Bitcoin price bounced to the tune of 5% following yesterday’s Federal Reserve meeting. However, the move has almost fully retraced. What’s interesting about the situation, is that traders at one particular platform could have seen this coming a lot more clearly, while others might have suffered a fake out.

Here is a closer look at a comparison between BTCUSD spot index price charts and BTC CME Futures that puts a spotlight on the strange discrepancy. We also shed some light on how to possibly take advantage when these instances occur.Why You Can’t Ever Sleep On Crypto Markets

The crypto market never sleeps. It trades night and day, 24/7 days a week. Even stock market futures take a break for short periods. But when it comes to CME Group’s BTC futures contracts, it more closely follows the stock market’s trading hours.

CME takes a break from Friday to Sunday evening. If Bitcoin price moves substantially during the time the trading desk is offline, it will leave a gap on its chart that regularly becomes a target that gets “filled” in the following days.

Related Reading | Bitcoin Indicator Hits Historical Low Not Seen Since 2015

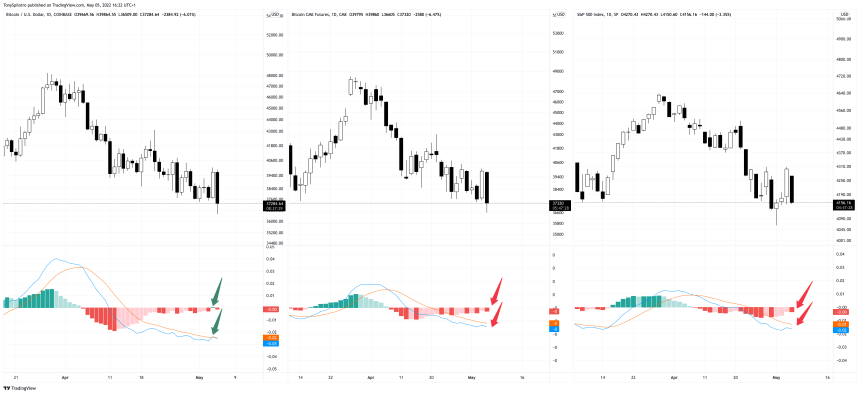

Because certain spot market trading days are missing from the CME BTC futures chart, certain technical indicators can produce minor deviations. More often than not, these minor discrepancies are early signs that a fake out is coming.

BTC CME futures performs more on par with the stock market | Source:

How To Potentially Predict Bitcoin Fake Outs Using Spot Vs CME Comparison

The LMACD – the logarithmic version of the Moving Average Convergence Divergence indicator – is considered a lagging indicator. For this reason, bullish or bearish crossovers are typically considered reliable signals to take or close a position.

Related Reading | Time Vs Price: Why This Bitcoin Correction Was The Most Painful Yet

Traders need not ditch the indicator altogether, but instead can use such discrepancies between the two indicator’s performance to try and predict when fake outs, stop runs, or other nasty moves will occur.

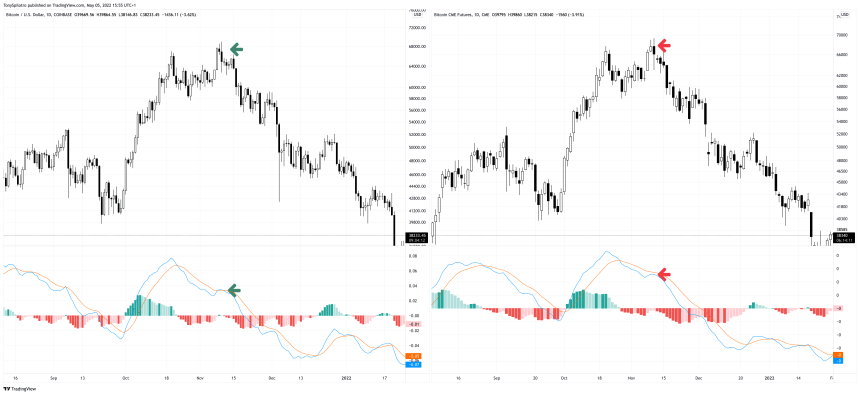

The last time the LMACD produced a false signal on spot exchanges, yet not on the CME BTC chart, was the exact peak in November 2021. Is there a chance this latest fake out is a sign the bottom is in, or is it merely suggesting more downside ahead?

The missing bullish crossover called the top in November 2021 | Source:Bitcoin bulls must push momentum back in their favor on daily timeframes, and follow through with enough strength to force higher timeframes to follow.

Follow or join for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com