Bitcoin Long-Term Holders Have Sold Huge In Past 4 Months

As analyst James Van Straten explained in a on X, the long-term holders have massively reduced distribution during the last ten days. The “long-term holders” (LTHs) here refer to the Bitcoin investors carrying their coins since more than 155 days ago.

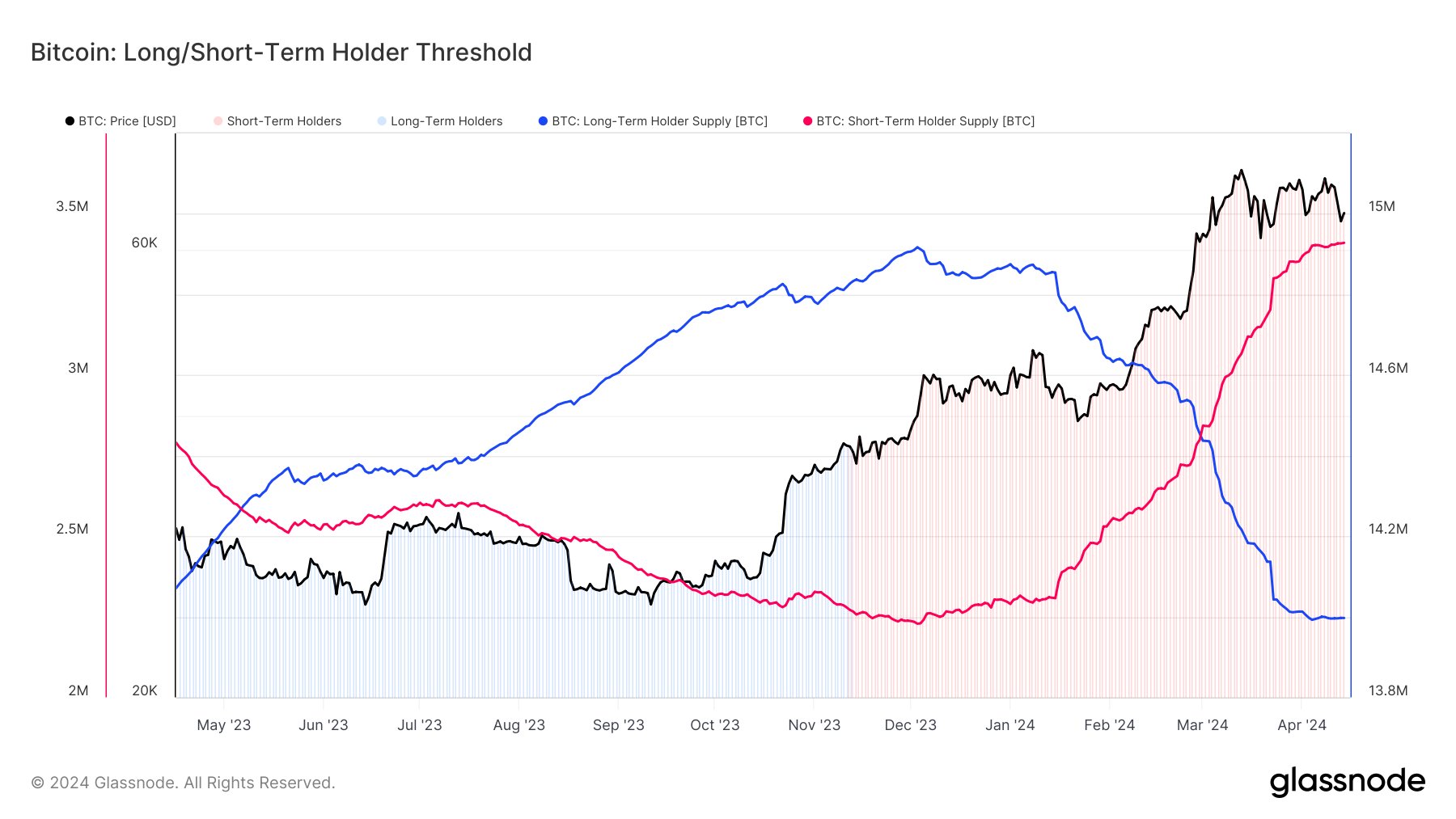

The LTHs comprise one of the two main divisions of the BTC sector, with the other cohort known as the “short-term holders” (STHs). The STHs are naturally the investors who bought within the past 155 days.

How the supplies held by these two cohorts have changed during the past twelve months | Source:As displayed in the above graph, the supply of Bitcoin LTHs increased through most of 2023. At the same time, the supply of STHs naturally decreased. Something to note here is that this increase in the LTH supply didn’t mean that these HODLers were buying then. Instead, some STHs bought 155 days ago and have finally held long enough to qualify for the cohort.

This excludes the selloff from Grayscale Bitcoin Trust (GBTC), which has constantly been bleeding coins since the US SEC approved the spot exchange-traded funds (ETFs) in January. These coins had also matured enough to become part of the LTHs.

Recently, as the price has gone through some bearish action, the LTH supply has flatlined, implying that the selling from these HODLers has finally stopped, at least for now. Given this new trend, it now remains to be seen how BTC’s value develops from here.BTC Price

Following the latest drawdown in Bitcoin, its price has dropped towards the $63,200 level.Looks like the price of the asset has gone down recently | Source: