What caused the bitcoin price to drop so suddenly?

The biggest catalyst for the abrupt drop in the bitcoin price within a span of minutes is most likely the liquidation of over-leveraged longs.The bitcoin price increased by 24 percent within the past 13 days, and technical analysts anticipated a swift pullback before the rally can continue.

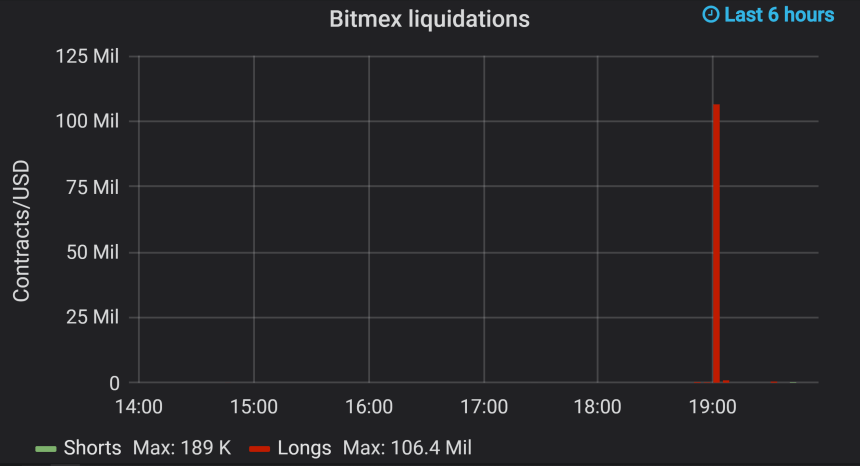

$108 million liquidated, likely about $10 million in actual liquidation

According to DataMish.com, more than

What does it mean for BTC in the short-term?

As said by notable crypto traders, there were large buy orders in the $8,600 to $8,900 range on Binance.

Looks like Binance oligarchs and their merry band of gibbons are ready to buy the dip. — Hsaka (@HsakaTrades)Before the drop, traders were weary about the strong upsurge of bitcoin since the first week of January without any significant correction. The six percent decline would mark the first major pullback BTC has seen in the past two weeks. The $8,600 support level, as emphasized by several technical analysts, was held with relative strength on BitMEX.

Wow my alarm went off thank god … 8600 support holding up like a champ — Satoshi Flipper (@SatoshiFlipper)

There is high probability that the move down was merely a pullback to hunt down over-leveraged longs in the short-term. If that is the case, it would provide BTC a stronger base to climb to higher resistance levels.

But, it is also worth noting that bitcoin is currently in a critical point that could decide its price trend throughout the first half of 2020. As explained by a top trader known as DonAlt, bitcoin would have to close its monthly candle at the end of January above a key resistance level at $9,500.“If this is a bear market rally, it ends this month. If it’s a bull market rally you better be positioned. The monthly close is gonna be fun to observe, it’s either gonna be shattered bear or bull dreams,” said the trader.Intense volatility in such an important period for BTC has to be expected.