Chainlink (LINK) rallied over 30% and it traded close to the $17.000 level against the US Dollar. It dethroned bitcoin cash and moved to the 5th spot in terms of the market cap.

- Chainlink token price is gaining momentum and it broke the $16.500 resistance against the US dollar.

- The market cap jumped sharply and LINK moved to the 5th spot to overtake bitcoin cash.

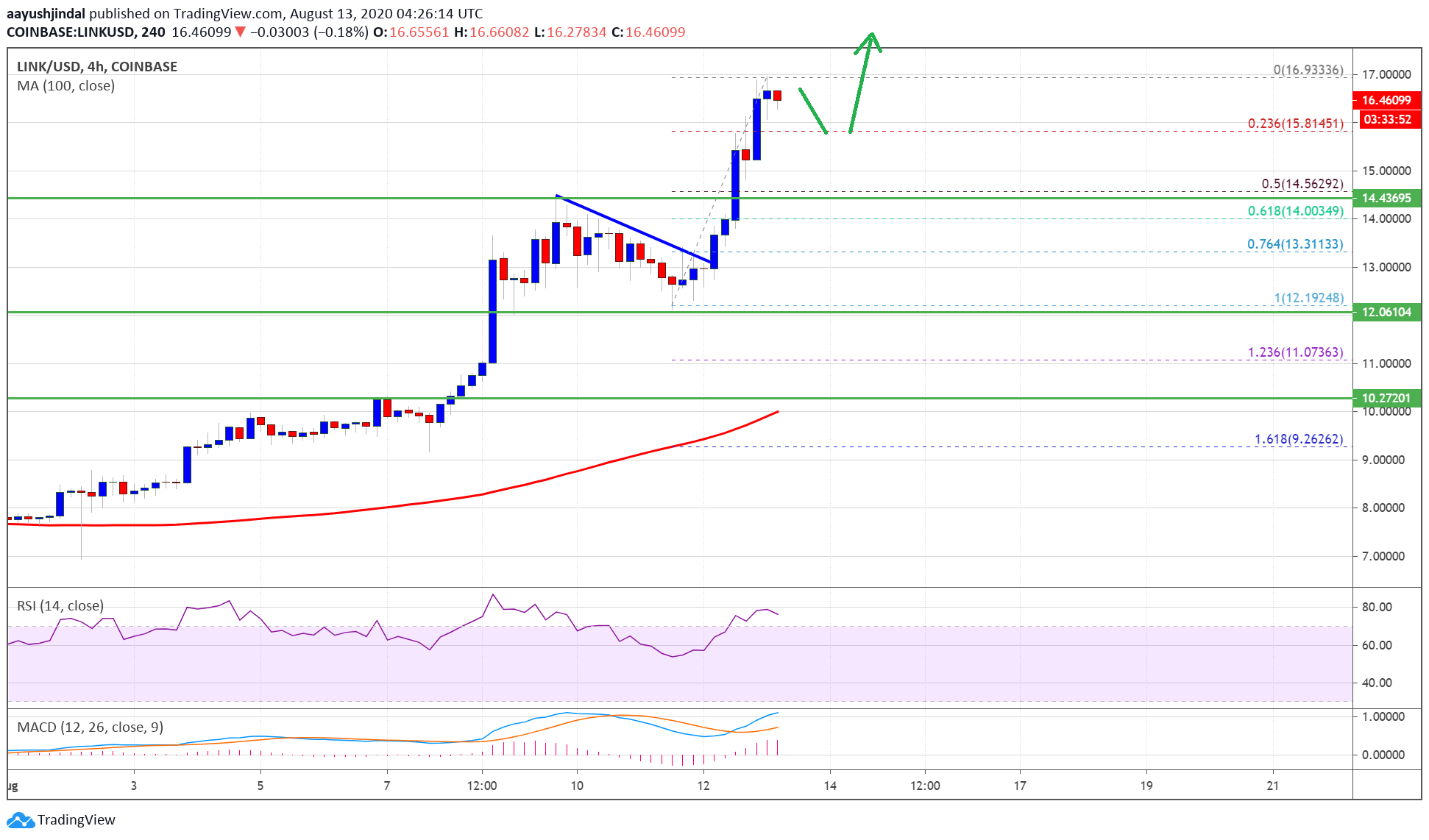

- There was a break above a key bearish trend line with resistance near $13.300 on the 4-hours chart of the LINK/USD pair (data source from Kraken).

- The pair might correct a few points, but dips are likely to find buyers near $16.000 and $15.800.

Chainlink (LINK) Jumps To The 5th Spot

In the last technical analysis, we discussed chances of a surge above $15.000 in chainlink (LINK) against the US Dollar. LINK did gain momentum above the $15.000 and surged over 30% in the past three sessions.

The upward move was strong as the price broke the $16.000 resistance and settled well above the 100 simple moving average (4-hours). During the rise, there was a break above a key bearish trend line with resistance near $13.300 on the 4-hours chart of the LINK/USD pair.

More importantly, the market cap of LINK overtook bitcoin cash and it moved to the 5th spot. A new all-time high is formed near $16.933 and the price is currently consolidating gains.

LINK price above $16.500. Source:

An initial support on the downside is near the $16.200 level. The first major support is likely forming near the $15.80 level. It is close to the 23.6% Fib retracement level of the recent surge from the $12.192 swing low to $16.933 high.

The main support is now near the $14.500 level (the recent breakout zone). It coincides with the 50% Fib retracement level of the recent surge from the $12.192 swing low to $16.933 high.

On the upside, the $17.000 level is a short-term resistance zone. If there are more upsides, there is an open space and the price might even test the $20.000 level in the coming sessions.

Dips Supported

In the short-term, there could be a minor downside correction in LINK price towards the $16.200 support. If there are more losses, the $15.800 support is likely to act as a strong buy zone.

A downside break below the $14.500 could only start a major downward move. The next key support is near the $12.20 level.

Technical Indicators

4-hours MACD – The MACD for LINK/USD is gaining momentum in the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI for LINK/USD is currently well in the overbought zone.

Major Support Levels – $16.200, $15.800 and $14.500.

Major Resistance Levels – $17.000, $18.500 and $20.000.