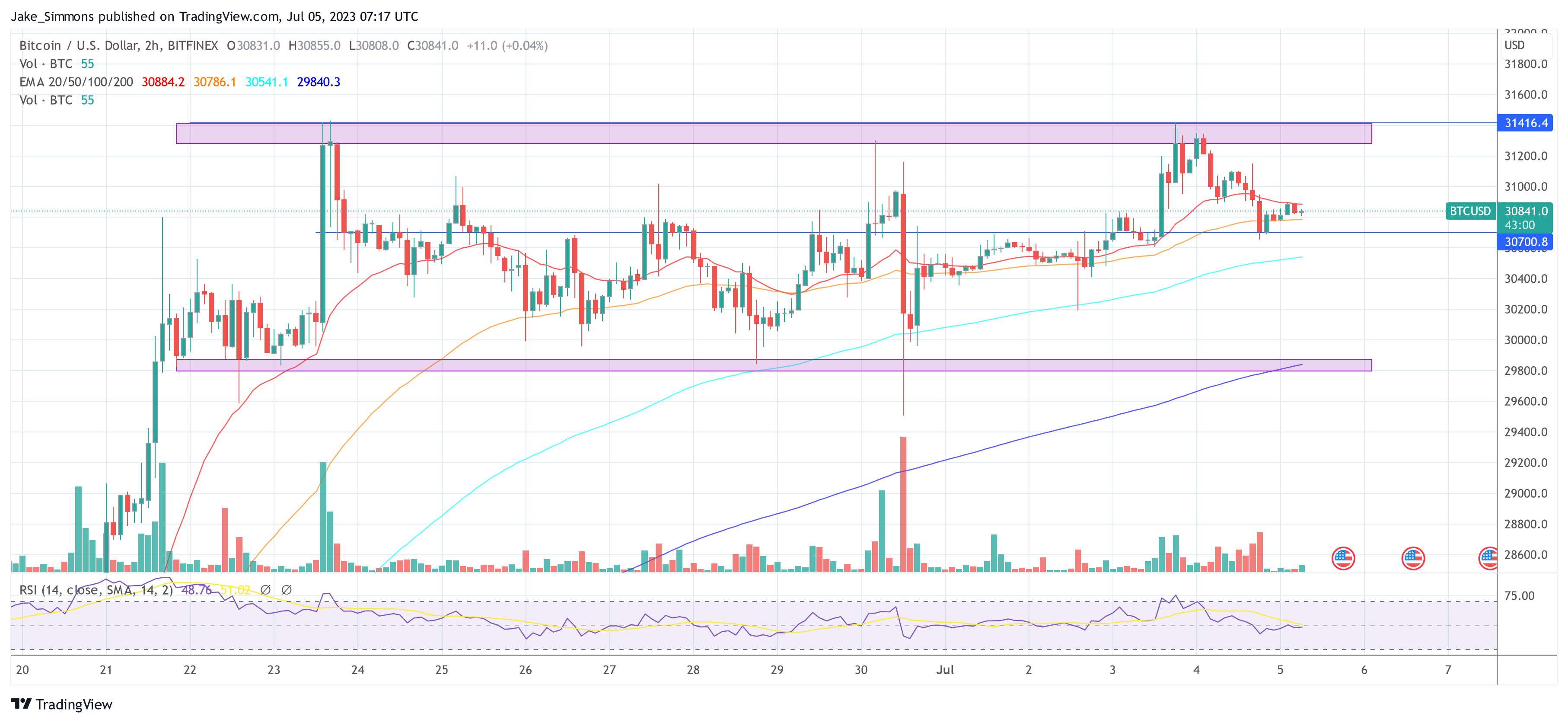

After Bitcoin reached a new yearly high at $31,413, the buy side has so far failed to initiate a trend-following move north. Although the bulls fended off a sell-off last Friday in the wake of the SEC’s perceived concerns over a Bitcoin spot ETF approval, the momentum seems to be increasingly flattening, or isn’t it?

What’s Next For The Bitcoin Price?

As the market awaits an approval from the Security and Exchange Commission (SEC) regarding a spot Bitcoin exchange-traded fund (ETF), investors are seemingly exercising caution. While open interest in the Bitcoin futures market continues to rise, activity in the spot market has recently declined. This shift indicates that price action in recent days has been primarily influenced by futures traders. Analyst @52Skew on Twitter, “$BTC Spot CVDs & Delta: Quite a bit of spot still being dumped on the market + no limit chasing today from coinbase buyers. Spot bid liquidity $30.5K.”

Experts Remain Bullish For Now

Renowned analyst Josh Rager believes the pullbacks won’t be as deep as many experts expect, suggesting that ETF approval, particularly from BlackRock, is a real possibility. He says, “Only an ETF rejection can cause pain, but I think BlackRock will be approved this time,” :Similarly, NewsBTC lead analyst Tony “The Bull” believes in the bullish case for BTC in the near term. However, he stresses the importance of Bitcoin’s Relative Strength Index (RSI) entering overbought territory, as a failure to do so could a lack of strong upside momentum:The $24k, then up sentiment seems to be quite popular. I think people are overthinking it. Similar was said about Bitcoin needing to sweep $20k first. IMO, pullbacks won’t be this deep now and if we manage to see $25k again it won’t be until later on in the year after more upside before so.

I want to see Bitcoin RSI push into overbought conditions by week end, or else I worry that this isn’t an impulse yet. We have a doji on the weekly, which signals indecision. We need to see follow through this week, or more correction becomes more probable w/ possible bear div.