- ETH price is slowly moving down and recently broke the $180 support area against the US Dollar.

- The price could soon test the $172 or $170 level before it starts a fresh increase.

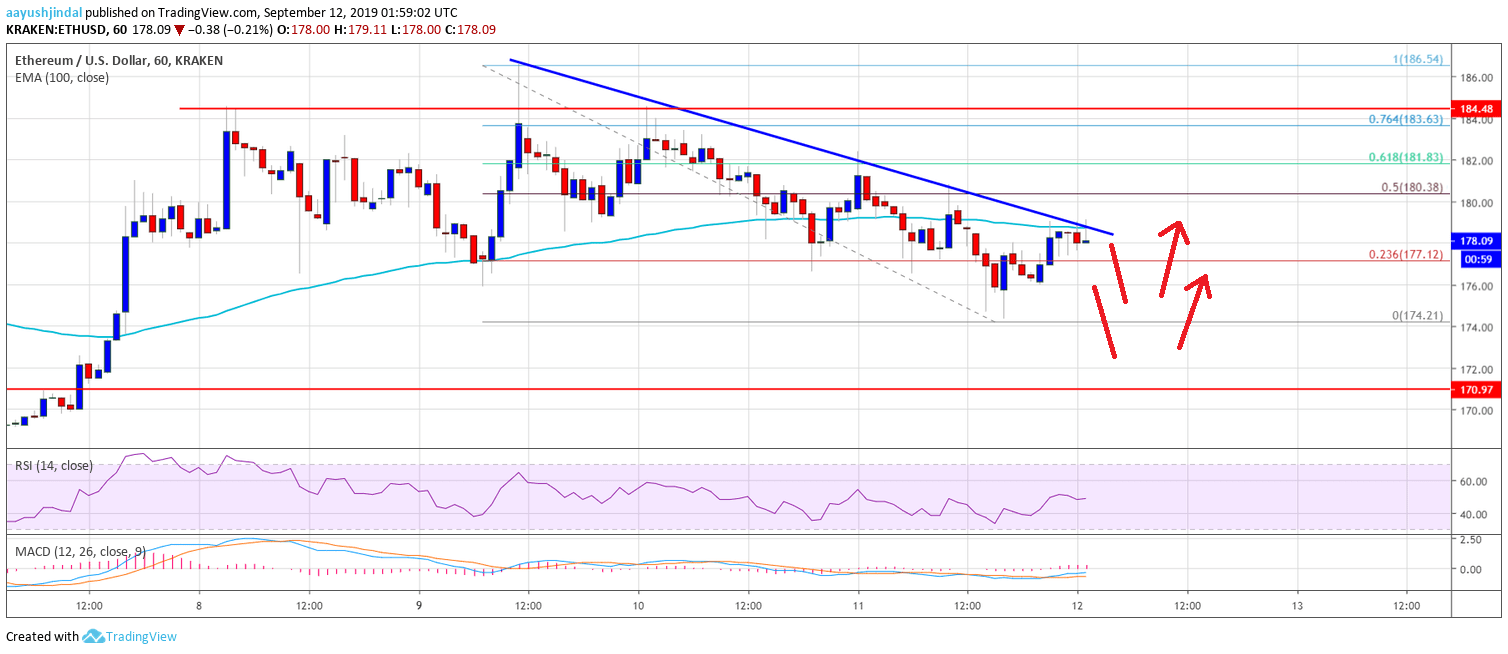

- Yesterday’s highlighted key bearish trend line is still active with resistance near $179 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair is still trading in a positive zone as long as there is no close below the $170 support.

Ethereum price is in a corrective decrease versus the US Dollar, while bitcoin is consolidating. ETH price might extend its decline to $172 before it could climb again.

Ethereum Price Analysis

After forming a short term top near $186, ETH price started a downside correction against the US Dollar. It broke the $180 support level and the 100 hourly simple moving average to enter a negative zone. Moreover, the recent decline in bitcoin pushed Ethereum below the $178 level. The decline was such that the price tested the $175 support level and it is currently consolidating losses.

It corrected above the $176 level plus 23.6% Fib retracement level of the last drop from the $186 high to $175 swing low. However, the previous support area near the $180 level is acting as a resistance. Besides, the 100 hourly SMA is also preventing gains near $179. More importantly, yesterday’s highlighted key bearish trend line is still active with resistance near $179 on the hourly chart of ETH/USD.ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is showing a few bearish signs.

Hourly RSI – The RSI for ETH/USD is currently below the 50 level, with a bearish angle.