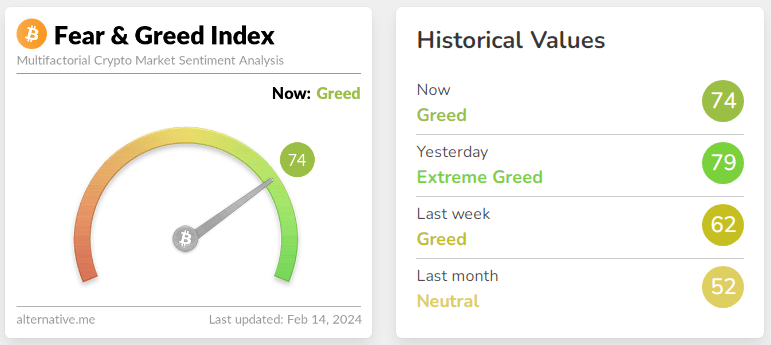

Bitcoin, the undisputed king of cryptocurrencies, is making headlines again with a recent price surge that has pushed it past the000 mark. This rally, coupled with an “extreme greed” reading on the Crypto Fear and Greed Index, paints a picture of a market brimming with optimism, but also raises concerns about potential overheating.

Greed Galore: Index Hits Highest Since ATH

The a widely used indicator of investor sentiment, recently skyrocketed to 79, its highest level since November 2021, when Bitcoin peaked at a record-breaking $69,000. This “extreme greed” reading suggests that investors are feeling euphoric about the current rally, potentially leading to risky investment decisions.

Source: Alternative.me

Bitcoin’s Bullish Charge: 15% Gain YTD

Fueling this optimism is Bitcoin’s impressive performance year-to-date. Since January 1st, the cryptocurrency has climbed a staggering 15%, showcasing a sustained bullish trend. This surge comes on the heels of a volatile 2023, where Bitcoin saw both dramatic dips and exciting climbs.

Spot Bitcoin ETFs: A Catalyst For Growth?

Many analysts point to the recent launch of in the US as a key driver of the current rally. These ETFs offer investors a regulated way to access Bitcoin, potentially attracting new money to the market. While the initial launch saw a sell-off, analysts like Cathie Wood of ARK Invest believe it was short-lived, paving the way for long-term institutional participation.

Bitcoin currently trading at $49,667 on the daily chart:

Doubled Value In A Year: A Turning Point?

Bitcoin’s current price of $50,000 is more than double what it was a year ago. This significant growth, coupled with the influx of new investors, leads some to believe that Bitcoin is entering a new era of stability and sustained growth. However, the cryptocurrency market is notoriously volatile, and past performance is not always indicative of future results.

Proceed With Caution: Experts Advise

Financial experts urge investors to exercise caution despite the current market enthusiasm. The “extreme greed” reading on the Fear and Greed Index serves as a warning sign of potential irrational exuberance. Investors should always conduct their own research, understand their risk tolerance, and not blindly follow market trends.

Featured image from Adobe Stock, chart from TradingView

Source: Alternative.me

Source: Alternative.me