For the second time over the past seven days markets have fallen back instead of heading higher indicating that a correction is imminent. Bitcoin’s bearish close on the day does not bode well for future gains and analysts are mostly in agreement that $8,200 is a key level to hold over the next 24 hours to maintain momentum.

Bitcoin Drops Below $8,000

After spending most of the past day trading between $8,500 and $8,600 Bitcoin took another tumble a few hours ago. The slide sent BTC back to $7,950 as it dumped over 8 percent in a couple of hours. Currently hovering around $7,900, Bitcoin needs to return to $8,200 by end of trading today to prevent another collapse.

“$BTC – Daily close Bearish. Bitcoin continues to push down quite aggressively and would like to see a move above $7824 and hold. Eyeing that previous CME futures gap that wasn’t explored at $7175. If Bulls don’t step in, I believe price is heading that way,”//twitter.com/Josh_Rager/status/66219776

Volume has increased to $23 billion but it is heavily red indicating that there could be short term relief before another move towards support. Rager ; “People have asked if that was short term sell off and the price is heading back up. Due to the amount of volume, it’s more likely price has short term relief that can last hours or days before another push down to retest support,”

Altcoins Bleeding Again

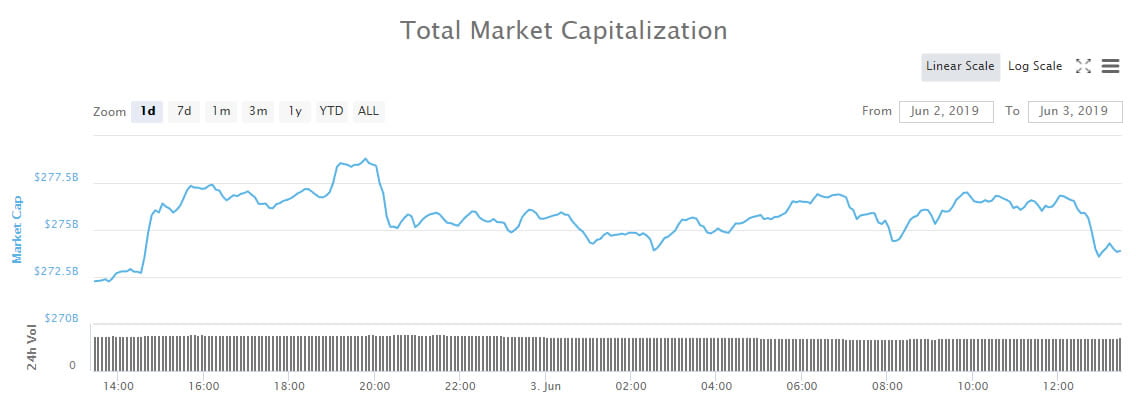

As usual Bitcoin is playing the digital pied piper, and a 7 percent dump for it spells a lot more pain for the altcoins, which still remain hopelessly coupled to BTC. Over $23 billion has been dumped out of crypto markets as the altcoins exodus accelerated during Asian trading today. Ethereum and XRP have been hit by the same 7 percent dropping to $245 and $41 respectively. Bitcoin Cash and EOS have been bashed even further dumping over 10 percent each back to $395 and $6.65 respectively. Altcoin losses are even greater for the smaller cap ones as the rout continues.May has been an epic month for crypto markets with a total gain of 50 percent so a correction is long overdue. The 30 percent action that many analysts have mentioned would drop Bitcoin back to $5,600 from current levels and total market cap down to $180 billion, where it was this time last month.

Image from Shutterstock