As the January 10 deadline for the US Securities and Exchange Commission (SEC) to decide on a series of spot Bitcoin Exchange-Traded Funds (ETFs) approaches, the market is rife with speculation.

Initially, there was a strong consensus for approval, but recent expert analyses suggest a possible change in course. Meanwhile, the Bitcoin price has crashed by 6.5% in 20 minutes, dropping from $44,400 to $41,500.1. Bloomberg’s Insight: A Matter of Timing, Not Denial

Bloomberg’s ETF expert, Eric Balchunas, assessed a mere 10% chance of the ETFs not being approved, primarily due to the SEC requiring additional time to review the proposals. This perspective is critical because it implies that the SEC is not outright opposed to the idea of a spot Bitcoin ETF, but is cautious in its approach.

Related Reading: Bitcoin ETF: SEC May Notify Approved Issuers To Launch Very Soon – Here’s When

Balchunas , “I would say if we don’t see it in the next two weeks, it’s more because they need more time,” indicating that a delay in approval should not be interpreted as a final rejection. His colleague, James Seyffart, further insights, noting, “Still looking for potential approval orders in that Jan 8 to Jan 10 window. […] We’re focused on these 11 spot Bitcoin ETF filers […] Expecting most of these N/A’s to be filled over the next ~week,” highlighting the dynamic nature of the situation.2. Matrixport’s Pessimistic Outlook: A Delay To Q2 2024

Matrixport offers a more cautious , anticipating that the SEC’s approval of might be deferred until the second quarter of 2024. This analysis hinges on a combination of regulatory challenges and the prevailing political climate under SEC Chair Gary Gensler‘s leadership.

The report states, “The leadership of the SEC’s five-person voting Commissioners, predominantly Democrats, influences the decision-making process. With Chair Gensler’s cautious stance on crypto in the US, it seems unlikely that he would endorse the approval of Bitcoin Spot ETFs in the near term.”

The firm further explains that despite the ongoing interactions between ETF applicants and the SEC, resulting in multiple reapplications, there remains a fundamental requirement unmet that is crucial for the SEC’s approval. This requirement, although unspecified in the report, is suggested to be a significant compliance or regulatory hurdle that could be addressed by the second quarter of 2024.3. Greeks Live’s Analysis: Decreasing Confidence

Greeks Live, focusing on crypto options trades, has a shift in market sentiment, with a decreased likelihood of the ETF’s passage. They report a significant decline in the ATM option IV for the week and below 65% for the January 12 expiration, indicating reduced market expectations for the ETF approval. The report notes, “Current month puts are now cheaper, and block trades are starting to see active put buying, with options market data suggesting that institutional investors are not very bullish on the ETF market.”A possible delay or rejection of Bitcoin ETFs carries significant market implications. The anticipation of ETF approval has been a major driving force in recent market dynamics, leading to increased investments. A decision against the ETFs could result in a rapid unwinding of these positions, potentially causing a sharp decrease in Bitcoin prices.

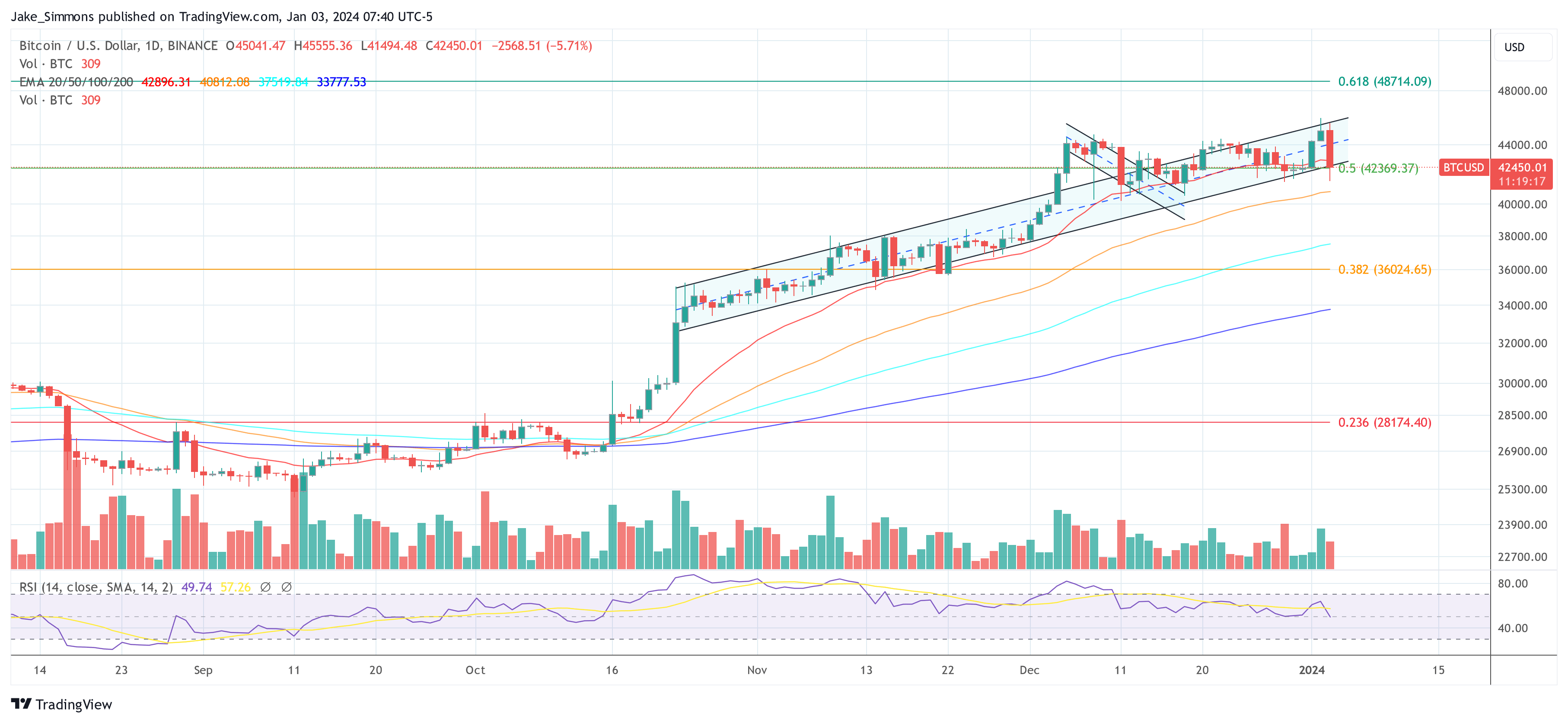

At press time, BTC had already recovered some of its losses and was trading at $42,450. This means that the price has once again returned to the upward trend channel in the 1-day chart that was established in mid-October last year.