- Bitcoin price is declining and it is trading below the key $9,400 resistance against the US Dollar.

- The price is likely to find a strong buying interest above the $9,200 support area.

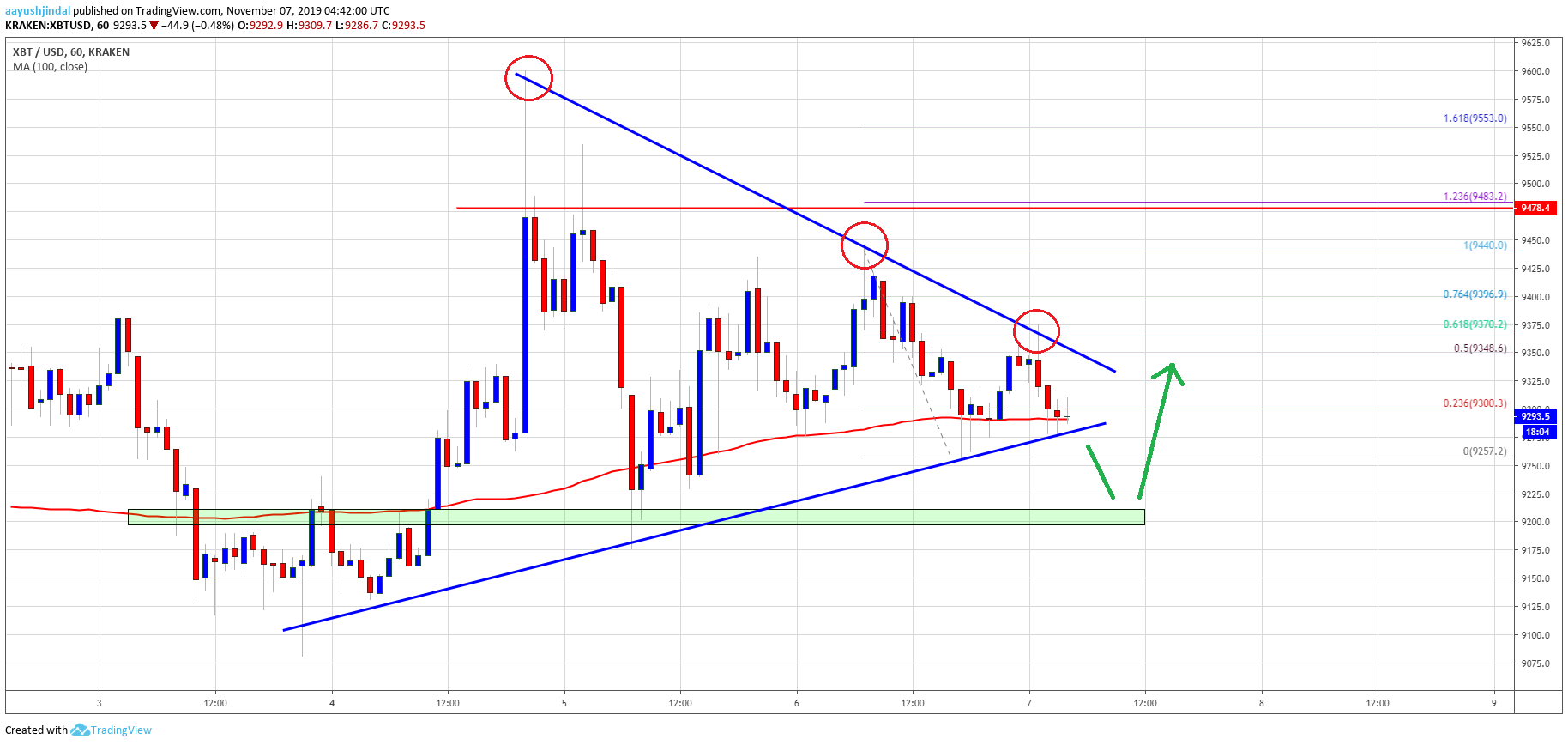

- There is a key contracting triangle pattern forming with resistance near $9,360 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- A clear break above the $9,360 and $9,400 levels is needed for more upsides in the near term.

Bitcoin price is struggling to continue higher against the US Dollar. BTC price remains at a risk of more downsides if it fails to stay above the $9,200 support area.

Bitcoin Price Analysis

In the past three sessions, there was a steady decline in bitcoin below the $9,400 pivot level against the US Dollar. BTC is facing an increase in selling interest below $9,375, but it is still holding the 100 hourly simple moving average.

The last swing high was near $9,440 before the price declined towards the $9,200 support area. The recent low was $9,257 and the price is currently consolidating losses.

An immediate resistance on the upside is near the $9,350-$9,360 area. It coincides with the 50% Fib retracement level of the recent drop from the $9,440 high to $9,257 low.

Moreover, there is a key contracting triangle pattern forming with resistance near $9,360 on the hourly chart of the BTC/USD pair. Therefore, an upside break above the $9,360 and $9,400 resistance levels could set the pace for more gains in the near term.

Having said that, there is a cluster of resistances between $9,350 and $9,400. Besides, the 76.4% Fib retracement level of the recent drop from the $9,440 high to $9,257 low could act as a resistance.

Overall, if there is an upside break above $9,360 and $9,400, there could be more gains in the near term. The next key resistance is near the $9,440, above which the price is likely to accelerate towards the $9,500 area.

On the downside, an immediate support is near the triangle trend line at $9,270. If there is a downside break below the triangle and the 100 hourly SMA, the price could test the main $9,200 support area.

Looking at the , bitcoin is clearly trading inside a breakout pattern with resistance near $9,350-$9,400. A successful close above $9,400 is needed for more upsides. If not, there is a risk of a bearish reaction below the $9,200 support.

Technical indicators:

Hourly MACD – The MACD is struggling to gain strength in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently declining towards the 40 level.

Major Support Levels – $9,280 followed by $9,200.

Major Resistance Levels – $9,360, $9,400 and $9,500.