- Bitcoin Price slide, potential support at $3,400 or 78.6 percent Fibonacci level

- SEC may not approve Bitcoin ETF

- Reaction at $3,700 important for bulls

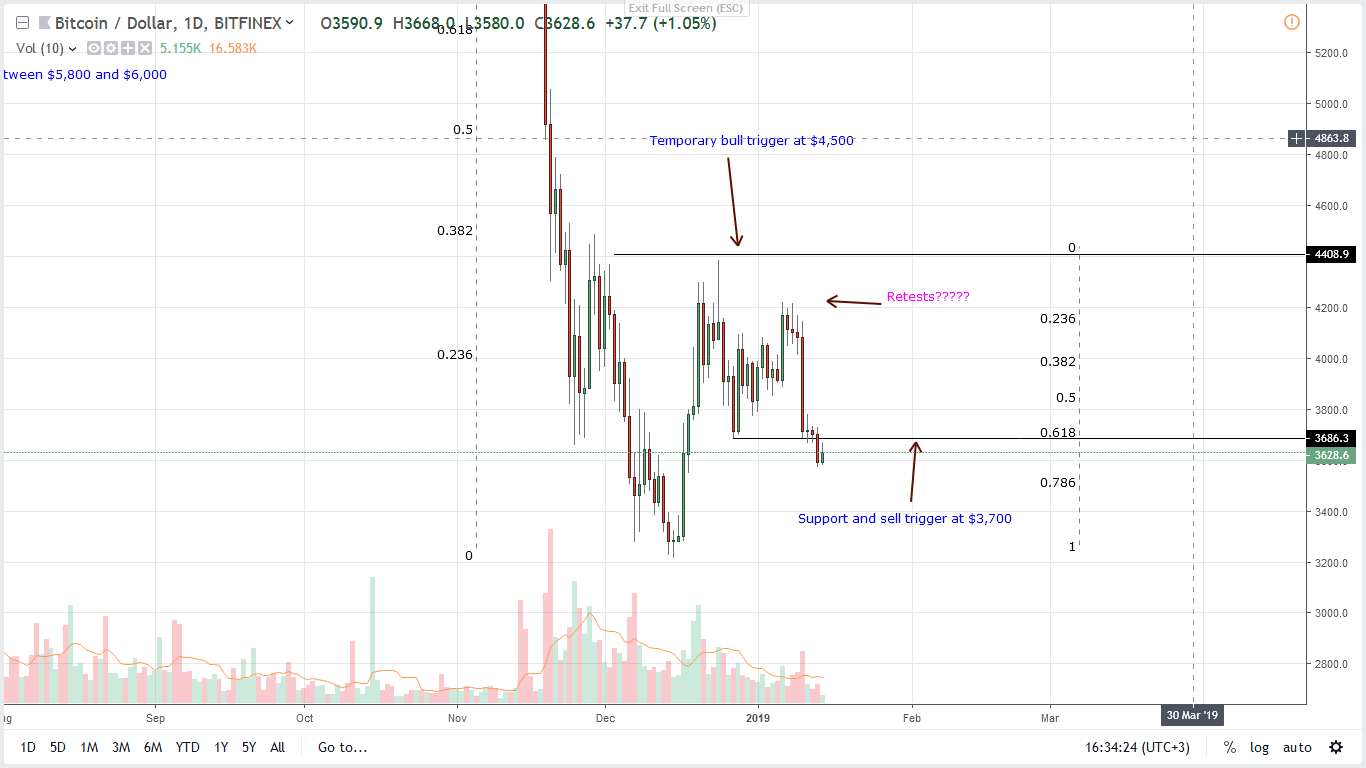

In the short-term, sellers seem to be in charge and yesterday’s drop below our immediate support at $3,700 may lead to reductions towards $3,400. In the midst of this, we are net bullish because of buy pressures of week ending Dec 23.

Bitcoin Price Analysis

Events of the week ending Dec 23 and consequent follow through reinvigorated bulls. Regardless, the fact that prices reversed from the $4,100-200 resistance zone at the back of high volumes meant sellers are back in contention and the third phase of a classic bear breakout pattern—the trend resumption phase is in progress. Going forward, the reaction of BTC prices at the 78.6 percent Fibonacci retracement level at $3,400-50 zone could define medium-term price trajectory.

Fundamentals

Surprisingly, the question of Bitcoin ETF approval appears to be shifting from regulatory compliance to market readiness. Cynics are not confident about the maturity of the sector and whether existing infrastructure, especially on the custodial side of the equation, shall handle the expected transaction deluge from institutional grade and HNW investors.

So far, the SEC has rejected nine application, and the VanEck, SolidX and CBOE application stands out. According to last years, rumors may be the first to be approved. However, Meltem Demirors, during Ran Neuner’s CNBC Crypto Trader said there is no way this application will get ticks from the SEC and that there are far few upsides for the US SEC.

Candlestick Arrangement

Technically, bulls have a chance. Founding our optimism are bulls of the week ending Dec 23 and the failure of bears to reverse these gains four weeks after confirmation by the first week of 2019. Moving on, we shall retain a bullish outlook even if sellers appear to be back following Jan 13 close and break below the $3,700 , the base of late Dec 2018, early Jan 2019 bull flag.

While the path of least resistance is southwards, assuming there is confirmation of yesterday’s losses, immediate support will be at $3,400-50 zone marking the 78.6 percent Fibonacci retracement level of Dec 2018 high low.

Drops below this support will inevitably lead to depreciation towards $3,220 or Dec 2018 lows. On the flip side, reversal at spot or from $3,400 could lead to gains above $3,700 and $4,000. However, we recommend patience until after there is a rally above $4,500 which could potentially open doors for $6,000.

Technical indicators

Behind Jan 10 declines were high volumes reflecting those of Nov 20. Both propelled bear bars. Therefore, for our projection to be accurate—short-term bullish in line with late Dec 2018 gains, a counter bull bar backed by high volumes—preferably above 35k or Jan 10 volumes should print driving prices above $3,700 ideally from spot prices.