Bitcoin is up around 4% and it is approaching the $10,000 resistance against the US Dollar. BTC price is likely to extend its rally above $10,000 unless it dives below the $9,500 support.

- Bitcoin is currently gaining bullish momentum and trading near the last swing high at $9,950.

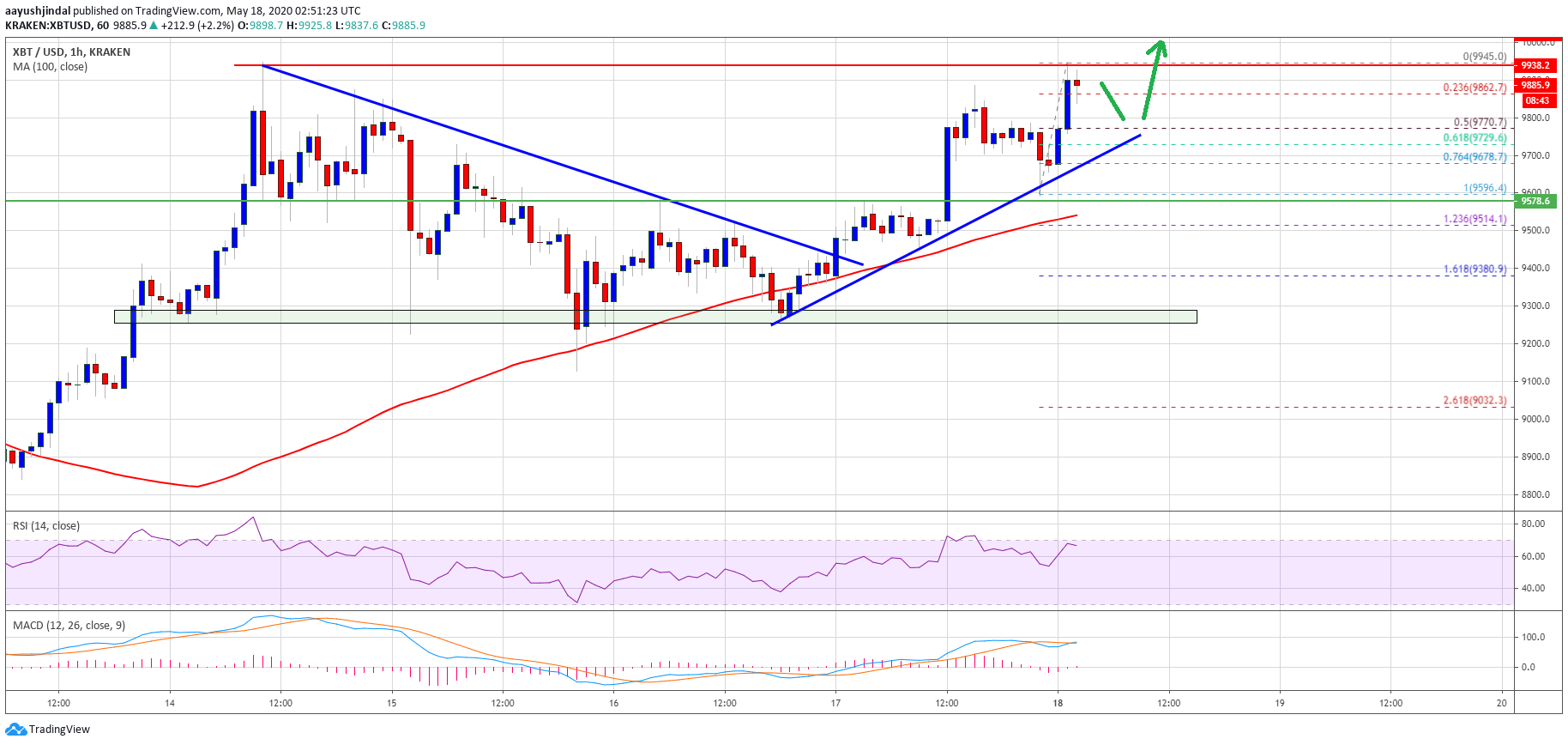

- The price is trading well above the $9,600 support and the 100 hourly simple moving average.

- There is a key bullish trend line forming with support near $9,720 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could correct a few points, but there are high chances of an upside break above $9,950 and $10K.

Bitcoin Gaining Bullish Momentum

After a short term downside correction, bitcoin found support near the $9,200 zone against the US Dollar. BTC price remained well bid above the 100 hourly simple moving average and started a fresh increase from $9,200.

There was a break above the $9,400 and $9,500 resistance levels, opening the doors for another positive wave. The upward move was such that the price surpassed the $9,800 level and revisited the $9,950 resistance level.

A high is formed near $9,945 and bitcoin price is currently attempting an upside break above the $9,950 resistance. An initial support is near the $9,850 level. It is close to the 23.6% Fib retracement level of the recent rise from the $9,596 low to $9,945 high.

The first substantial support is seen near the $9,770 level since it represents the 50% Fib retracement level of the recent rise from the $9,596 low to $9,945 high. Moreover, there is a key bullish trend line forming with support near $9,720 on the hourly of the BTC/USD pair.

On the upside, the bulls are facing a significant hurdle near the $9,950 and $10,000 levels. A successful break and close above the $10,000 resistance may perhaps open the doors for a sustained upward move. The next resistance could be $10,500, above which the bulls might aim $11,200.

Bearish Reaction?

If bitcoin fails again to clear the $9,950 resistance zone, there could be a bearish reaction. If the price breaks the trend line support, it could test the main support near the $9,500 level.

The 100 hourly SMA is also near $9,500. If the bulls fail to defend the $9,500 support, there is a risk of a double top pattern, resulting in a sharp decline below $9,200 and $9,000 in the near term.

Technical indicators:

Hourly MACD – The MACD is slowly gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now well above the 60 level.

Major Support Levels – $9,720 followed by $9,500.

Major Resistance Levels – $9,950, $10,000 and $10,500.