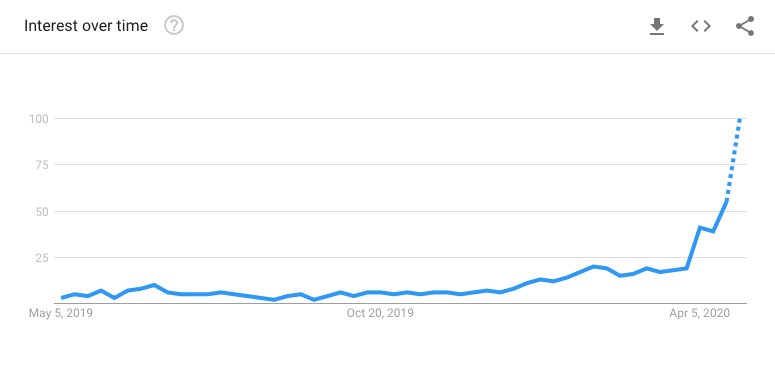

Data Signals That Anticipation for Bitcoin’s Halving is Growing at a Rapid Rate

Bitcoin’s rally seen in the time following its sharp mid-March meltdown has been attributed by some investors to growing anticipation for the mining rewards halving.

It is important to note that although this may be a partial cause for the over 100% rebound seen throughout the past several weeks, it likely stems more from the massive technical strength formed as a result of the “V-shaped” recovery seen in the days following its decline to lows of $3,800. Nevertheless, volume data from Google Trends regarding the search term “Bitcoin Halving” does suggest that there is significant global interest in this event.

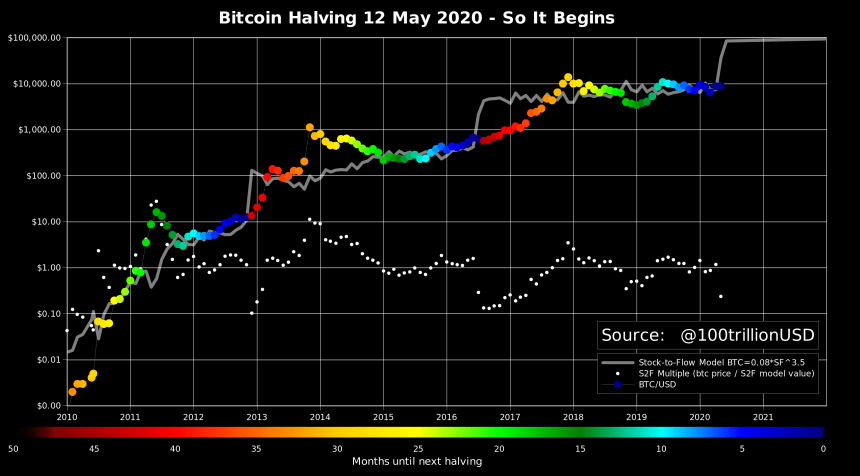

“Chart update: Bitcoin halving May 12… so it begins,” he said while pointing to the chart seen below.

Halving May Be Followed by Brutal Selloff

Despite PlanB’s S2F model predicting that Bitcoin will begin another parabolic rally in the months ahead, history seems to suggest that BTC will see a brutal post-halving selloff.

One popular crypto analyst on Twitter spoke about this in a on Twitter, explaining that historically BTC has seen notable selloffs in the 1-2 months following the mining rewards halving.“For those who is going through their first Bitcoin halving, congratulations, you made it… Historically, BTC price tends to dump in the first 1-2 months post halving. History repeats itself?”

Although Bitcoin has only seen two halving events prior to this one and the sample size is too small to gain any conclusive trends from, it’s possible that a lack of any immense bullishness around the time it takes place will lead to great disappointment amongst speculators.

Featured image from Unplash.