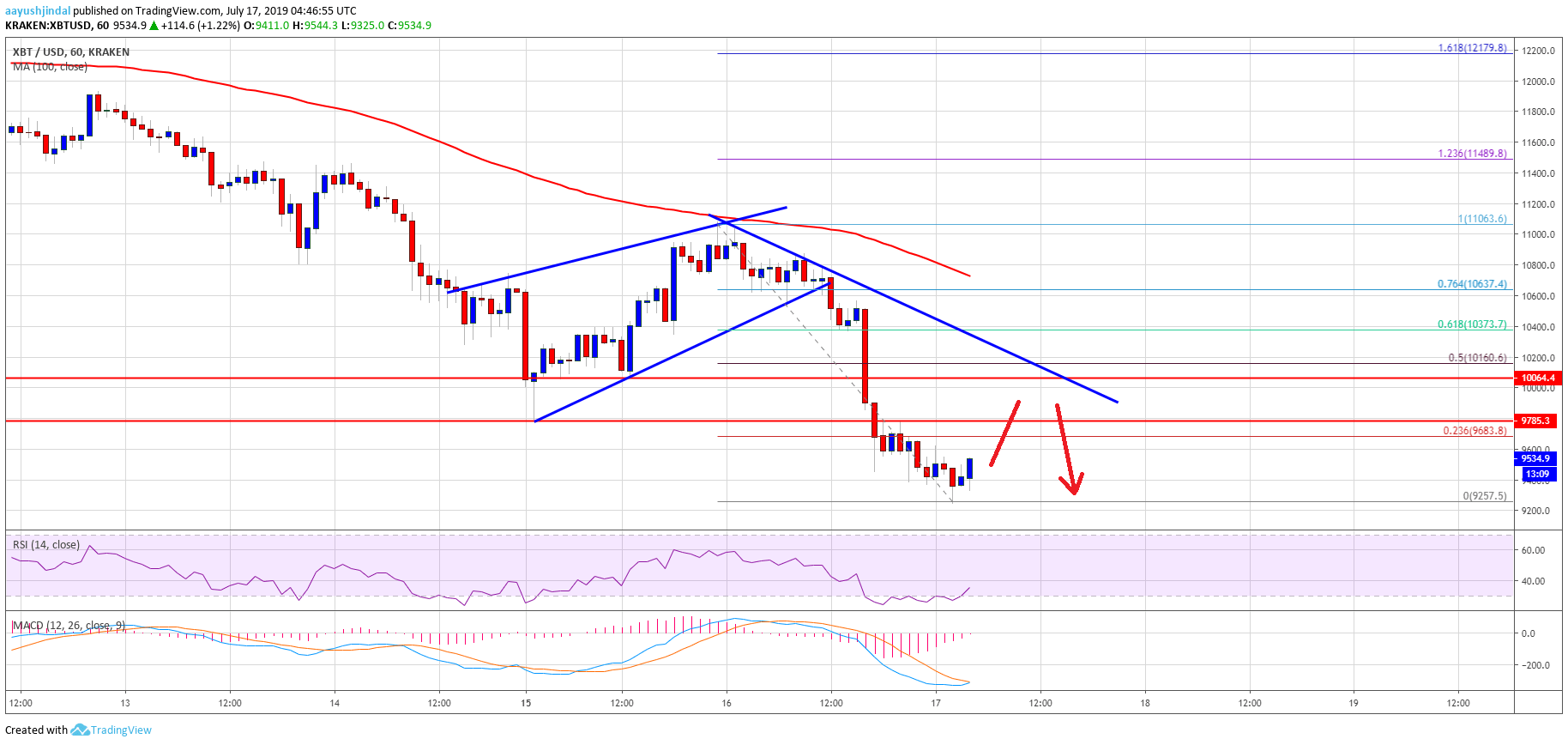

- There is a new connecting bearish trend line forming with resistance near $10,060 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The price remains at a risk of more losses below the $9,200 and $9,000 support levels in the near term.

Bitcoin price tumbled around 15% and broke the $9,500 level against the US Dollar. BTC remains at a risk of more losses and it seems like the $8,800 bearish target is still in sight.

Bitcoin Price Analysis

This week, we saw a major decline in bitcoin price below the $10,500 support against the US Dollar. The BTC/USD pair found support near $9,800 and yesterday corrected higher. It climbed above the $10,500 level, but struggled to gain momentum above the $11,000 level. A top was formed near the $11,100 level and the 100 hourly simple moving average. As a result, the price started a fresh decline below the $10,500 support level.

The decline was such that the price broke the $10,000 and $9,800 support levels. Moreover, the price declined close to 15% and traded as low as $9,257. It is currently consolidating above $9,300 and it might correct higher. An immediate resistance is near the $9,680 level plus the 23.6% Fib retracement level of the recent drop from the $11,063 high to $9,257 low. However, the main resistance is near the $10,000 and $10,100 levels.Conversely, if there is no recovery above $9,650 or $10,000, the price could continue to decline. An immediate support is near the $9,200 level, below which it could even break the $9,000 support zone. The main target could be $8,880 (as discussed in the weekly forecast when the price was well above $10,500).