Bitcoin’s intense upwards momentum has stalled as the cryptocurrency enters a firm bout of consolidation within the upper-$8,000 region. This has come about in the time following the multiple firm rejections the crypto posted within the lower-to-mid $9,000 region.

It now appears that these rejections have caused the crypto to form some incredibly bearish divergence that could be confirmed if BTC closes below $8,400.

This comes just as professional traders and institutions trading Bitcoin futures on CME begin reducing their short positions and flipping long.

Bitcoin Continues Trading Sideways Around $8,800 as Upwards Momentum Falters

At the time of writing, Bitcoin is trading down marginally at its current price of $8,830, around the level at which it has been trading at throughout the past couple of days.

This sideways trading comes close on the heels of the three rejections that BTC faced at $9,200 and $9,500.

In the near-term, $9,200 is the first key resistance level that the crypto needs to firmly surmount if it is to see further upwards momentum.

In order for this to happen, Bitcoin needs to maintain above its point-of-control (POC) level at roughly $8,800, as any sustained period of trading below this level would open the gates for a move to the crypto’s lower range boundary at $8,400.

“In a half-sized long from 8.6; I think we’ll see price close back above the range POC (point of control) from here,” an analyst while speaking about the importance of this level.

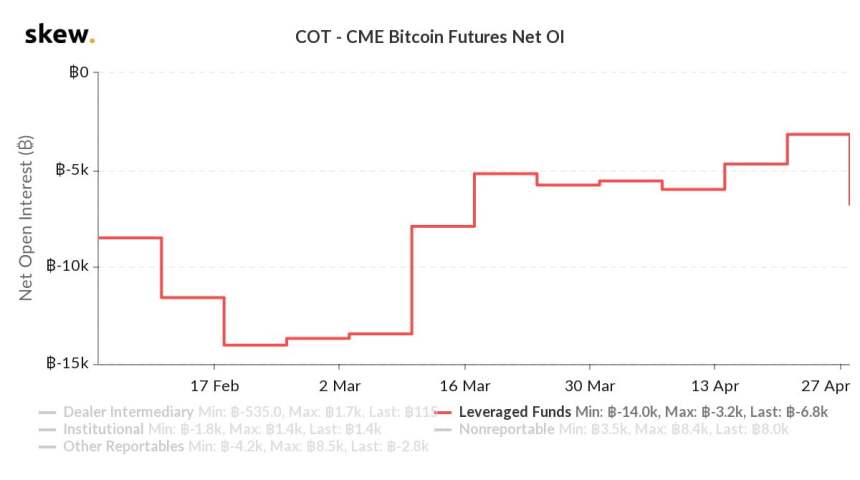

One interesting possibility to be aware of is that professional traders and institutions engaged in Bitcoin futures trading on the CME platform have been heavily reducing their short exposure throughout the past few months.

This is seen while looking towards CME Bitcoin futures net open interest.

“Leveraged funds reduced shorts at CME post the 12th of March sell-off,” research platform .

BTC Begins Forming Massive Bearish Divergence

Despite the signs of tempered optimism amongst institutional and professional traders, Bitcoin could be on the cusp of seeing grave losses.

This possibility stems from bearish divergence seen on the crypto’s Renko 4-hour chart, which will be confirmed if BTC declines below $8,400.

One analyst mused this possibility in a , noting that it can only be invalidated if BTC is able to push above $9,500.

“Renko 4h bearish divergence, strong one. Invalidated with a close above 9500. Confirmed with a close below 8400,” the analyst stated.

If Bitcoin is able to hold above its point-of-control in the hours and days ahead, this could provide it with some much needed upwards momentum that allows it to invalidate this bearish divergence and surmount the heavy resistance in the lower-$9,000 region.

Featured image from Unplash.