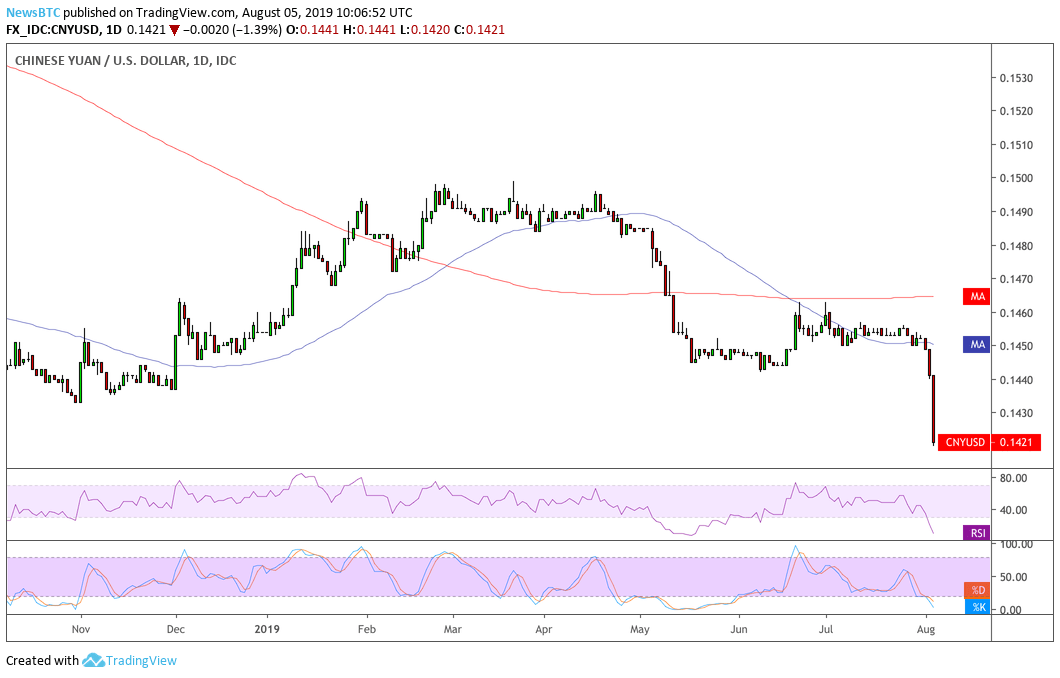

Yuan Declines

The gains in the bitcoin market coincide with the decision of US President Donald Trump to impose 10 percent tariffs on $300 billion worth of Chinese imports. The macroeconomic event led the PBoC today to set its daily referential rate for yuan below $7, its worst in a decade. The Chinese central bank said in a statement that it would keep the currency “,” adding that their move is an act of “trade protectionism” against Trump’s economic warfare. The latest drop in yuan, says PBoC, is merely a reflection of fluctuating demand and supply.

“Fears of yuan depreciation and a currency war have ramped up again; this will likely compound worries across financial markets.”

Bitcoin Turns Safe-Haven

Investors looking for a refuge from the adverse sentiments in the global market are visibly bringing more capital to the bitcoin market. Scott Melker of Texas West Capital believes Chinese are once again driving the cryptocurrency prices up while avoiding to become collateral damage of the US-China trade war.

“If you are looking for narrative on the recent move, look at what just happened to the Chinese Yuan — absolutely getting crushed. Perhaps the Chinese are scooping up some Bitcoin as a store of value. It’s a fun thought.”

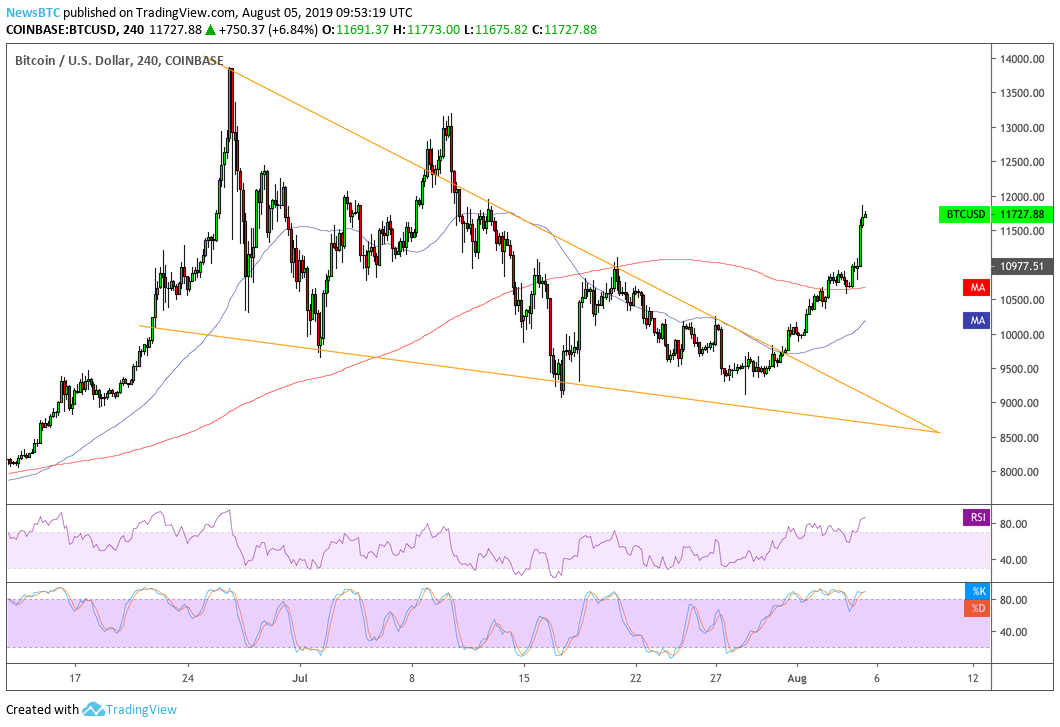

The price of bitcoin has surged 17.54 percent since Trump’s tariff warning.China markets down 0,5%

We are entering a new cycle where Investors are moving into Bitcoin when equity markets fall. — Ran Neuner (@cryptomanran)

Hong Kong Down 1,5%

Dow futures down 125 points.

Bitcoin up 5%.