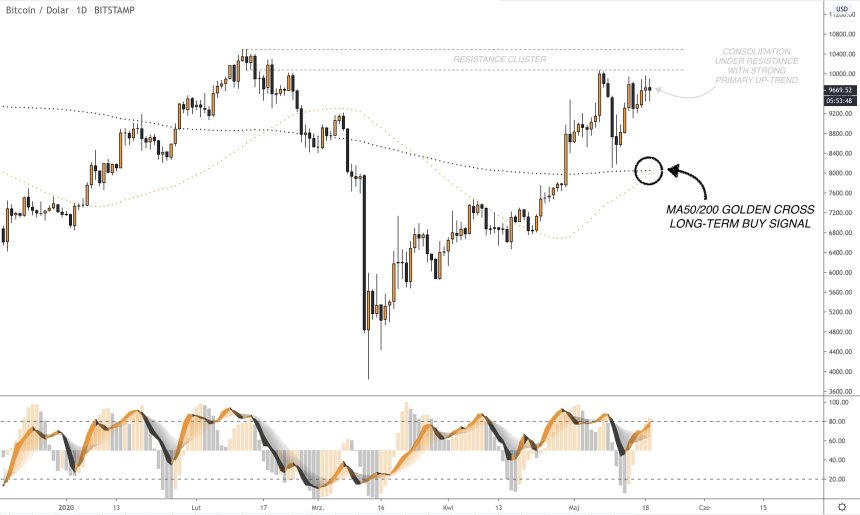

This trend may not persist for too much longer, however, as a recently confirmed golden cross seems to suggest that it is poised to see further upside.

Bitcoin’s Ongoing Consolidation May Not Last for Too Much Longer

At the time of writing, Bitcoin is trading down marginally at its current price of $9,680. This is around the price level at which it has been trading at in the time following this morning’s rejection at just under $10,000.

Today’s decline from these highs marks the latest in a series of rejections that BTC has faced at this level, with the selling pressure here seemingly being insurmountable.

Popular Economic Model Now Forecasts That BTC Could be Trading at Nearly $300k in Coming Years

The stock-to-flow model has long been looked towards by investors to justify large price targets.

Despite being controversial, the model is based on the simple economic principles of supply and demand, and now signals that Bitcoin could have a multi-trillion-dollar market capitalization in the years ahead. PlanB – the Bitcoin commentator who has crafted this model – spoke about the stock-to-flow cross asset model in a recent tweet, explaining that it suggests Bitcoin could soon be trading at nearly $300,000.S2FX clusters:Although a $5.5 trillion market cap may seem like a pipe dream presently, this would still make Bitcoin’s market size nearly half that of Gold.1 – S2F 1.3 -> Market Value $1M -> BTC $0.23

Beauty is that change in S2F is proportional to change in BTC Market Value (d_MV=d_S2F^4.1)🔥 — PlanB (@100trillionUSD)

2 – S2F 3.3 -> $58M -> $6

3 – S2F 10.2 -> $5B -> $410

4 – S2F 25.1 -> $114B -> $6700

5 – S2F 56.0 -> $5.5T -> $288K

Featured image from Unplash.