Bitcoin Investors Are Still Accumulating

Despite the drawdown in price, it has not deterred Bitcoin investors from filling up their bags. A notable example of this was a large BTC transaction that was recorded on Tuesday. The carried a total of 23,500 BTC worth over $710 million to a single receiver, making it the fourth-largest transaction of the year. Interestingly, this transaction was not made to an exchange, but rather to a large BTC holder, pointing to accumulation. Centralized exchange net flows are also pointing to accumulation among investors. Glassnode reports that there was . Such trends where investors are moving their coins out of exchanges always point to a long-term hold mentality which is usually bullish for the price of the digital asset.

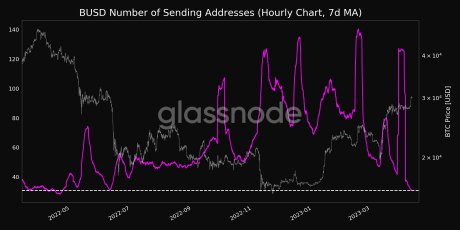

BTC sending addresses drop to 11-month low | Source:Investors are also moving their coins around at a much lower rate the number of sending BTC addresses on a 7-day moving average dropped to a new 11-month low. All of these indicate that investors are choosing to hold their coins to wait for better price headwinds.

Crypto Market Gripped By Greed

In addition to the accumulation trend, the Bitcoin Fear & Greed Index also shows that investors are still very bullish in the market. The index is currently sitting at a score of 65 which indicates high levels of greed in the market. While greed can sometimes be a precursor of a downward correction, the index has maintained this level for the last week, and it is yet to reach the ‘Extreme Greed’ territory that usually marks the peak of a rally.BTC recovers above $30,000 | Source:With such positive sentiment, investors are more likely to purchase the digital asset as euphoria sets in and more people expect the digital asset’s price to continue to climb. As long as this bullish sentiment continues to hold, then support will mount at $30,000, giving BTC the boost it needs to take on $35,000.

Related Reading: Why Is Ethereum (ETH) Still Trading Below $2,000?

At the time of writing, BTC is trending at $30,030 after falling to the $29,000 level briefly. Despite reclaiming $30,000 though, the asset is still feeling the effect of the drawdown as it saw a 29% decline in trading volume over the last day.Follow for market insights, updates, and the occasional funny tweet… Featured image from iStock, chart from TradingView.com