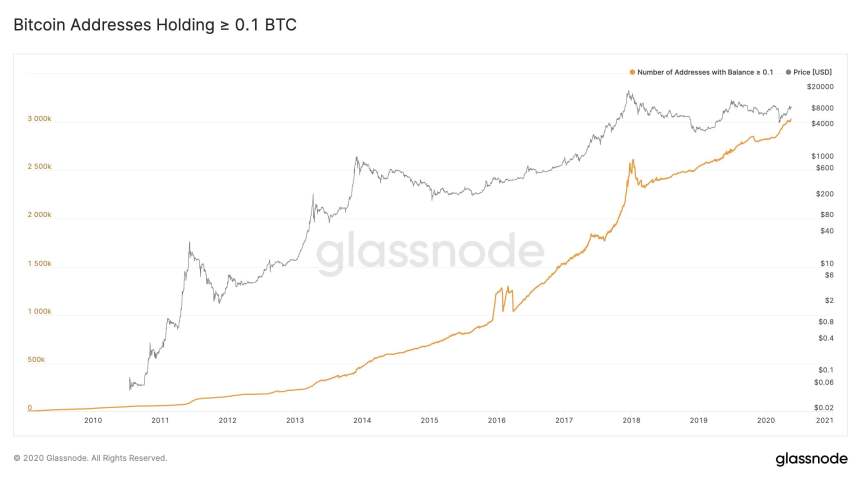

It now appears that the cryptocurrency is also seeing a massive rise in the number of smaller retail investors that have been accumulating in recent times.

Bitcoin Sees Heightened Retail Accumulation

Bitcoin has been performing quite well despite the turbulence seen within the traditional markets.

Although smaller markets typically perform quite poorly during periods of widespread weakness, it does appear that BTC’s positive performance has been emblematic of its growing position as a safe haven asset.“There are now more than 3 million Bitcoin addresses holding at least 0.1 BTC (current value: $975 USD). That’s 14% more addresses than one year ago today.

Retail Investors Aren’t the Only Ones Accumulating BTC

It is important to note that multiple parties are currently engaged in accumulating Bitcoin. In addition to smaller retail investors, large Bitcoin investors have also been purchasing BTC at a rapid rate. Glassnode data also elucidates this trend, that there has been a “continued increase in the number of BTC whales” throughout the past couple of months. Traditional investors have also grown increasingly interested in the nascent market. Data from analytics platform Skew shows that CME’s Bitcoin futures have seen rapidly climbing open interest in recent times. Currently, open interest for BTC futures on the CME sits at nearly $600 million. Its trading volume, however, typically hovers below $500 million.

Because Bitcoin is seeing accumulation from multiple important components of its investor base, it is highly likely that this wide-spread accumulation will help provide the cryptocurrency with greater upside in the weeks ahead.

Featured image from Unsplash.