Related Reading: Cardano (ADA) Price Alert: Analyst Predicts 60% Rally In Next 7 Days

Big Players Dominate The Crypto Arena

This week’s narrative unfolded on a stage dominated by two juggernauts of the financial realm – BlackRock, the undisputed titan of asset management, sent ripples through the market by filing with the SEC, outlining tentative plans to incorporate spot Bitcoin ETFs into its Global Allocation Fund. Although in its infancy, this move has ignited hopes for heightened demand, especially through BlackRock’s IBIT ETF, already wielding a substantial 204,000 BTC. Enter MicroStrategy, the steadfast evangelist of Bitcoin strategies. This corporate behemoth poured more fuel into the already blazing fire by revealing the acquisition of an additional 12,000 BTC.Source: IntoTheBlock

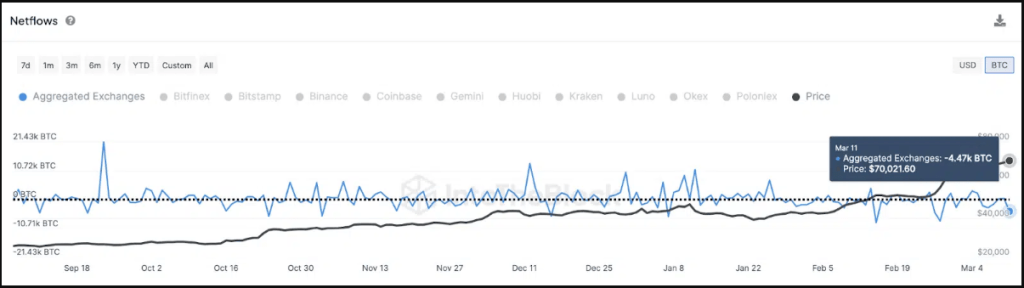

$520 Million In Bitcoin In Transit

IntoTheBlock’s exchange netflow metric showcased a significant outflow of 4,470 BTC on March 11th. This substantial move, valued at over $520 million, saw coins making a pilgrimage from exchange wallets to cold storage.Total crypto market cap at $2.6 trillion on the daily chart:Drawing parallels from the pages of history, the recent exodus from exchanges echoes a similar event on February 27th. On that day, a netflow of 8,050 BTC correlated with a breathtaking 26% surge in prices within 48 hours. If this historical rhyming persists, the recent outflow might just be the wind beneath Bitcoin’s wings, propelling it to conquer the $75,000 resistance level in the imminent days. As the stage is set for Bitcoin’s next act, technical indicators join the ensemble, singing harmoniously in the chorus of a potential breakout.

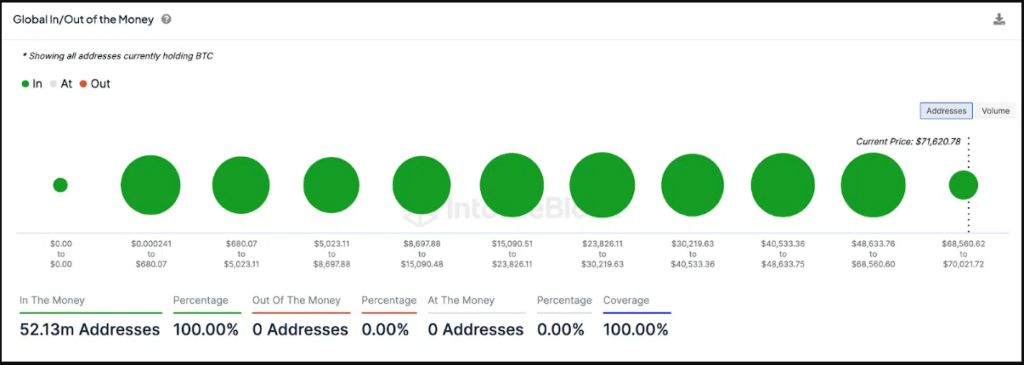

GIOM data. Source:

Enjoying Profits

IntoTheBlock’s “Global In/Out of the Money” chart offers a visual feast, showcasing that in this era of Bitcoin’s price discovery, nearly all of the 52 million holder addresses are now enjoying profits. This absence of selling pressure, combined with the rising institutional tide, paints a canvas of explosive potential. While the bulls eye the lofty target of $75,000, technical analysis points to a potential support station at $69,000. This zone, a fortress where over 6.6 million holders acquired nearly 3 million BTC, could stand as a formidable psychological barricade in the face of any price pullback. At the time of writing, Bitcoin is level, trading at $73,529, up 2% and 10% in the daily and weekly timeframes, data by Coingecko shows.Featured image from Unsplash, chart from TradingView

Source: IntoTheBlock

Source: IntoTheBlock