Related Reading: BTC Just Confirmed a Signal That Preceded Historical 5,000% Rallies

Bitcoin Volatility Continues to Plunge Lower

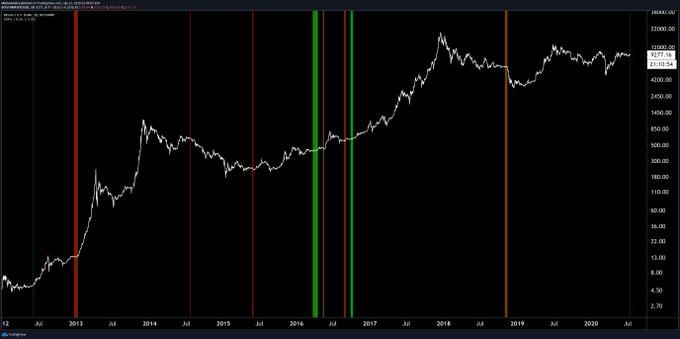

If you step back and view Bitcoin’s price action from a macro perspective, it would be fair to say that BTC has flatlined. For the past nine or ten weeks now, the leading cryptocurrency has been stuck in a consolidation pattern of 15%. Both bulls and bears have failed to maintain a breakout in either direction.Chart of BTC's macro price action with the width of the Bollinger Bands indicator. Chart by Josh Olszewicz (CarpeNoctum on Twitter). Chart fromOlszewicz’s observation is important because, for those that don’t remember, Bitcoin crashed 50% in the two weeks after a consolidation from September-November. In some senses, the price action before the November 2018 crash is like the price action now: Bitcoin consolidated around a single price point for 2-3 months in both periods. The question is: will history rhyme or will Bitcoin rally to the upside?

Related Reading: Ethereum 2.0 Is Likely to Boost DeFi Further, Even After Parabolic Rally

Consolidation Could Resolve Upward, Suggest Fundamentals

a senior commodity analyst at Bloomberg, the consolidation will resolve upward:“Volatility should continue declining as Bitcoin extends its transition to the crypto equivalent of gold from a highly speculative asset, yet we expect recent compression to be resolved via higher prices.”

This can be corroborated by Bitcoin mining data. The seven-day moving average of the Bitcoin hash rate just hit a new all-time high of 125 exahashes per second. An analysis by Charles Edwards, a digital asset manager, has found that a strong mining ecosystem should correspond with higher prices. Edwards’ “Energy Value” model says that “the value of Bitcoin is a function of its energy input in Joules.” Bitcoin is trading 28% below its EV as the hash rate has surged.Blahs? Benchmark Looked Similar Before Past Gains —

— Mike McGlone (@mikemcglone11)

Volatility should continue declining as Bitcoin extends its transition to the crypto equivalent of gold from a highly speculative asset, yet we expect recent compression to be resolved via higher prices.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from Last Time This Volatility Gauge Was This Low, BTC Dove 50% in 2 Weeks