Bitcoin has been showing a tight correlation with the stock market – the largest correlation in the asset’s young history.

A historically accurate sell signal has just triggered across three major United States stock indexes, which not only could cause another major selloff across all markets, but it could cause Bitcoin and the rest of the crypto market to plunge in tandem.

Continued Stock Market Correlation Is Dangerous for Bitcoin and Crypto

Bitcoin price is currently struggling with overhead resistance, is facing the largest stretch of extremely fearful sentiment across the crypto market ever, and still has the coronavirus and its impact on the economy to deal with.

Things are looking well for the first-ever cryptocurrency, which was expected to be trading closer to $55,000 per BTC when the asset’s halving arrives in less than 30 days.

Related Reading | Bitcoin’s Minute-By-Minute Correlation With Stock Market May Signal Disaster

Not only is Bitcoin price nowhere near that lofty figure predicted by the faltering stock-to-flow model, it recently fell to a shocking low of $3,800 during the Black Thursday collapse last month

Bitcoin and the crypto market was dragged down back into the deepest depths of the bear market during the record-breaking selloff.

It was an unusually strong correlation with the stock market that caused Bitcoin to plummet, and if it stays that way, another epic plunge is coming.

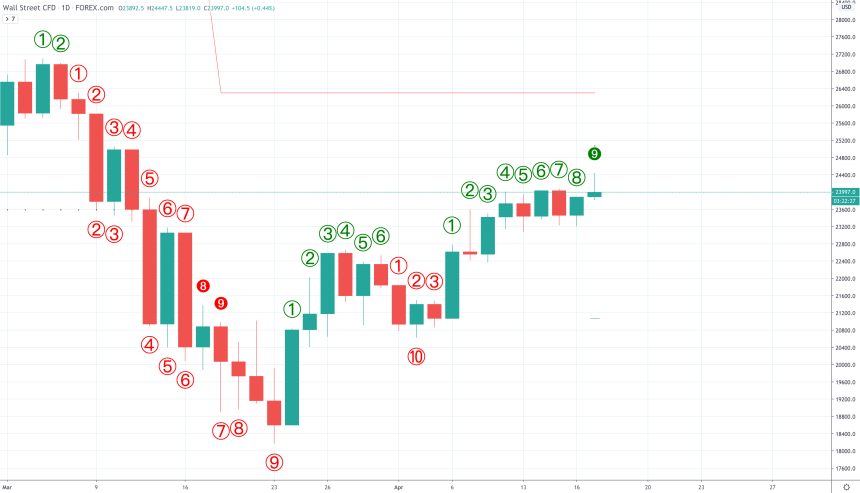

The Dow, NASDAQ, and S&P 500 Trigger TD 9 Sell

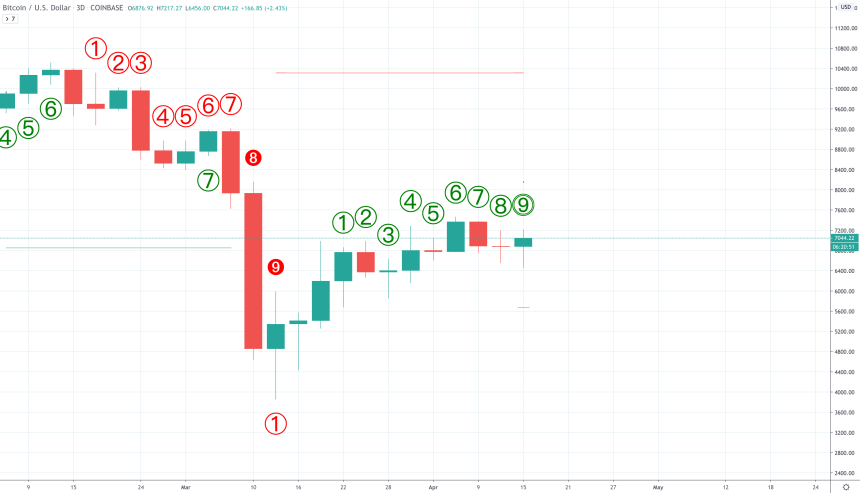

The TD 9 Sequential indicator created by market timing wizard , has triggered a TD 9 sell across the S&P 500 (SPX), NASDAQ Tech 100 (NDX), and the Dow Jones Industrial Average on the daily.

These price charts exhibiting an exhausted uptrend doesn’t bode well for Bitcoin and altcoins alike. Making matters worse, Bitcoin also reached a 9 on the indicator on 3-day price charts.

Bitcoin’s correlation with the stock market continues, and major US stock indexes are vulnerable to further collapse due to the coming recession and economic slowdown thanks to quarantine conditions caused by COVID-19.

Related Reading | How the Dow’s Fractal of Doom Could Take Bitcoin to $1,000

In fact, things may get even worse for Bitcoin price. Cryptocurrencies are a high-risk asset class that is difficult to assign a fair market value. Instead, market dynamics between sellers and buyers keep the asset in constant price discovery mode, making for extreme volatility

Because the asset thrives on speculation, it also falls the hardest with panic. There’s never been a time in history where there was more panic in the air, putting Bitcoin and the stock market at severe risk of further collapse.

Bitcoin may have been in a bear market for over two years now, but if it says correlated with stocks, and stocks are about to enter an extended downtrend, it could spell doom for the crypto asset class.

Featured image from Pixabay