In this episode of NewsBTC’s daily technical analysis videos, we use the Fisher Transform and other tools to see how close Bitcoin is to putting an end to crypto winter.

Take a look at the video below:VIDEO: Bitcoin Price (BTCUSD): October 24, 2022 Crypto Winter

Bitcoin continues to be boring, but the theme of this video is all about what happens when the notoriously volatile cryptocurrency gets dull. All downside and no rallies makes Bitcoin a dull boy.

“Here’s Johnny:” What Happens When Bitcoin Becomes A Dull Boy

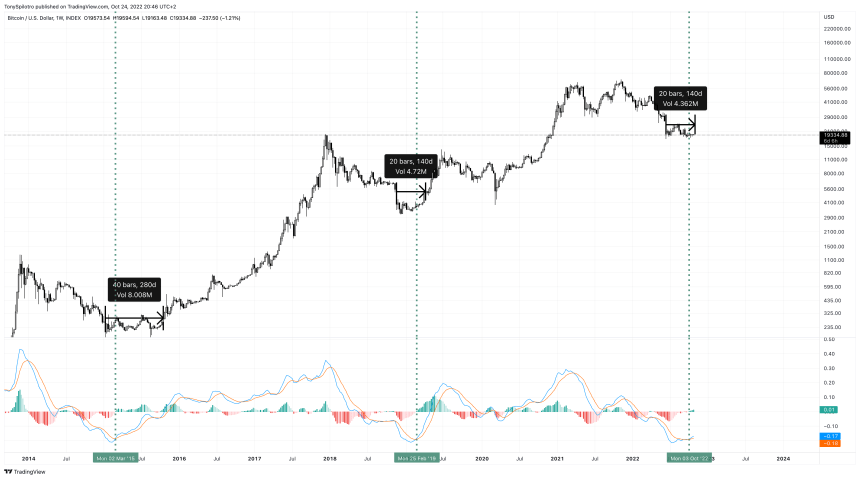

The Bollinger Bands are getting even tighter, showing that explosiveness is coming soon enough and this ongoing lull is just the calm before the storm. Daily Bollinger Band Width is now at the lowest point since October 2020 right before the bull breakout in 2020. Prior to that, the bands got that tight just ahead of the collapse to the bear market bottom in 2018.

On weekly timeframes, Bollinger Band Width is the tightest since the November 2018 breakdown, where Bitcoin dropped another 50% to its eventual bottom. All instances before that when the bands got this tight led to an enormous rally.

The monthly timeframe shows a very unusual phenomenon. The Bollinger Bands are actually now expanding after being some of their tightest ever. Rising after such a lull in volatility has in the past always triggered a trendmous bull run. Is the third time the charm?

The Bollinger Bands are some of the tightest ever | Source:

Related Reading: Is The Final Wave In Ethereum Up Next? | ETHUSD Analysis October 19, 2022

Why We Could Have Several More Weeks Of Crypto Winter

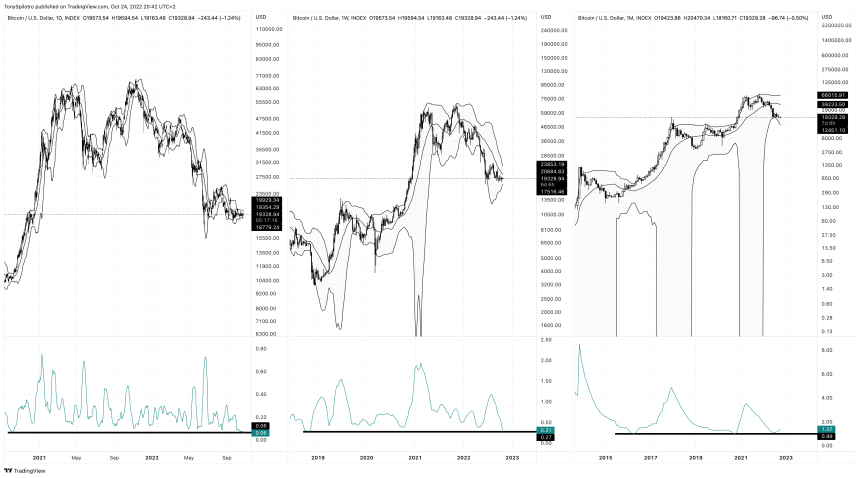

After this weekend’s weekly close, Bitcoin bulls have now closed three full weeks with a confirmed bullish crossover on the LMACD. Compared to the 2018 bear market bottom, we would only be a week or so away from making a larger move upward.

However, a comparison with the 2015 bear market bottom shows that although new lows might not arrive, there could be twice as long to wait before the bottom is confirmed as in and the range is left behind.

Other possible signals on weekly timeframes that could suggest we’ve seen the bottom already, is that Heiken Ashi candles are starting to turn green.

Cyclical Timing Tools Suggest Spring Is Almost Here

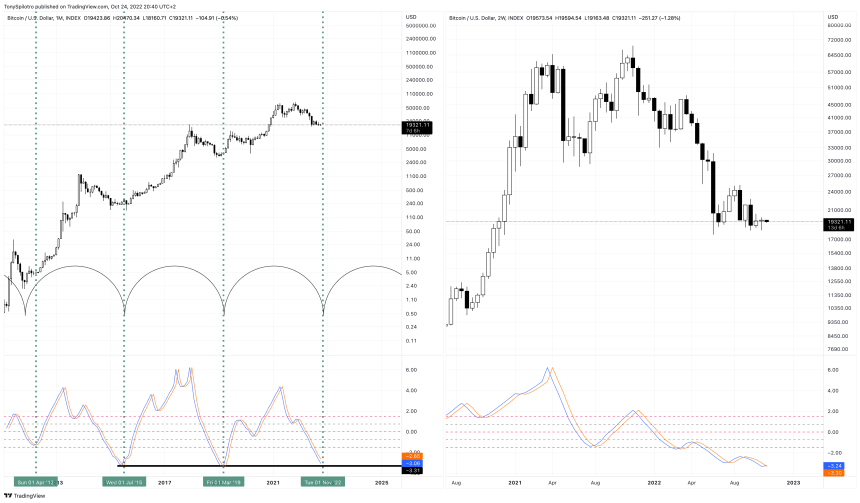

The two-week Fisher Transform has also started to flip bullish (pictured right). But it will take another 14 days to confirm the signal. The Fisher Transform is used to find major turning points in markets, but works best on the highest timeframes.

Moving to the monthly timeframe (pictured left), we can see that even here the Fisher has very little room left and if Bitcoin hands around here for another week or so, the monthly should begin to flatten, signaling a possible turnaround in price action. The Fisher Transform is based on a standard deviation formula, and with Bitcoin monthly at a -3.0 standard deviation, there is only a limited 0.1% chance the bear market will continue.