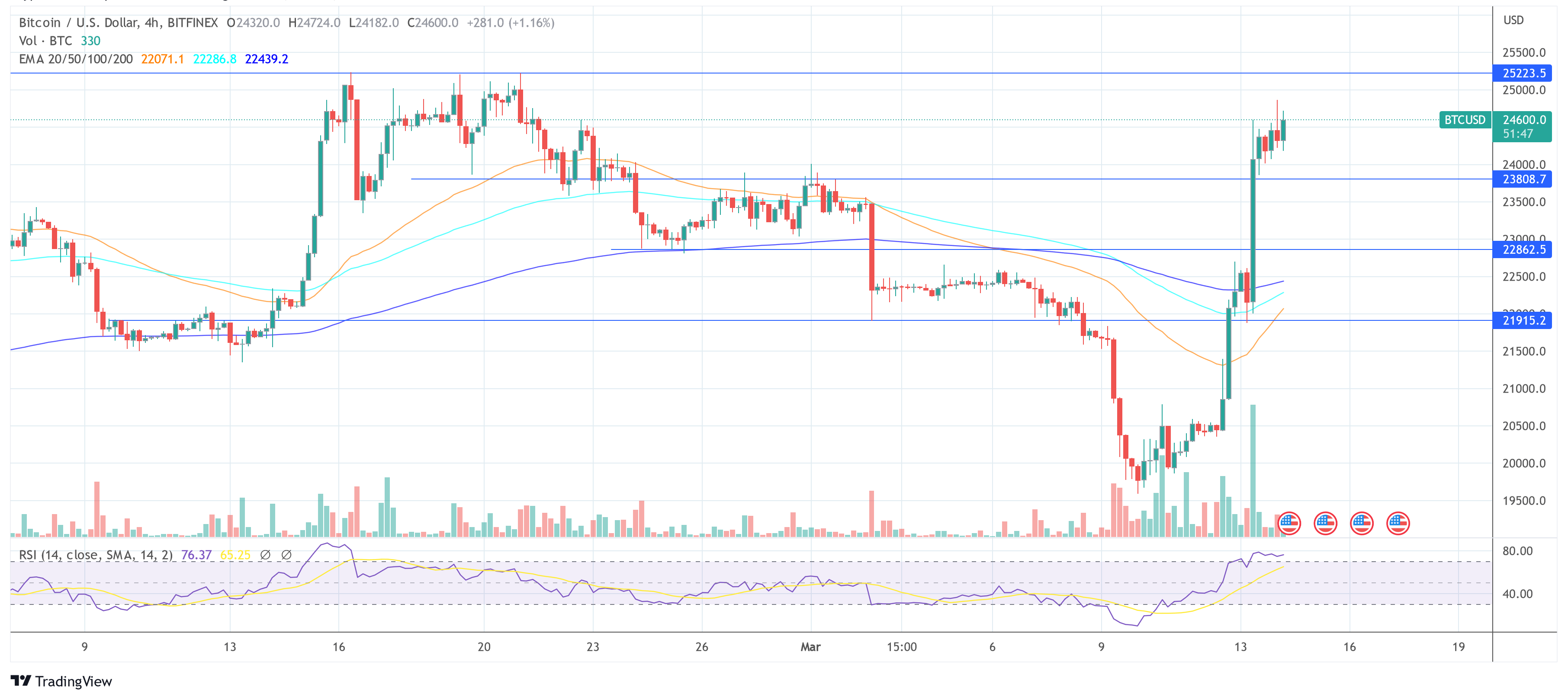

The Bitcoin price has risen by more than 20% amid the crisis in the US banking system, which saw three banks shut down by the US government and a massive crash in the prices of numerous banks. After the furious price surge, BTC has stabilized between 24,000 and 24,8000 as of press time – but the calm might not last long.

With today’s release of the Consumer Price Index (CPI), the Bitcoin price is traditionally in for a volatile day. And it’s not just the CPI that points towards massive volatility in the market.Bitcoin Faces A Volatile Day

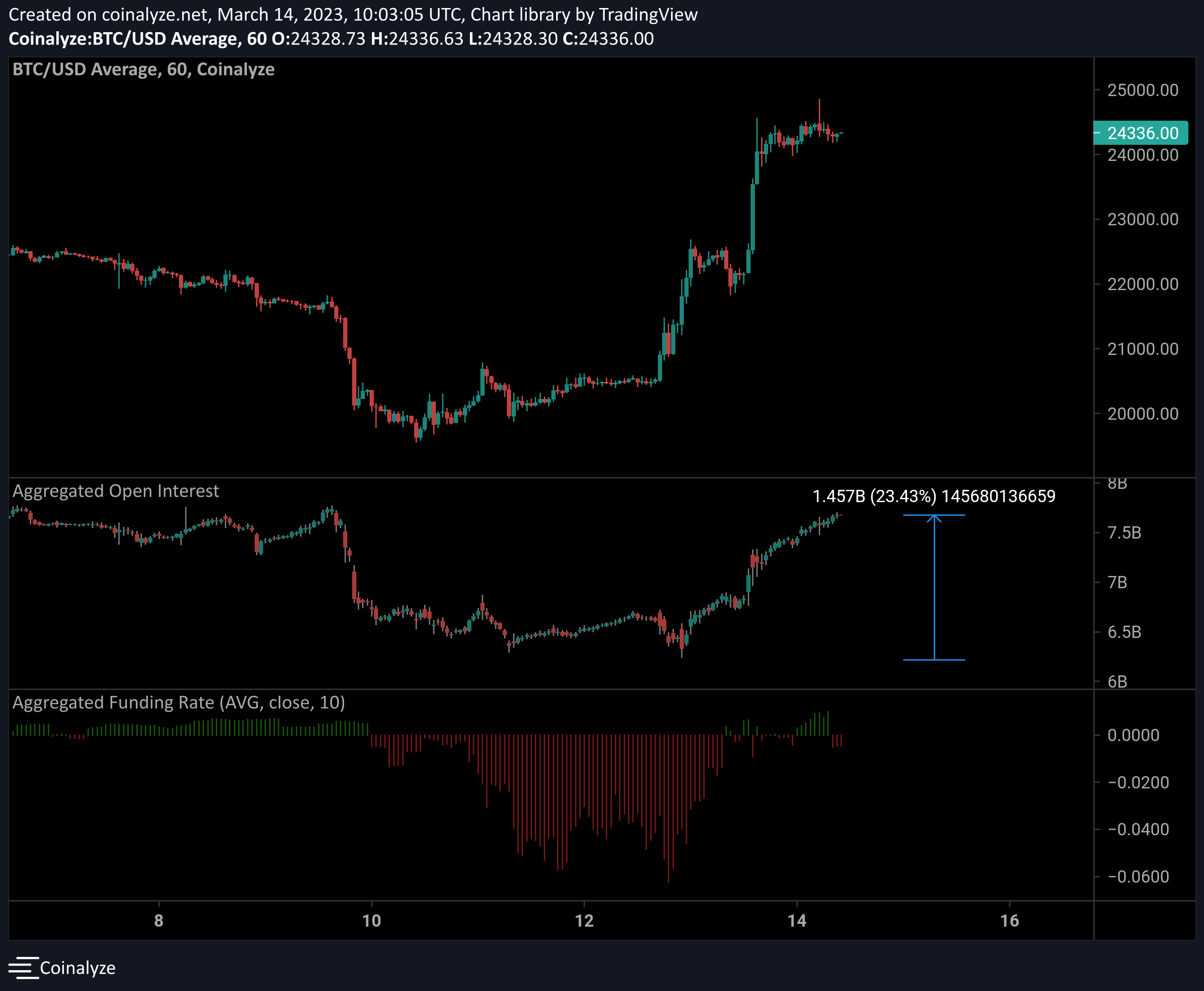

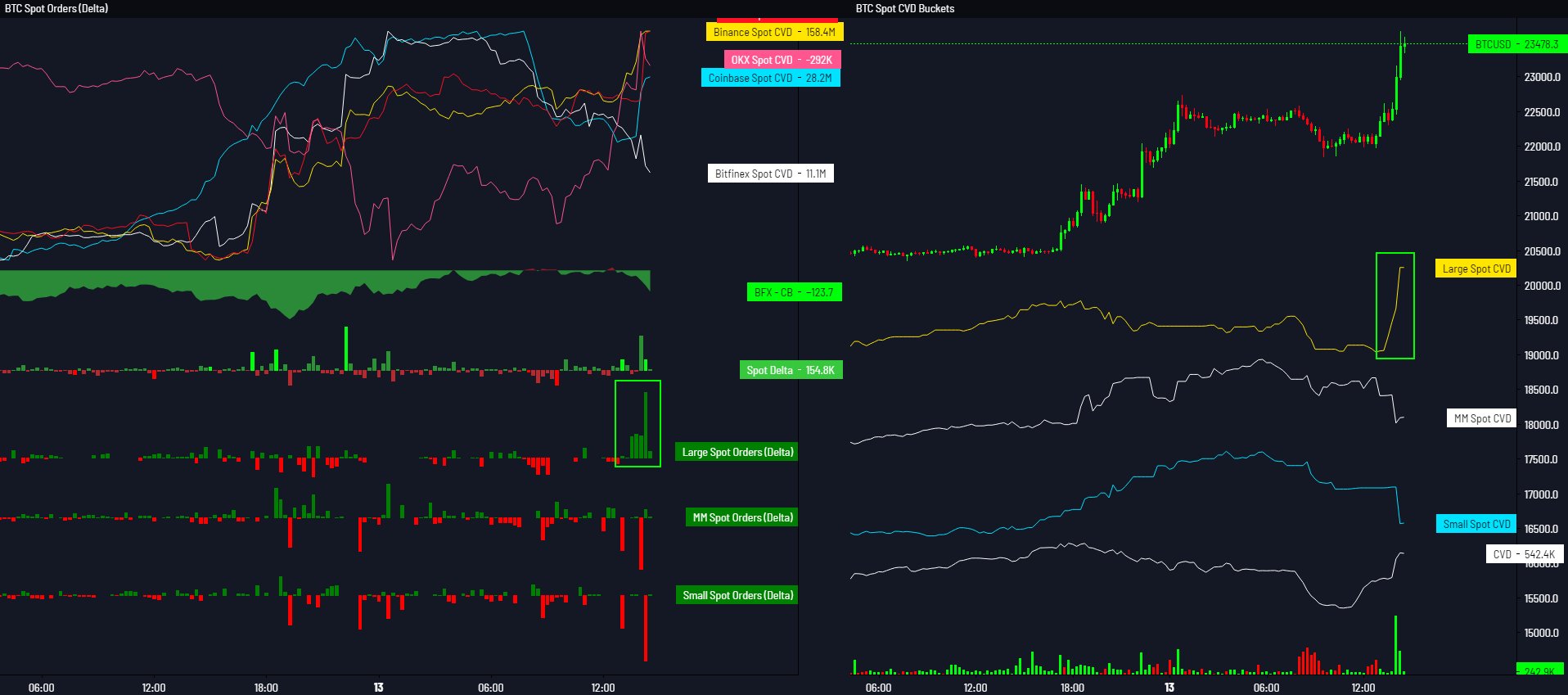

Maarten Regterschot, founder of diveonchain, outlined in a tweet that the “perfect mix for strong volatility” is currently evident with regards to BTC futures data. Open interest is up $1.45 billion (23%). Funding rates are neutral / slightly negative.

Chinese journalist Collin Wu also that in the last 24 hours, the notional value of Bitcoin options trading volume was about $2.5 billion , the second highest in history. It is also worth noting that call options with expiration dates on March 31 and June 30 are the largest.perp funding rate turns negative ahead of .

— James Van Straten (@jvs_btc)

While options 25 Delta Skew suggests bearish sentiment with puts slightly at a premium

Will Bitcoin Continue Its Rally?

It is also worth noting that Changpeng Zhao has yet to complete the announced conversion of the Binance Recovery Fund from BUSD to Bitcoin, Ethereum, and BNB. Both “Skew” and renowned analyst on Twitter @tedtalksmacro have yet to observe any movement of Binance funds.