It was an exciting event celebrated by tens of thousands of cryptocurrency investors, with thousands packing into celebratory live streams, tens of thousands liking halving tweets, and hundreds of thousands hearing about Bitcoin via the news.

The halving was so popular that at one point, the topic trended on Twitter in the U.S., the U.K., and Canada (and maybe other countries). This came shortly after it did the same in China.

We got Bitcoin halving trending!!! — Tim Copeland (@Timccopeland)Although decisively bullish for Bitcoin in the long term, analysts say an “extreme” capitulation may take place in the coming days. But this may just be a short-term blip in a long-term bull market for the cryptocurrency.

Bitcoin Could Be Subject to Another “Extreme Capitulation”

Matt D’Souza, a hedge fund manager and the chief executive officer of Blockware Mining, after the halving that Bitcoin miners are at risk of “extreme capitulation.”It’s Not Exactly a Bad Thing

While “capitulation” sounds scary, especially since it has been affiliated with the late-2018 Bitcoin crash, it’s not exactly a bad thing. As prominent finance podcaster and Bitcoin bull Preston Pysh in response to D’Souza’s analysis:“During the 2016 halving, the price went sideways for 9 days and then had a 28% drop, and it took 100 days to get back to the halving price. Mentally prepare yourself for the efficiency cleansing and difficulty adjustment as the protocol prepares all passengers for launch.”

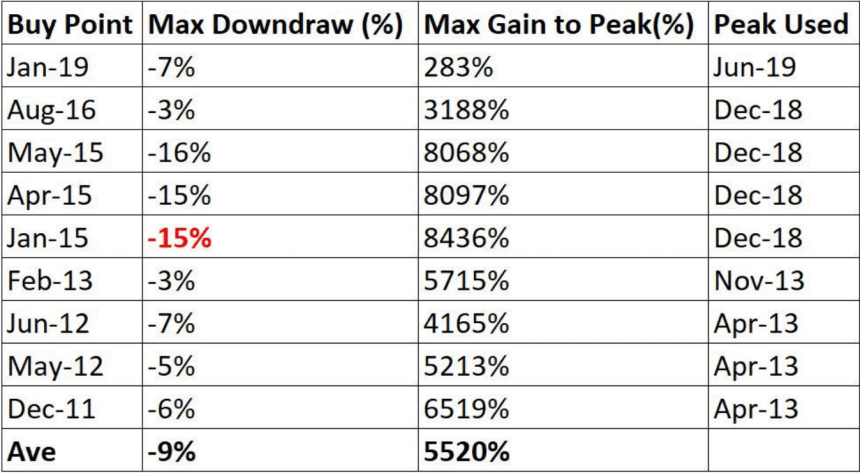

During the 2016 halving, the price went sideways for 9 days and then had a 28% drop, and it took 100 days to get back to the halving price. Mentally prepare yourself for the efficiency cleansing and difficulty adjustment as the protocol prepares all passengers for launch. — Preston Pysh (@PrestonPysh)The key part of this statement is that it “prepares all passengers for launch.” Data compiled by Charles Edwards suggests that after every Bitcoin miner capitulation, which is often followed by a capitulation by broader crypto investors, a strong surge has taken place.

The table below depicts this, as it shows that every time capitulation was signaled by the Hash Ribbons indicator, what followed was a massive macro surge to highs.

Per previous reports from NewsBTC, a prominent crypto trader remarked that he is “struggling” to see a bear case for BTC in the long run, citing the macroeconomic environment, the halving, and exchange dynamics.

Photo by on