- Bitcoin (BTC) soar, add 13.3 percent in the last week.

- Lisk founder says Bitcoin is a secure investment next to Gold

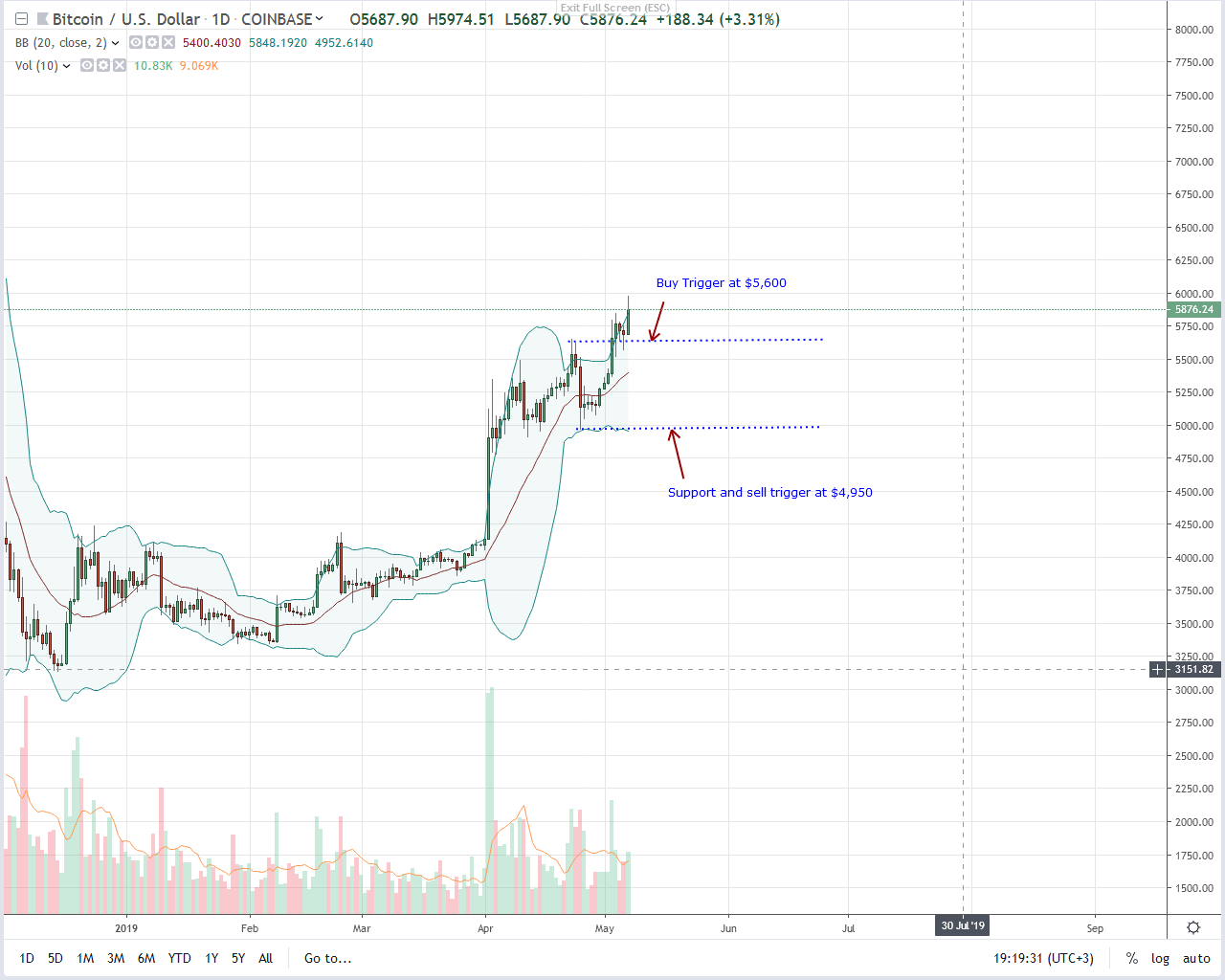

After a stellar performance, analysts believe last year’s crypto winter is over as Bitcoin (BTC) prices bottom up, retesting $6,000. From candlestick arrangement, we expect buyers to be firmly in control once prices rally and close above Q4 2018 support now resistance.

Bitcoin Price Analysis

Fundamentals

That the space is rapidly evolving is true, and it is an observation that the founder of Lisk, Max Kordek, notes. In an interview, the founder said although blockchain as a technology is revolutionary and disruptive, not “everything will be based on blockchain.” He goes on to add that while “blockchain is one technological level above texting (Web 3.0 Ver 2.0)” and the ecosystem researching and developing, “there are quite a few processes that can be optimized with this technology.”

Max is pragmatic realizing that blockchain is after all not that golden technology that will replace everything since “there isn’t even one-use case that has reached 100,000 daily active users”. All the same, he sees “a world where blockchain really helps people in very specific industries and solutions.” On Bitcoin, Max says next year’s Bitcoin halving would help prices recover.

Besides, with increasing prices, Bitcoin as a secure layer will evolve into a store of value that is independent of any other market. Because of this, investors can “just fill up your portfolio with 1 to 2 percent with it, and it can act as a secure investment next to Gold.” Overly, he sees Bitcoin as an inspiration and a stepping stone for blockchain.

Candlestick Arrangements

With what Bitcoin (BTC) represents, the world’s most valuable coin is up 3.2 percent in the last day. On a week-to-date basis, it is up 13.3 percent with bulls stepping on the gas pedal. For a clearer picture, analysis from a top-down approach hints of trend continuation.

The wide-ranging bull bar of the week ending Apr-7 is the base of our trade plan confirming the breakout pattern of week ending March 31. Since the trend is clear and prices are not only retesting the main resistance levels of $5,800–$6,000 as buyers blast above minor resistance at $5,700, aggressive traders should load on every dip now that bars are banding along the upper BB in the weekly chart.

Unless otherwise there is a cool-off, it is likely that Bitcoin will breach the $6,000 level reversing losses of Nov 2018.

Technical Indicators

From the chart, May-3 bull bar is our reference candlestick. Because of increasing bull momentum, we expect confirmation of today’s bull breakout as volumes spike above 19k. Any counter trade with equally high volumes reversing today’s gains could pour cold water on bulls.

Chart courtesy of Trading View