Bitcoin Exchange Supply Has Declined To Just 1.17 Million BTC Now

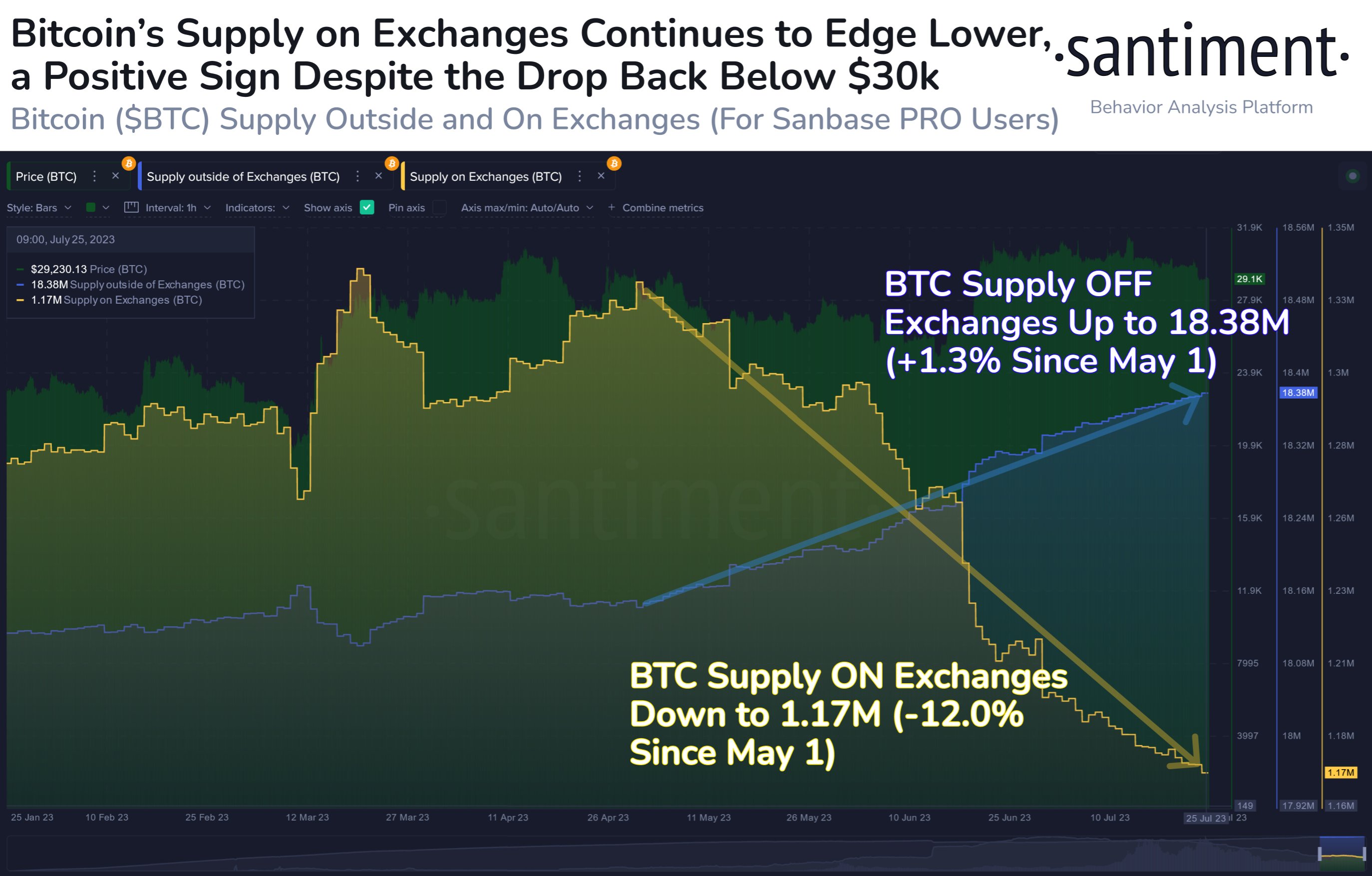

According to data from the on-chain analytics firm , the latest decline in the price doesn’t look to have triggered a severe reaction from the market yet.The relevant indicator here is the “supply on exchanges,” which measures the total amount of Bitcoin supply that’s currently being stored in the wallets of all centralized exchanges.

The value of the metric seems to have been going down in recent weeks | Source:As displayed in the above graph, the Bitcoin supply on exchanges has observed a constant downtrend during the last few months or so. This means that the investors have been consistently taking their coins off these platforms during this period despite price declines.

Interestingly, this decline in the indicator continued even when the rally above $30,000 had occurred in the middle of June. Generally, during such sharp price surges, it’s not rare to see the metric rise, as some investors would be looking to harvest their profits.

In the past week, Bitcoin has registered a decline towards the low $29,000 level, but the indicator has still only continued to head down, implying that this price drop hasn’t been enough to trigger a mass panic-selling reaction from investors.

The current trend in this metric is naturally a positive sign for the cryptocurrency’s value, as it means that at least another selloff may not be probable to take place in the immediate future. With the latest downward move in the supply on exchanges, only 1.17 million BTC is left in the wallets of these platforms now. This value is around 12% lower than back during the beginning of May, which is a significant drop.BTC Price

At the time of writing, Bitcoin is trading around $29,200, down 2% in the last week.BTC has plunged during the last few days | Source: