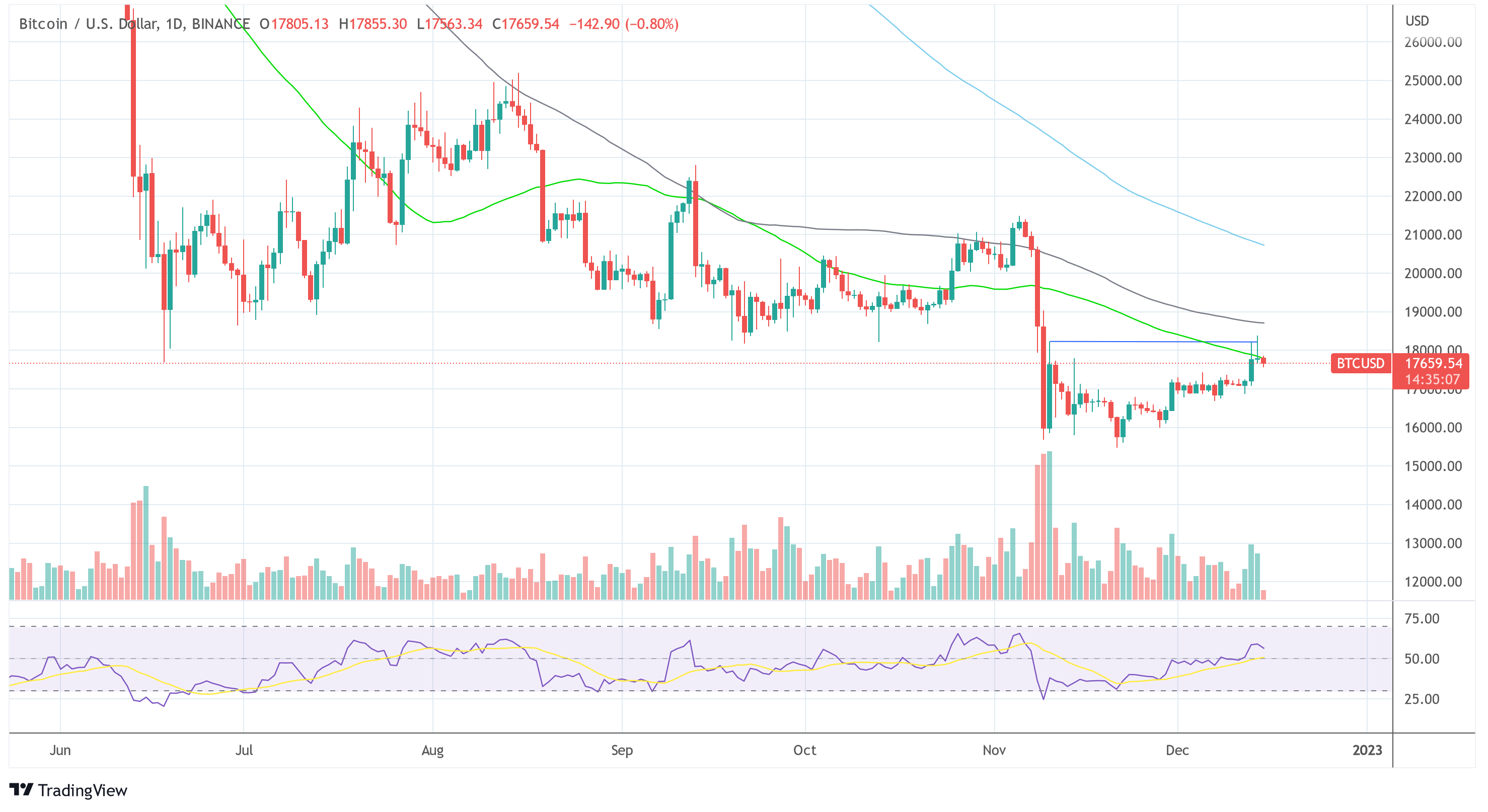

The bitcoin price has seen a minor rally ahead of yesterday’s FOMC meeting and has held relatively strong despite the hawkish outlook from the US central bank. A look at the daily chart of BTC shows that the price managed to hold above $18,600. After an exuberant euphoria following the release of CPI data, bitcoin seems ready for a consolidation phase for now.

In the daily chart, the bitcoin price was rejected at $18,220. Therefore, it seems likely that bitcoin will go through consolidation for now and look for a higher low. The support area to hold is currently at $17,200 to $17,400.

Are Bitcoin Whales Signaling A Trend Reversal?

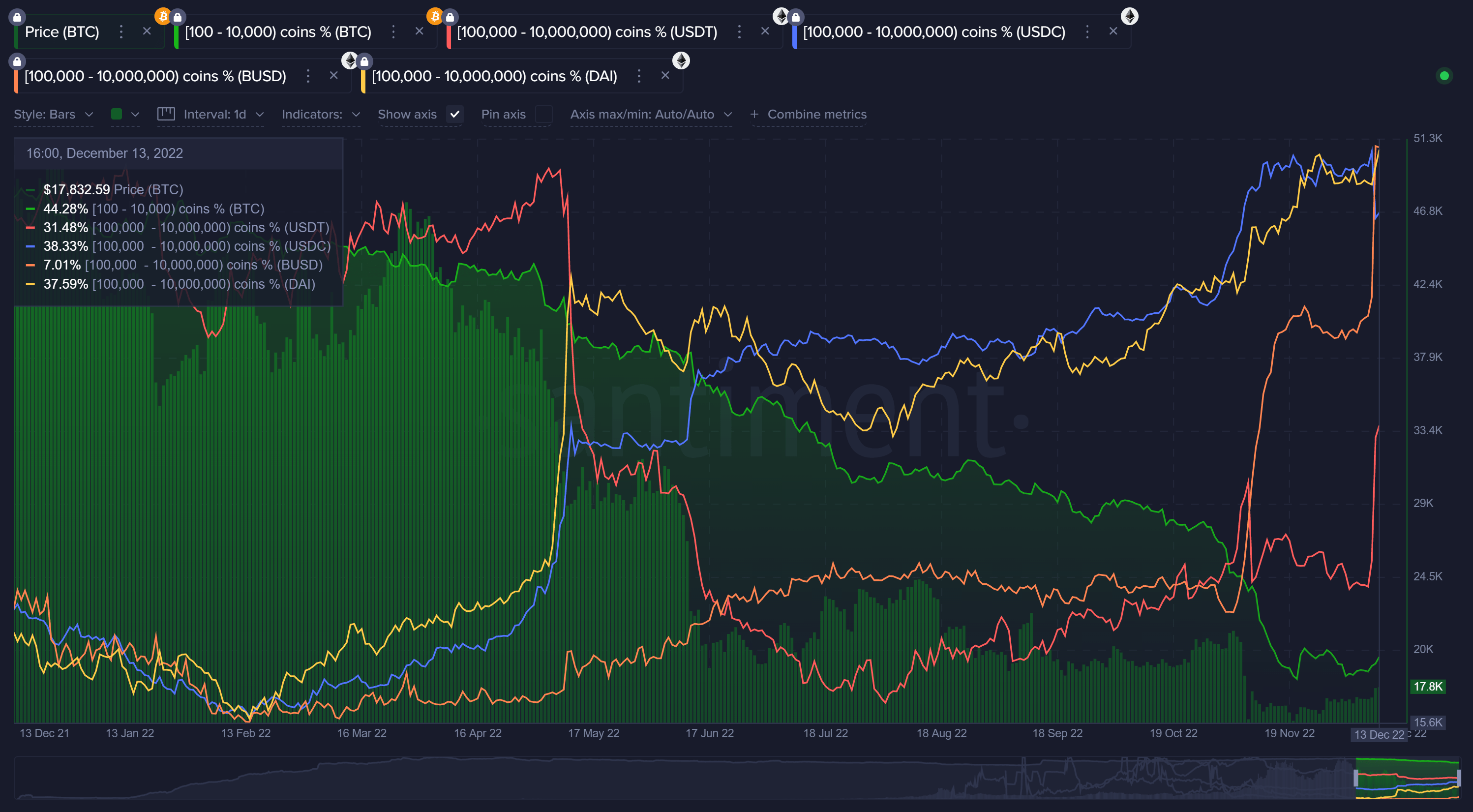

As on-chain data provider Santiment writes in an , bitcoin’s fundamentals are looking extremely strong. Santiment pays particular attention to the shark and whale addresses, which hold between 100 and 10,000 BTC and are a notoriously important indicator of future price trends.

However, we may be seeing a turnaround now. Not necessarily with prices just yet… but at least with whales finally accumulating rather than dumping.

Whales Stock Up Their Dry Powder

The bitcoin metrics are not the only things pointing to a turnaround, but also the stablecoin movements. “[W]e have just seen massive sudden jumps in the key $100k to $10m USDT and BUSD wallets worth $100k to $10m,” Santiment said.Thus, according to Santiment, there are good reasons to expect the final weeks of 2022 to be bullish, though further crypto-intrinsic issues and macroeconomic headwinds could dampen the joy.