Unveiling Bitcoin Double Pump Prediction

Willy Woo, a figure well-respected in the cryptocurrency analysis sphere, has recently shared insights that paint an intriguing future for Bitcoin.

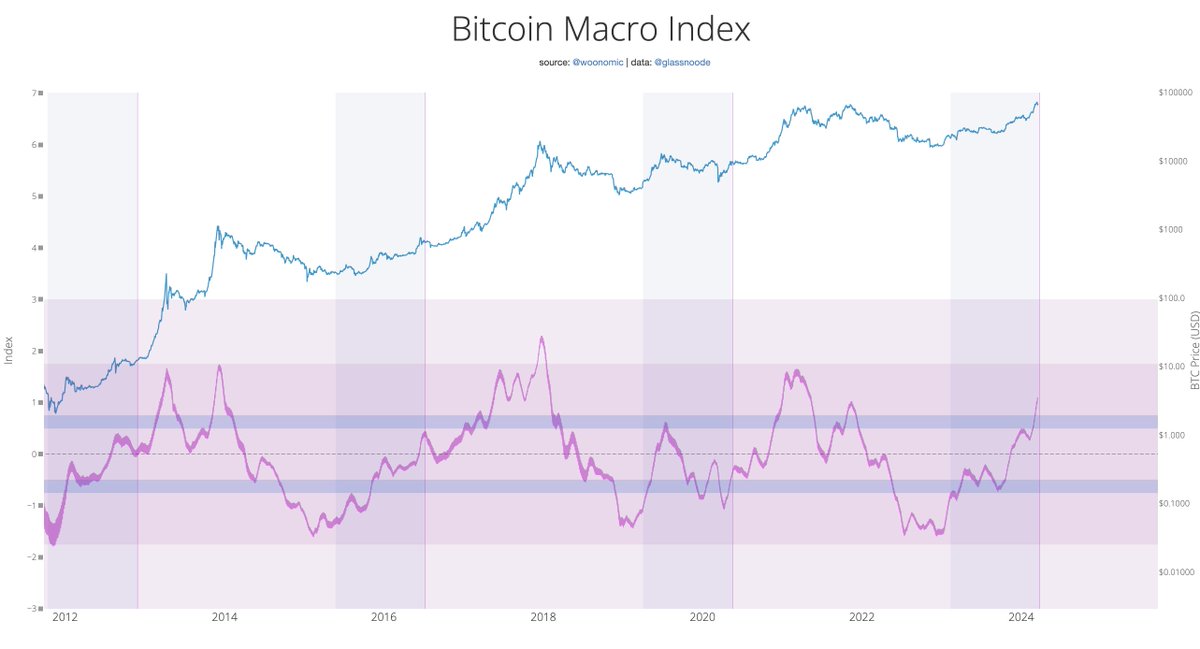

According to Woo, the notable increase in the Bitcoin Macro Index could signal more than just a recovery; it might be the precursor to a rare “double pump” cycle.

This dual surge scenario, though historically uncommon, aligns with Woo’s analysis of current market conditions and Bitcoin’s intrinsic growth potential.

At the rate the Macro Index is pumping, I wouldn’t be surprised if we get a top by mid-2024, which would hint at a double pump cycle like 2013… a second top in 2025. — Willy Woo (@woonomic)

Navigating Through The Bearish Terrain

Meanwhile, the past week has not been kind to BTC, with the asset experiencing a roughly 10% decline. This downward trend extended over the past 24 hours, seeing Bitcoin’s value dip by 4.9%, bringing its price to around $65,000—a sharp fall from its recent peak above $73,000.

Bitcoin is looking for support. But where will it find it?

— IntoTheBlock (@intotheblock)

The $61k range could be a key area to keep an eye on. 805k addresses acquired over 466k BTC at this level, indicating a healthy appetite for around that level.

Additionally, as Bitcoin navigates its current market challenges, cryptocurrency analyst Charles Edwards points out that a typical pullback during a Bitcoin bull run amounts to about 30%.

A normal Bitcoin bullrun pullback is 30%. Back in December, we were already in the longest winning streak in Bitcoin’s history. A 20% pullback here takes us to $59K. A 30% pullback would be $51K. These are all levels we should be comfortable expecting as possibilities. — Charles Edwards (@caprioleio)These levels represent potential buying opportunities for investors looking to capitalize on Bitcoin’s cyclical nature and its anticipated ascension post-pullback. Featured image from Unsplash, Chart from TradingView