This move has been undoubtedly impressive, with the price action attracting mainstream media attention and Wall Street investors. However, analysts say it’s not clear skies ahead for Bitcoin just yet, pointing to a key resistance the cryptocurrency is rubbing up against.

Related Reading: Crypto Tidbits: Bitcoin Halving, Reddit Using Ethereum, JP Morgan Dabbles in Crypto

Bitcoin Crossing $10,500 Will Open Price to New Highs

If you have perused Crypto Twitter over the past few months, you’ve likely noticed the weight analysts have given to the $10,500 price point for Bitcoin. The level, as can be seen in the chart below, has been key on a number of occasions over the past few years, marking the top of rallies two times in 2019 and once earlier this year.“If Bitcoin gets over this. There isn’t much standing in the way of new all-time highs. They’d be on the horizon. Way less resistance than anything BTC overcame going from 3.7k to here. Would be a macro higher high confirmed. Don’t underestimate the implications!”This was echoed by another trader, who in April that if Bitcoin manages to flip $10,500 into support, his bearish bias will flip bullish. This is especially notable as this is the same trader that called for BTC to revisit $3,000 months before it did.

Related Reading: Once In a Lifetime Money Printing Strengthens Bitcoin’s Bull Case: Investor

Breaking $10,500 Likely to Be a Struggle

Bitcoin may struggle to break past $10,500, though, market data indicates.Per previous reports from NewsBTC, order book data of Bitfinex’s BTC/USD market indicates that there is a massive block of orders looking to sell Bitcoin around $10,000 that may be hard to break past.

Bitfinex’s order book suggests that from $9,900 to $10,600, there is ~4,200 Bitcoin worth of sell orders, most of which are clustered around $10,000-10,400. That means on one exchange alone, there is over $40 million worth of sell-side pressure if the cryptocurrency attempts to rally past $10,000.

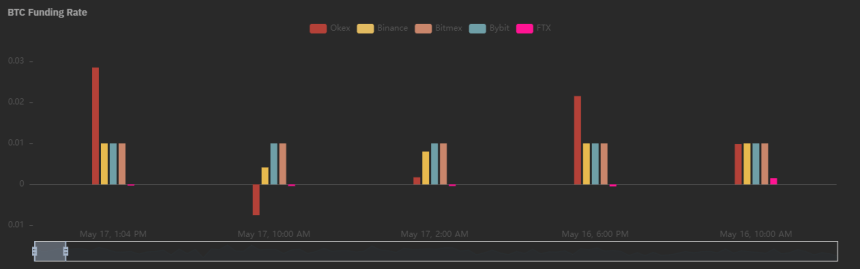

Adding to this, an analyst recently observed that Bitcoin’s latest price action has led the funding rate on OKEx to spike, indicating bulls are overextended and may soon capitulate:

“Funding on OKEX is suddenly very high again,” he said while pointing to the chart seen below.

Featured Image from Unsplash