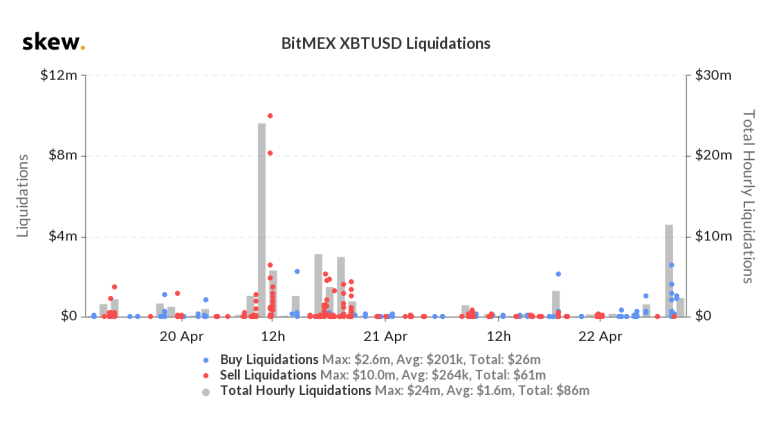

After managing to retake $7,200 on the weekend, Bitcoin tumbled lower on Monday morning, falling as low as $6,800 in a move that liquidated $40 million worth of BitMEX long positions. With this, the cryptocurrency had tumbled 7% from the weekend highs and 9% from the $7,470 highs seen two weeks back.

This was a move that initially was a win for bears, but bulls aren’t letting them win that easily. Over the past 12 hours, Bitcoin has mounted a strong comeback, passing $6,800, $6,900, then $7,000. Now, the asset trades above $7,100, 5% above the local bottom.

Bitcoin Rallies In Tandem With Oil

It seems once again that Bitcoin’s price action is basically a derivative of that of the U.S. stock market, which itself is being influenced by oil prices at the moment. The S&P 500 is actually up 1.8% in the past 24 hours after posting its worst day in weeks, -3% on Tuesday, reversing after a $500 billion coronavirus bill that was passed by the U.S. Senate.Could Be The Start of a Greater Rally

This may be the start of an even greater move higher.Per previous reports from NewsBTC, crypto trader remarked that Bitcoin’s chart from the February highs of $10,500 to now have formed a “classic BARR” bottom, marked by three textbook phases of a Lead-in, a Bump, then a Run.

As it stands, Bitcoin is in the third phase of the formation —technician Charles Bulkowski’s “best performer” out of 56 chart patterns — suggesting Bitcoin will trade as high as $10,000 by the start of May, just prior to the block reward halving.

There’s also an analysis by a crypto trader showing that every time the premium of Grayscale Bitcoin Trust (GBTC) fell substantially to a local low, the price of BTC found itself at a local bottom:

“Historically, it has been profitable to accumulate Bitcoin as GBTC premium visited its lows.”

Photo by on