Despite this, one respected technical indicator that has been closely watched by analysts in recent times is now signaling that the bear market ended when BTC broke above $7,000, and it would require a relatively large drop to put the crypto back into bear market territory.

Bitcoin Likely to See Further Gains in Near Future, Regardless of Current Instability

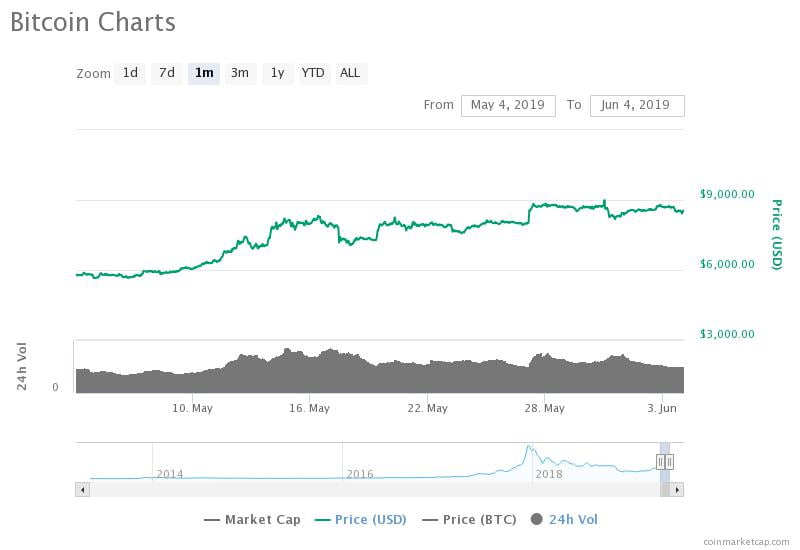

At the time of writing, Bitcoin is trading down nearly 3% at its current price of $8,460, down from 24-hour highs of over $8,700.

“$BTC – 1 Week Super Guppy. After looking at the 3 Day Guppy chart, we confirmed a bull trend as it flipped green. Now we see the 1-week flip from red to grey signaling end of bear market after the price pushed 7k. Guppy is a lagging indicator but makes for strong confirmation IMO,” he noted, while referencing the below chart.//twitter.com/josh_rager/status/79843591?s=21

BTC Has Room to Fall Before Bulls Lose Their Strength

In a later tweet, Rager further explained the importance of the data elucidated by the aforementioned indicator, explaining that he believes that bulls will still have enough strength to push the crypto higher so long as it holds above the $5,500 area on a weekly time frame.

“With Bitcoin and crypto markets, anything can happen as these markets are easily manipulated. But until we close below $5500 area on a weekly level, I’ll remain bullish. Let’s not forget that we just closed out the strongest monthly candle on the Bitcoin since 2017,” he said.//twitter.com/Josh_Rager/status/03928576 Although Bitcoin’s latest dip and its recent bout of instability certainly does appear to mark the end of the upwards momentum experienced in recent times, from a technical perspective it does seem as though there is likely to be further gains in the near future.

Featured image from Shutterstock.