Bitcoin is clearly at a pivotal point in its current market cycle. But market cycles aren’t always obvious as to what might occur, even if the when happens to become more clear with time.

In the leading cryptocurrency by market cap, Decembers are particularly notable, culminating in most of the asset’s tops and bottoms. With the all-important month now here, and Bitcoin at a potential inflection point something significant could be brewing.

Crypto Analyst Reveals Compelling Bitcoin Cycle Theory

In 2017, Bitcoin’s bull run and meteoric rise – as the mainstream media dubbed it – came to a climax in December of that year. December 2018 is when Bitcoin set its bear market bottom. In December 2019, the “post PlusToken low” was put in, from crypto trader Philip Swift.

Related Reading | This Unique Perspective Makes It Clear Bitcoin Cycles Are Lengthening

The cryptocurrency has primarily topped and bottomed during the December months, but one instance also kicked off the 2017 bull run and began the asset’s most recent parabolic phase.

Swift says Decembers are important for Bitcoin market timing | Source:

Given the cyclical nature of Bitcoin, there’s a chance something equally important happens any moment now. But which direction is it, and does market timing based on cycles or key dates hold any credence?

Remembering The Legendary W.D. Gann And The Role Of Astrology And Geometry In Market Timing

The idea that markets are cyclical and can top or bottom at specific dates isn’t a new one. Legendary trader William Delbert Gann made a name for himself by combining geometry and astrology to time tops and bottoms in markets or when important inflection points might take place.

Notice the December tops and bottoms in the Wheat market match what Swift says above | Source:

Gann noticed that tops and bottoms take place often in December in the commodities market, especially during the astrological event, “Sun conjunct retrograde Mercury in Sagittarius,” .

His tools are used today, although aren’t very popular with the crypto crowd. But after putting his market timing technical analysis tools to the test, the results are quite shocking and line up with Swift’s cycle-based theories above. However, it still doesn’t help much with direction.

The Gann Box is one of many time-based technical analysis tools the trader left behind | Source:

In the first tool we’re examining, each Fib time zone happens to take place at a major turning point. The first was at Bitcoin’s bottom, the second was right before the 2019 blow-off top.

The third at 0.5 takes place at the “PlusToken low” Swift points to as another December moment of importance. The 2019 top was not in December, to be clear.

The Gann Square is another. Note how the angles intersect important points in price action | Source:

Yet another tool, the Gann Square, also clearly lines up with these key December dates. The geometrical support and resistance points all react with the asset’s intra-session price action.

Gann was also a “fan” of geometrical shapes, and other techniques he developed include the “Square of Nine, the Hexagon Chart, and the Circle of 360.” His fan-based tool as pictured below. When the cryptocurrency made it through the final Gann fan resistance drawn from all-time high, we saw the breakout that took us back to the current levels.

The Gann fan perfectly predicted the timing of the retest, coinciding with key numbers from Gann | Source:

Gann also paid close attention to the timing of cycles with a direct focus on numbers that appear to be based on , which used a sexagesimal number system. The number system is still the basis of time, with intervals of sixty seconds and sixty minutes. Night and day cycles are 12 hours each and each day is 24 hours – all divisible by three, and six.

The iconic trader specifically called attention to any timeframes with intervals of three, including the 3-minute, 15-minute, 3 hour, 6-hour, and 3-day charts, and he claimed to never trade in the direction of the trend on the third day.

On larger timeframes, Gann cared a great deal about the significance of 144 time periods. Could it really just be coincidental, that Bitcoin broke out of the Gann fan, and retested the “meme” downtrend line on exactly 144 weeks from all-time high? The chart above offers strong evidence to support the theory.

This Gann fan is a dangerous take on the Dow Jones at the end of 90-year supercycle | Source:

Finally, Gann warned very specifically about economic supercycles, which take place every 90 years or so. Roughly 90 years ago, was the massive stock market crash of 1929 that brought with it The Great Depression. That recession officially ended in 1938. This would also mean that we’re beginning another supercycle now, with the beginning of the pandemic.

90 years prior to that, was the recession of 1957 when the Ohio Life Insurance and Trust Company , causing widespread panic.

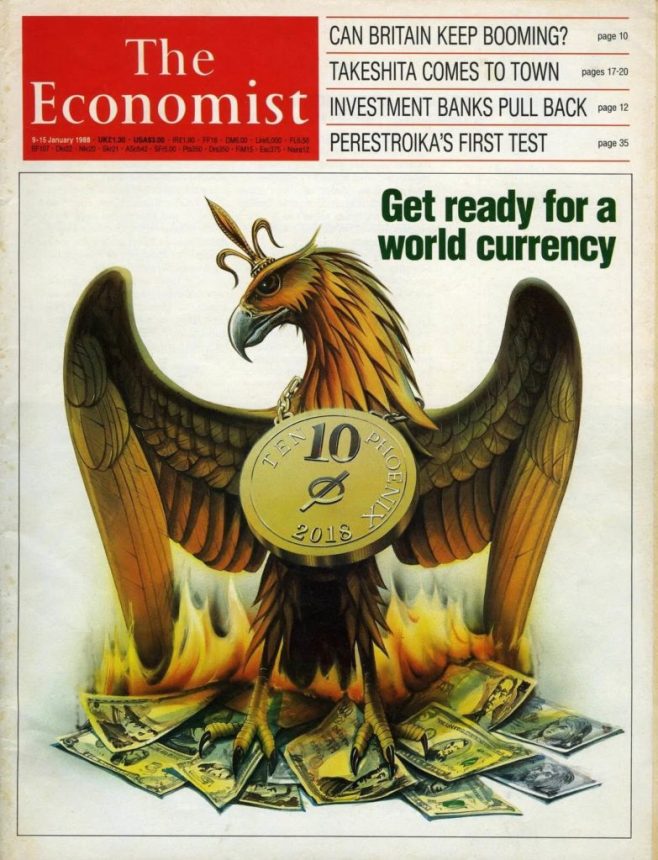

Fiat money became so worthless, that new coins were minted, depicting a Phoenix rising from flames. The same sort of coin and the mythical bird can be seen rising on , where the magazine predicts the coming of a new world currency will come by the year 2018.

Related Reading | Technical Expert Shows How Bitcoin Path Could Reach Gold’s $10 Trillion Cap

The coin depicting the Phoenix from 1957 has the month of November (Nov) printed on it. The astrological sign Scorpio is assigned to those born between October 23, and November 21. Scorpio is the only astrological sign with more than one animal associated with it.

, the Scorpio transitions throughout life to the Eagle, and finally, rises as the Phoenix. Interestingly, Bitcoin was revealed to the world via the whitepaper by Satoshi Nakamoto on October 31, 2008 – essentially making Bitcoin a Scorpio and eventually a Phoenix by birthright.

The information above proves nothing at all and could be construed as pure coincidence, but with so much of Gann’s time-based theories and tools matching up with Bitcoin so perfectly, and his analysis being based on little more than math (geometry) and time, could there possibly be more to it?

And because math (computer code) and time (the halving and block confirmations) are so crucial to the anatomy of the first-ever cryptocurrency, could there be some type of undeniable connection between the asset and astrology? Appropriately, only time will tell.

Featured image from Deposit Photos, Charts from TradingView.com