- Bitcoin price is jumped higher recently, but it struggled to continue above $10,500 against the US Dollar.

- The price is currently trading in a bearish zone and it could accelerate losses below $10,200 in the near term.

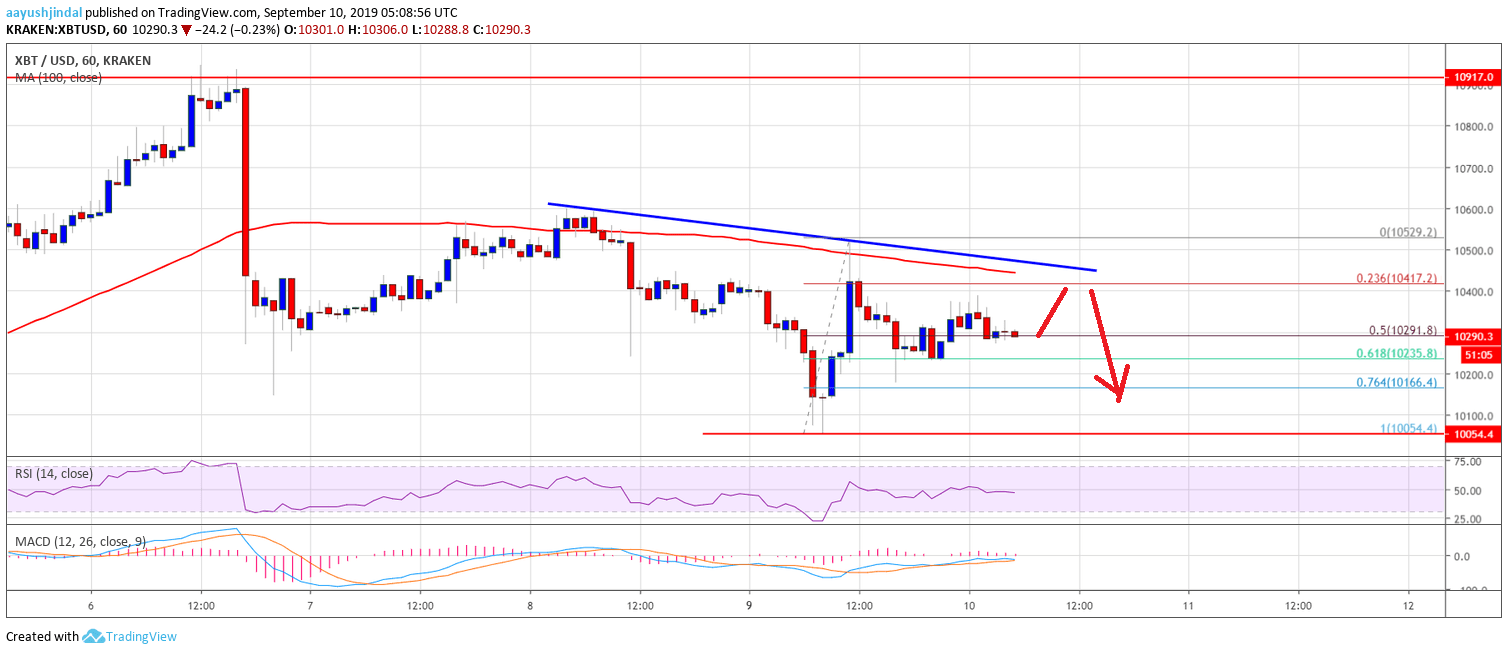

- There is a connecting bearish trend line forming with resistance near $10,450 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The price is slowly turning sell on rallies near the $10,450 and $10,500 levels.

Bitcoin price is currently trading in a range below $10,500 against the US Dollar. BTC could decline further if it continues to struggle below the $10,500 level.

Bitcoin Price Analysis

In the past few sessions, bitcoin price remained in a bearish zone below $10,600 against the US Dollar. The decline was such that the BTC/USD pair broke the $10,200 support area as well. Moreover, the price spiked below the $10,100 level. A new swing low was formed near the $10,054 and recently the price corrected higher. It spiked above $10,400, but the bulls failed to gain traction above the $10,500 level.

A swing high was formed near $10,529 and the price is currently correcting lower. The price broke the $10,400 level plus the 50% Fib retracement level of the last wave from the $10,054 low to $10,529 high. Moreover, the price is trading well below the $10,350 level and the 100 hourly simple moving average. An immediate support is near the $10,250 level and the 61.8% Fib retracement level of the last wave from the $10,054 low to $10,529 high.If there is a downside break below the $10,250 support, the price could revisit the $10,050 support area. Any further losses could accelerate decline below the $10,050 and $10,000 levels. A clear break below the $10,000 level might call for a drop to $9,500.

On the upside, an immediate resistance is near the $10,350 and $10,400 levels. Moreover, there is a connecting bearish trend line forming with resistance near $10,450 on the hourly chart of the BTC/USD pair. The 100 hourly SMA is also near the $10,400 level. Therefore, it won’t be easy for the bulls to push the price above the $10,400 and $10,500 resistance levels.