Binance rumors were the all-dominant topic last week after the FOMC meeting. Rumors of insufficient proof of reserves and the pullback from accounting firm Mazars, allegations of a bank run and insolvency, as well as CZ’s interview on CNBC have dragged the Bitcoin and crypto sentiment and prices down.

Charles Edwards of Capriole Investments pointed out in a Twitter thread that this “FUD is really bad for the industry,” pointing out that there is “nothing” backed by data that is legitimately worrisome, “but when fear is great enough, it doesn’t matter.” “If current withdrawal rates continue, expect more exchanges to go down – not from poor practices – but bankruptcy,” Edwards contended.Is The Binance FUD “Thinly Veiled Xenophobia”?

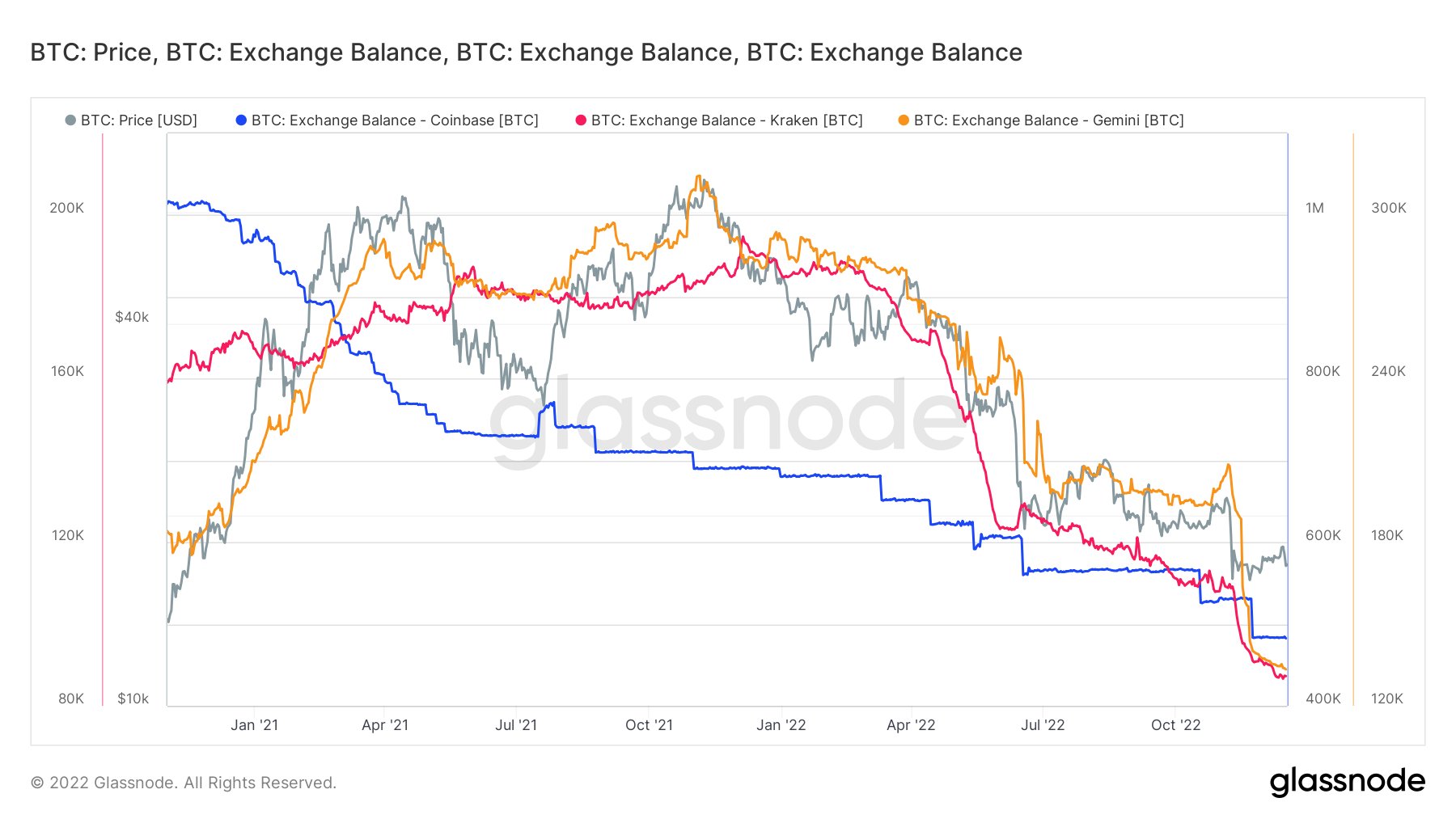

The analyst that all exchanges are being hit extremely hard by current market conditions. They have to deal with a price drop of more than 80%, a drop in trading volumes of more than 90% and a reduction of reserves by more than 50% “due to irrational panic.” As Edwards analyzes, even the U.S. exchanges Coinbase, Gemini and Kraken have been hit badly. They are currently experiencing a 60% drop in their Bitcoin reserves over the past year.

At the same time, Edwards emphasized that his opinion on Bitcoin has not changed. He said the current price movement is largely fueled by panic. Still, Edwards spoke from the heart of many crypto enthusiasts when he turned to Changpeng Zhao and said:I love Bitcoin. But the maxis screaming for cold storage only, don’t realize that if everyone actually went to cold storage, your precious Bitcoin price would approach $0. Influencers spreading FUD are literally damaging the industry & their net worth just to pump engagement.

Edwards was joined by market analyst Alex Kruger, who denounced the people who view bank runs as healthy stress tests. Those people “clearly haven’t thought this through. When funds leave, trading activity diminishes, and so do trading fees. And then, many funds never come back.” Ryan Selkis, the founder of Messari, much of the Binance FUD is “thinly veiled xenophobia.” Selkis also added: “I’m all for the stress test on deposits and think it’s bad that such a high percentage of volumes runs through a single exchange. I also don’t love the tone of some of the critiques. Sorry!”And CZ, let’s stop dilly dallying and put this issue to bed with a _real_ audit.

Notably, on-chain analytics firm CryptoQuant recently conducted an analysis of Binance’s reserves. The company’s data shows that the amount of BTC Binance said it held as liabilities at the time the PoR report was conducted is consistent with CryptoQuant’s reserve data.

Conclusion: Our analysis should not be interpreted as a favorable opinion of Binance as a company or the BSC/BNB networks. Our data merely shows that the amount of BTC Binance says it holds as liabilities at the moment the PoR report was conducted matches our reserve data. — CryptoQuant.com (@cryptoquant_com)

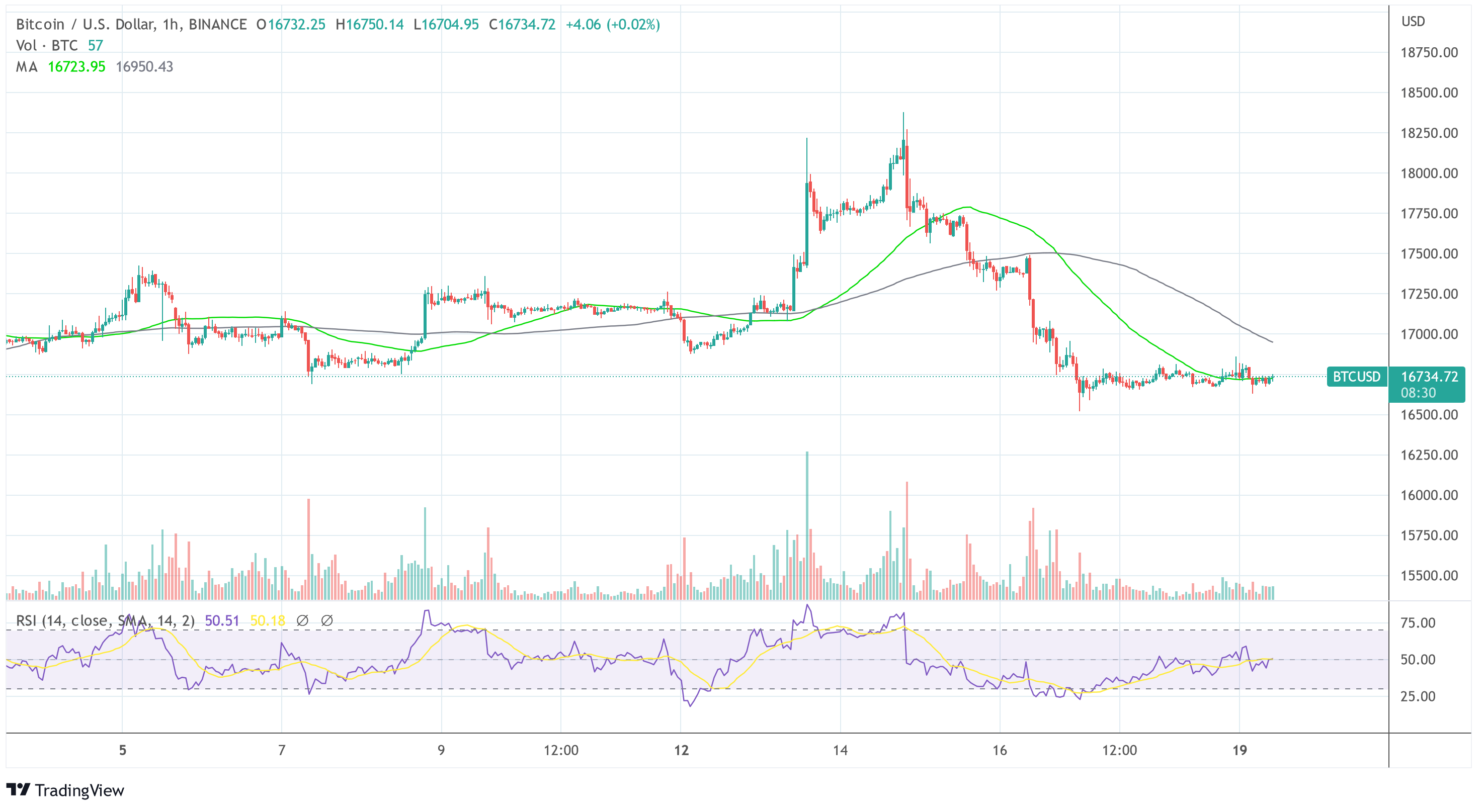

Why Doesn’t Binance Take A Big Four Auditor?

In Friday’s much-discussed interview on CNBC, Binance CEO Changpeng Zhao said that “Big Four” auditing firms are currently unable to conduct an audit for a cryptocurrency exchange. The hosts then countered that Coinbase is working with Deloitte. Blockworks was today by a Binance spokesperson that the “Big Four” audit firms – famously Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers – are “not currently prepared” to conduct a proof-of-reserves audit for a private crypto company. As reported by the news outlet, the spokesperson went on to say that Binance is going ahead with the Merkle tree proof of reserves to show that its assets exist on the blockchain. However, the exchange is still looking for a partner to verify the proof of reserves:At press time, the Bitcoin price was at $16,734.We have reached out to multiple large firms […] and we are still looking for a firm who will do so.