XRP, the native cryptocurrency of and its blockchain platform, spiked by 10.5 percent on January 6. The sudden upsurge is likely to have been fueled by Binance Futures integration and strong technicals.

Similar to platforms that existed in the crypto sector for many years like BitMEX, Binance Futures enable users to trade cryptocurrencies with a high level of leverage. Futures platforms tend to see substantially higher volumes than spot exchanges and as such, XRP rising in the aftermath of a Binance Futures integration is justifiable.

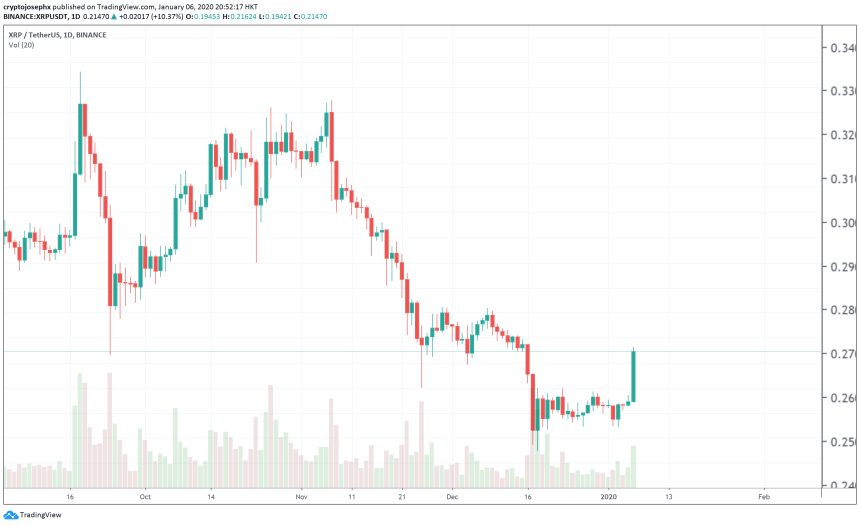

A large spike in XRP, first of its kind since mid-2019

The price of XRP increased from $0.1942 to $0.2139 from the day’s lowest point to highest, by just over 10.5 percent.

But, some of the upside movement of XRP occurred before the official integration of XRP by Binance Futures.

One possible scenario is that XRP, which , saw its first meaningful increase in price since September of last year as the crypto market sentiment improved.

The upward movement of XRP was further boosted by the launch of XRP futures on Binance, as it increased by an additional 2.3 percent hours after trading opened on Binance.

Had the Binance Futures integration been the sole driving factor of its price increase, then a sell-the-news type correction is likely to have occured right after the integration.

Yet, the price of XRP is continuing to increase across major platforms including Binance Futures and BitMEX.

Still a long way to go for full recovery

XRP remains one of the few top cryptocurrencies to be down by more than 93 percent from its record high alongside Bitcoin Cash.

Despite major partnerships secured by Ripple and the extensive usage of XRP by blockchain platforms operated by Ripple, the cryptocurrency has failed to demonstrate signs of a proper recovery since 2018.

The sales of XRP by Ripple, which range from tens of millions of dollars to hundreds of millions dollars per quarter, could have limited the upside potential of the cryptocurrency in recent years.

Ripple’s SVP of Marketing Monica Long said that 2019 has been a key “breakout” year for RippleNet and the usage of XRP for cross-border payments. For that to happen, sales of the cryptocurrency to institutions are deemed as necessary to a certain extent.

For XRP to position itself for a sustainable recovery in 2020, the

“I was very pleasantly surprised by the demand that we saw for On-Demand Liquidity from the existing RippleNet customer base. For a long time we had validated the value proposition for On-Demand Liquidity both for market research and talking to our customers, but 2019 was a breakout year for that product and customer adoption,” Long said.