“Volatility in bitcoin is guaranteeing to reach new lows. The low in 180-day volatility is around 40 percent and that was from October 2015. That marked the bottom in the market and took off.”

McGlone added that the reason people would prefer to hold bitcoins over trading them is institutionalization. The analyst highlighted the Intercontinental Exchange’s digital assets arm Bakkt for bringing bitcoin futures contracts to big investors on Wall Street. Catalysts such as these would make investors more confident about the cryptocurrency, in general. And – as a result – the volatility will drop.

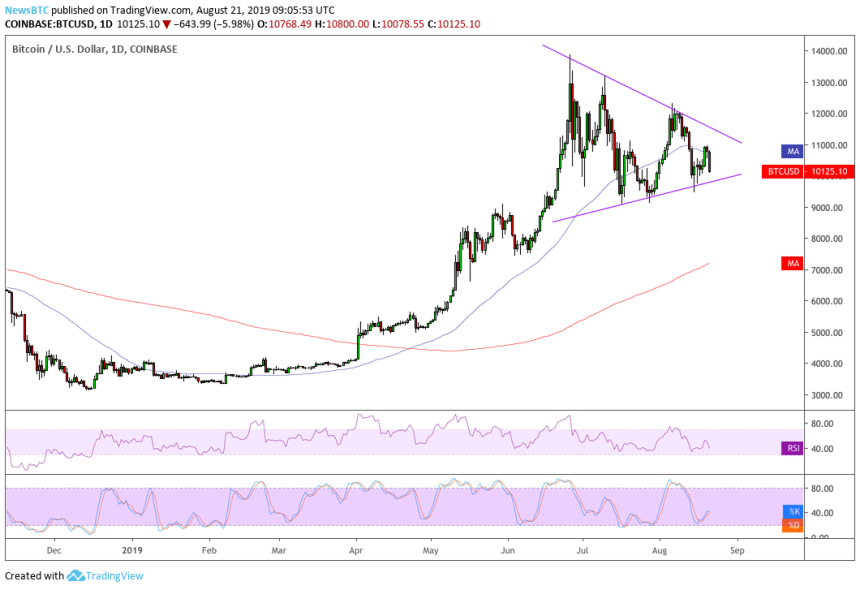

“[Bitcoin] is doing that right now,” stated McGlone. “It has put in a pretty good low near the support around $8,000 and a pretty good resistance around the $20,000. It could be stuck in that range endlessly, which pushes volatility low, and make [bitcoin] much like gold.”

Better Upside Targets

But not everyone agrees with bitcoin limiting its upside near $20,000 – which is also the cryptocurrency’s all-time high established during the 2017’s bull run. Thomas Lee of New York-based Fundstrat Global Advisors believes bitcoin could touch the $40,000 level within a few months. The managing partner and head of research said in a note to clients this June that investors would buy the cryptocurrency out of their fears of missing out. He noted that bitcoin is becoming a reserve currency for other, similar assets – and that it has been above the $9,000 level in only 4 percent of its overall history.“I think bitcoin is easily going to take out its all-time highs,” Lee added.

“It’s going to keep going because I’m a believer that in four years, something like that, bitcoin will be about a 5 percent market share of the Earth,” Draper told Fox Business. “It’s a better currency, it’s decentralized, open [and] it’s transparent – everybody knows what happens on the blockchain.”

Negatives

Meanwhile, some skeptics see bitcoin as an overhyped investment vehicle with no intrinsic value. Noted economist Nouriel Roubini and gold bull Peter Schiff think the cryptocurrency price would go to zero. At the same time, Uber angel investor Jason Calacanis thinks the best bitcoin can do is hold its value near a meager $500 mark.

My position remains the same. will likely be replaced by a new technology & it’s manipulated It’s possible it’s built to last, but not probable, so keep your position to an amount you’re willing to loose For most, that’s 1-5% of net worth It will likely go to 0-$500. — @jason (@Jason)Bitcoin was trading at $10,120 at press time, down 6 percent on a 24-hour timeframe.