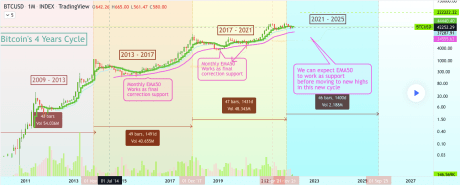

Bitcoin In Four-Year Cycles

As bitcoin has settled above $43,000, looking at other metrics to figure out where the digital asset may be headed has become imperative. In this report, we take a look at bitcoin through 4-year cycles and what it has often meant for the asset. Four years is important to the movement of bitcoin given that things like halvings happen in such timeframes. But for this, we take a look at the monthly EMA50 and how it works as the last correctional support before takeoff.Related Reading | TA: Bitcoin is Surging, Why Bulls Could Aim More Upsides

EMA50 marks four-year cycles | Source:

BTC On The Charts

Long-term, bitcoin shows tremendous promise. With adoption expected to rise and supply on the decline, it would impose scarcity on the asset, making it even more valuable. However, in the short term, BTC continues to struggle price-wise.Related Reading | The Bear Signal That Suggests Another Bitcoin Crash Is Coming

After fighting its way out of a bear trend, it remains up to the bulls to pull out from underneath the bears. Market sentiment is getting better but still remains mostly negative, making investors wary of putting more money into the market. Bitcoin is now trading in the $43,500 territory at the time of this writing. It lost about $2K after bursting through $45,000 in the early hours of Tuesday. But it has begun to recover after falling near $43,000.BTC slips to $43K | Source:

Featured image from Tokeneo, charts from TradingView.com