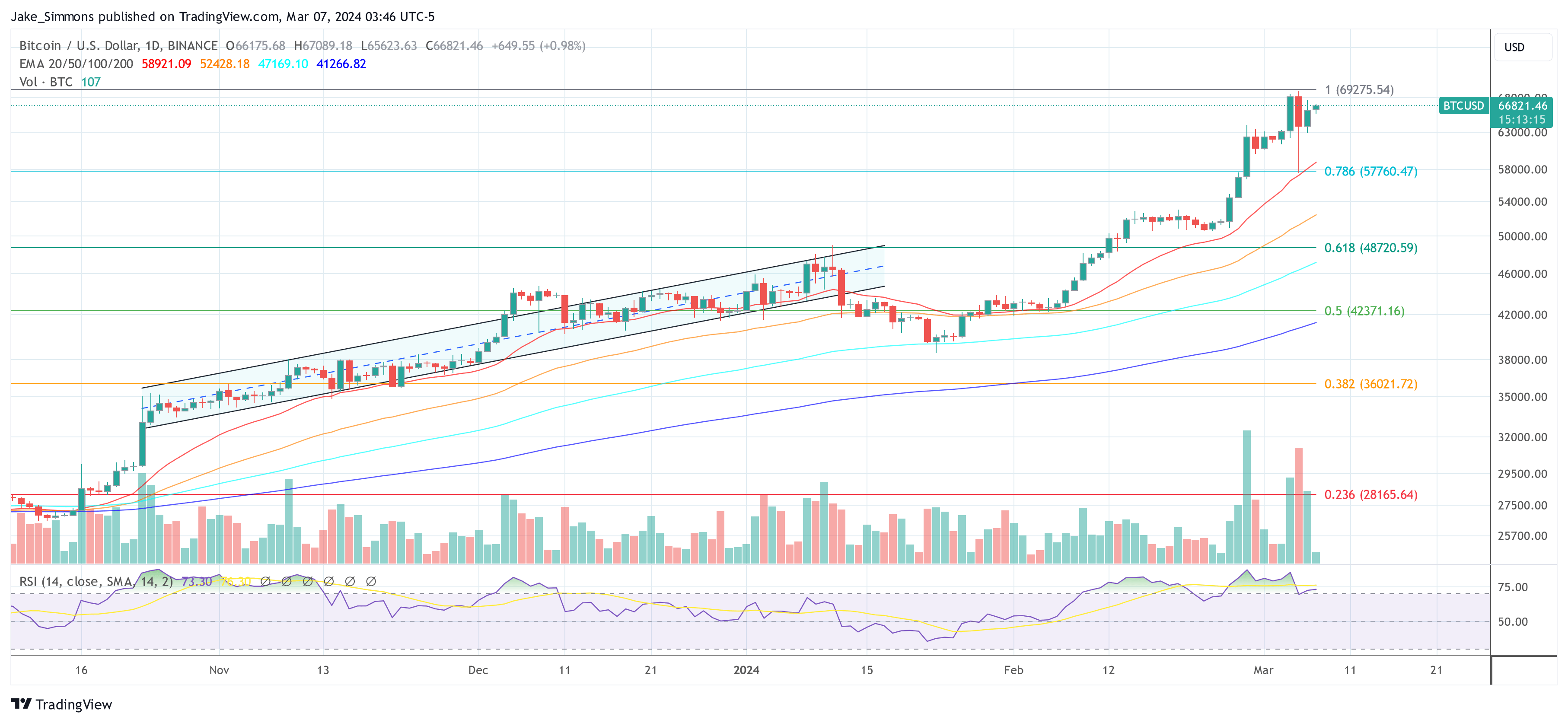

“We Will Climb the Wall of Worry,” Thorn proclaimed, setting the tone for his analysis. Bitcoin’s recent price action saw it reaching $69,324 on Coinbase on Tuesday, marking its first all-time high since November 10, 2021. This milestone came after an 846-day period of anticipation and speculation, only for the price to retract 14.3% to an intraday low of $59,224. This volatility, exacerbated by $400 million in long liquidations within an hour, underscores the cryptocurrency’s unpredictable nature.

Despite the pullback, Bitcoin recovered, trading back at $67,000. Thorn remarked, “Volatility is back, and it’s likely to remain as we scale the wall of worry.” He compared the current situation to 2020 when Bitcoin first approached its then all-time high of approximately $20,000 from December 2017.

Notably, Bitcoin already had two 15%+ retracements since the spot ETFs launched on January 11. This week was the second one, the first major drawdown was directly after the ETF launch, with price plunging roughly 20%.

Why Bitcoin Is Just Getting Started

In his analysis, Thorn also touched upon the role of ‘old coins’ or long-held Bitcoin in shaping market movements. “Some old coins did revive and probably sell, possibly helping to create the intraday top,” he explained, pointing to blockchain data that indicated movement of coins mined as far back as 2010. This shift from old to new hands is characteristic of bull markets in Bitcoin, facilitating its broader distribution and acceptance.Highlighting the significance of market sentiment and investment flows, Thorn noted, “And Tuesday was the Bitcoin ETFs largest ever day of inflows and second largest day of net inflows (+$648m) since DAY 1.” This impressive influx of capital into Bitcoin ETFs underscores the growing interest and confidence in the cryptocurrency, even amidst volatility.

Thorn remains bullish on Bitcoin’s future, suggesting that the current price dynamics are typical of the cryptocurrency’s bull markets, known for their non-linear progression and numerous corrections. He underscored the resilience and potential for growth despite the hurdles, stating, “nothing about yesterday’s price action makes me think we aren’t going higher.”